IREN (IREN) shares soared as much as 20% on Monday morning after Microsoft (MSFT) signed a $9.7 billion agreement with the Australian artificial intelligence (AI) infrastructure company.

The five-year deal brings MSFT access to Nvidia’s (NVDA) advanced chips, boosting the giant’s AI compute capacity.

According to IREN’s press release, the infrastructure will be hosted at its Childress, Texas campus with phased deployment through 2026.

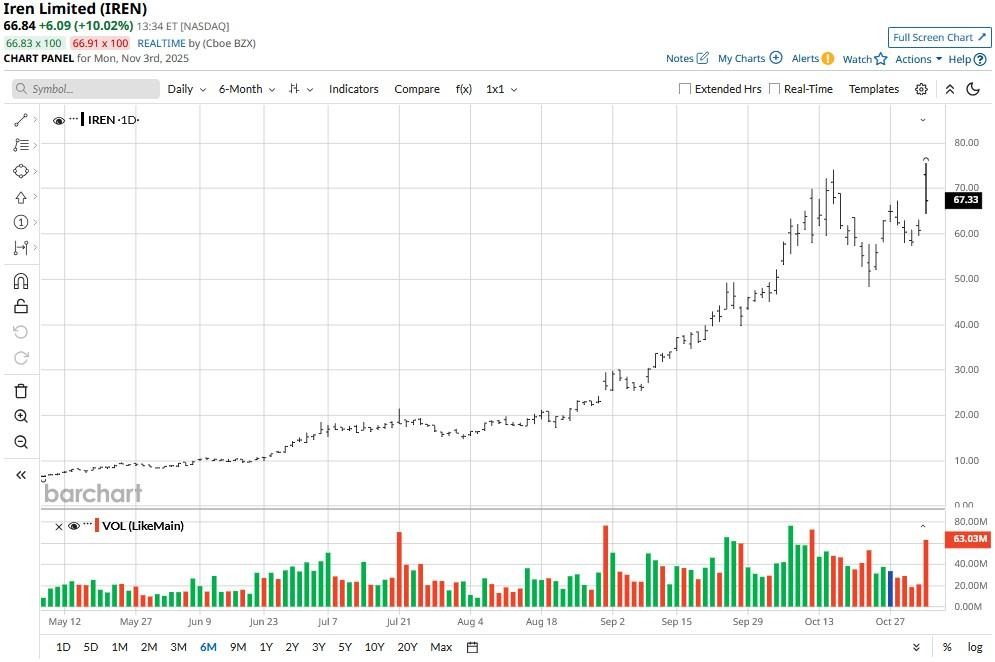

IREN stock has pared back half of its intraday gains in recent hours. Still, it’s trading at more than 11x its price in early April at the time of writing.

Why Did IREN Stock Soar on Microsoft Announcement?

The Microsoft news is significantly positive for IREN stock as it validates the firm’s strategic pivot from a niche bitcoin miner into a major artificial intelligence infrastructure name.

With guaranteed revenue from one of the world’s largest tech companies, the agreement bring both credibility and long-term visibility to the Nasdaq-listed firm.

It leverages IREN’s renewable-powered data centers, aligning with MSFT’s sustainability goals as well.

IREN has also secured commitment from Dell (DELL) to supply $5.8 billion worth of NVDA hardware, positioning itself at the heart of the AI boom, supporting both training and inference workloads.

Why IREN Shares Still Aren’t Worth Owning

Despite the headline-grabbing MSFT announcement, caution is warranted in playing IREN shares at current levels since the company’s fundamentals remain shaky at best.

IREN has a volatile financial history tied to its legacy crypto mining operations, and its strategic pivot to AI infrastructure is still in early stages only.

This leaves questions unanswered about scalability, sustainability of margin, and competition from larger, more diversified players.

Plus, IREN isn’t an inexpensive stock to own. At just under 96x, its forward price-earnings (P/E) multiple currently sits an alarming 100% above Nvidia’s, reinforcing that the company’s valuation is pricing in years of execution that hasn’t yet materialized.

What’s the Consensus Rating on IREN?

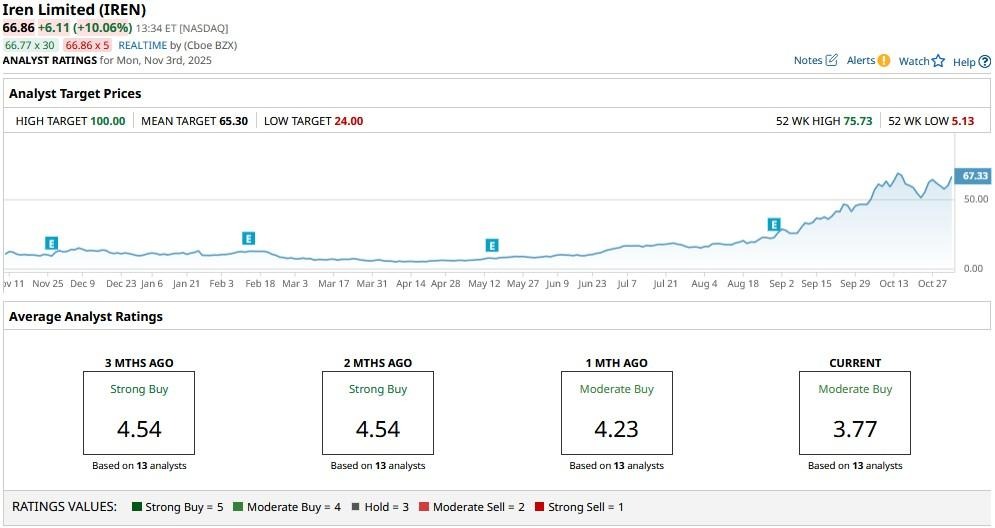

Wall Street analysts’ current estimates also favor trimming exposure to IREN stock following the Microsoft-driven rally on Nov. 3.

While the consensus rating on IREN shares remains at “Moderate Buy,” the mean target of roughly $65 does not indicate any further upside from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart