All News about Total Bond Market ETF Vanguard

Via Benzinga

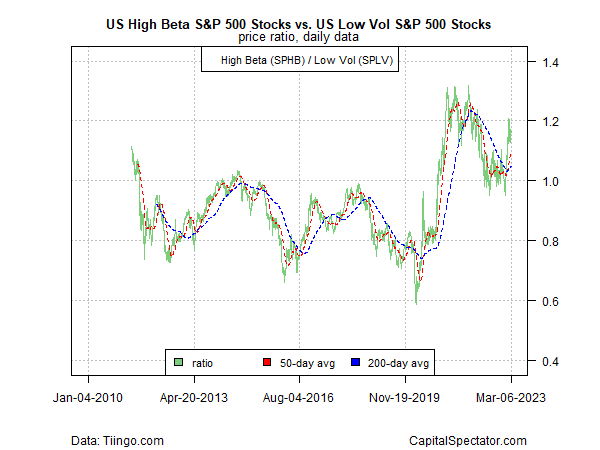

Why Tesla, Microsoft, Nvidia, FAANG Remind Forecaster Of 2021 'Meme Stocks' Effect

February 26, 2023

Via Benzinga

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.