Auto services provider Monro (NASDAQ: MNRO) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 2.7% year on year to $301 million. Its non-GAAP profit of $0.22 per share was 48.6% above analysts’ consensus estimates.

Is now the time to buy Monro? Find out by accessing our full research report, it’s free.

Monro (MNRO) Q2 CY2025 Highlights:

- Revenue: $301 million vs analyst estimates of $296.1 million (2.7% year-on-year growth, 1.7% beat)

- Adjusted EPS: $0.22 vs analyst estimates of $0.15 (7c beat)

- Operating Margin: -2%, down from 4.5% in the same quarter last year

- Same-Store Sales rose 5.7% year on year (-9.9% in the same quarter last year)

- Market Capitalization: $489.1 million

“The Monro team drove mid-single-digit comparable store sales growth in the first quarter, which has enabled us to report two consecutive quarters of positive comps for the first time in a couple of years. This was driven by the progress we continue to make with our ConfiDrive digital courtesy inspection process, which resulted in sales and unit growth in our tire category and our high-margin service categories, including front-end shocks, brakes, batteries, and maintenance services. We maintained prudent operating cost control, as reflected in lower store direct costs in the quarter. We reduced inventory levels across the system by approximately $10 million, primarily as a result of reducing our store count. Our profitability on an adjusted diluted earnings per share basis was in-line with the prior year first quarter. These results serve as a solid foundation to build upon as we implement our performance improvement plan to enhance Monro’s operations, drive profitability, and increase operating income and total shareholder returns. Encouragingly, our preliminary fiscal July comps are up 2%, which would result in our sixth consecutive month of consistent comparable store sales growth”, said Peter Fitzsimmons, President and Chief Executive Officer.

Company Overview

Started as a single location in Rochester, New York, Monro (NASDAQ: MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

Revenue Growth

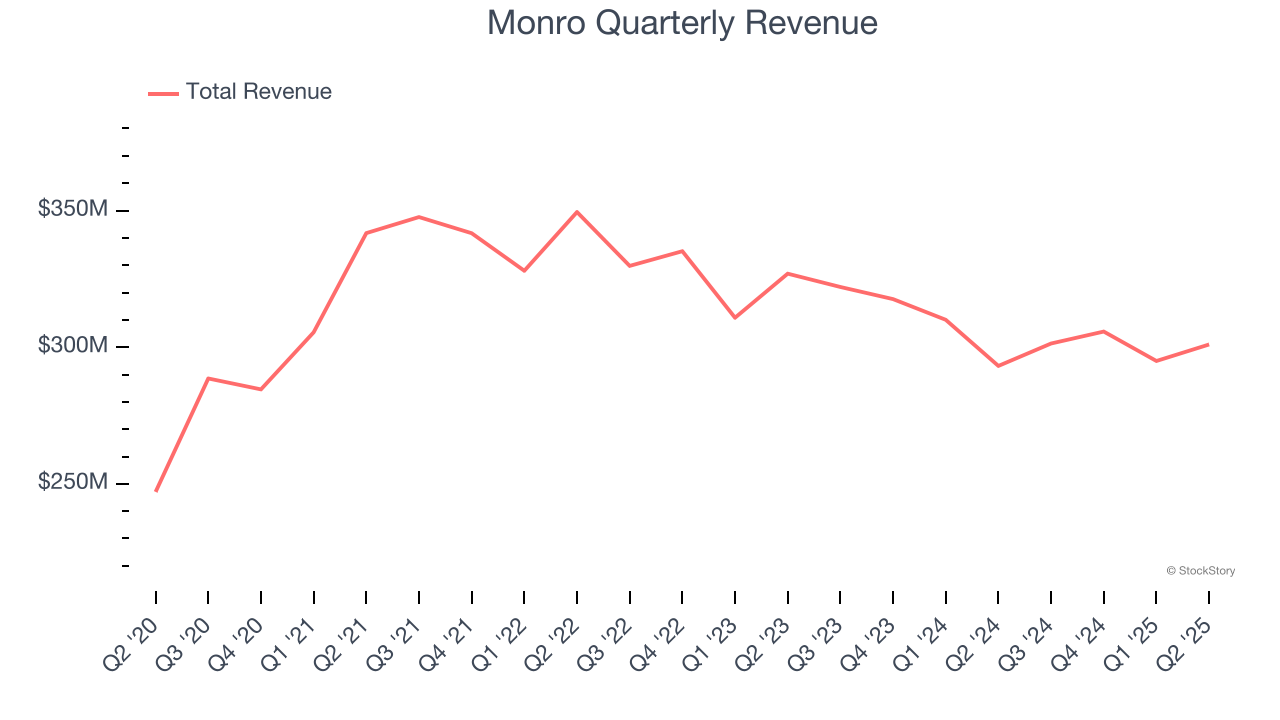

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.20 billion in revenue over the past 12 months, Monro is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, Monro struggled to increase demand as its $1.20 billion of sales for the trailing 12 months was close to its revenue six years ago (we compare to 2019 to normalize for COVID-19 impacts). This was mainly because it closed stores and observed lower sales at existing, established locations.

This quarter, Monro reported modest year-on-year revenue growth of 2.7% but beat Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to decline by 1.4% over the next 12 months, similar to its six-year rate. This projection is underwhelming and suggests its products will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

Number of Stores

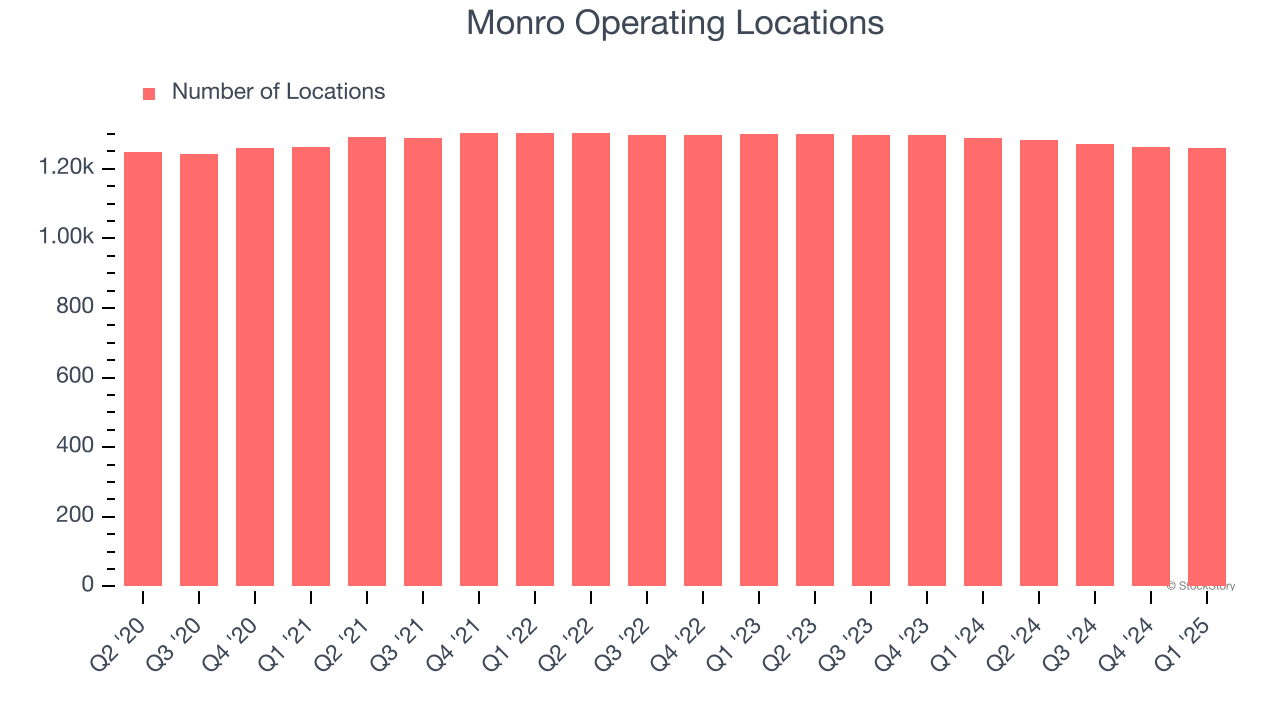

A retailer’s store count often determines how much revenue it can generate.

Monro has generally closed its stores over the last two years, averaging 1.2% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Note that Monro reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

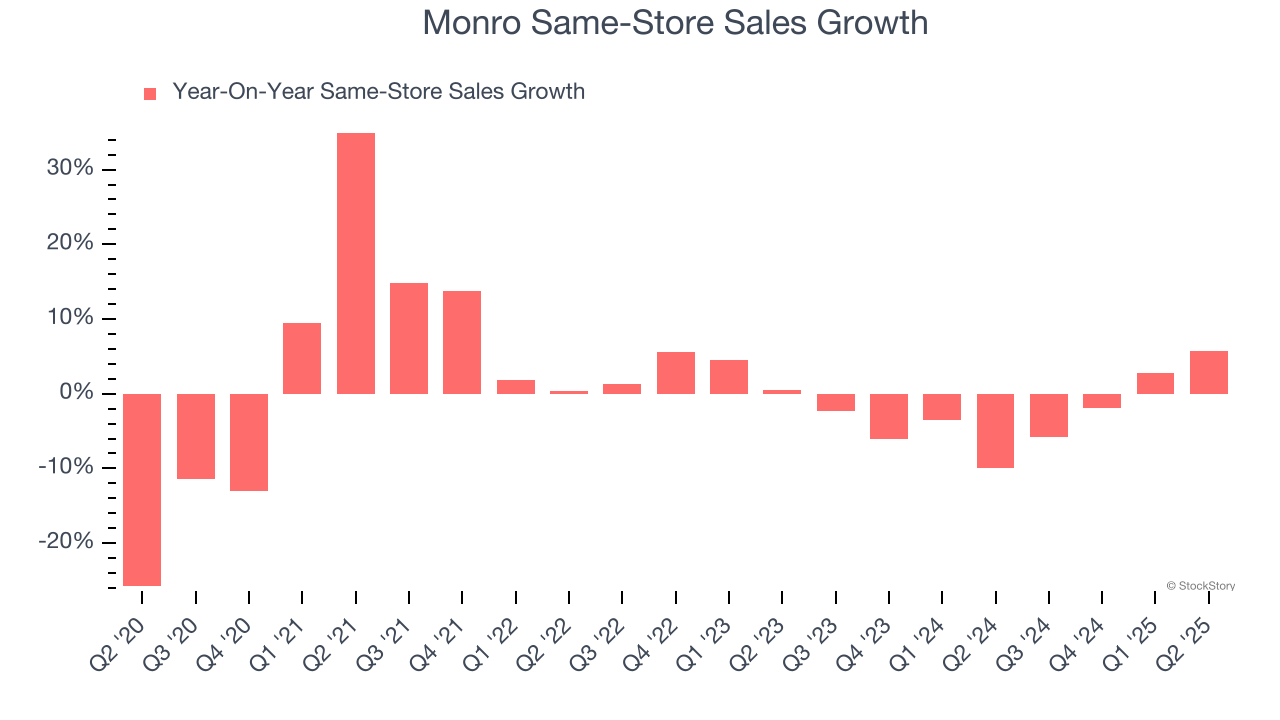

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Monro’s demand has been shrinking over the last two years as its same-store sales have averaged 2.6% annual declines. This performance isn’t ideal, and Monro is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Monro’s same-store sales rose 5.7% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Monro’s Q2 Results

We were impressed by how significantly Monro blew past analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 1% to $16.50 immediately after reporting.

Monro put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.