Social media keeps adding users, with over 5.4 billion people actively using social platforms worldwide in 2025. The industry has nearly doubled in less than a decade, rising from 2.73 billion users in 2017 to its current level, and social media ad spending is projected to reach $276.7 billion by 2025. That kind of growth is particularly important for smaller platforms that focus on local communities and local ads, rather than trying to compete directly with the largest social networks.

Nextdoor Holdings (NXDR) became one of the most talked-about stocks in December 2025 after Eric Jackson, the activist investor who helped drive a more than 15-fold rally in Opendoor (OPEN) shares during 2025, shifted his attention to the hyperlocal social network.

On Dec. 10, NXDR stock jumped as much as 45% after Jackson called the company “the most mispriced Agentic-AI platform of the 2020s,” pushing shares to a new year-to-date (YTD) high. With analysts tracking a high price target of $4 for the stock, can Nextdoor’s mix of verified neighborhood networks, AI potential, and renewed meme-stock interest push shares higher in the final weeks of the year? Let’s find out.

Nextdoor’s Financial Pulse

Nextdoor runs a hyperlocal social platform that connects verified neighbors with each other and with nearby businesses, and it makes most of its money through targeted advertising. The stock had been moving up, but not extremely so, until Dec. 10, when it closed out 26% up in a single trading session. Over the past 52 weeks, it’s down about 12%, and it’s down roughly 7% YTD. In the last six months, it is up 46%, which shows sentiment has improved without turning into a full meme-style surge.

With a market cap just under $1 billion, trailing EPS around -0.15, and annual sales near $247 million alongside a net loss of roughly $98 million, investors are betting that management can keep improving the business model and eventually turn that revenue base into real earnings.

The most recent quarterly results point to gradual progress. In Q3 2025, revenue rose about 5% year-over-year (YoY) to $69 million, even as platform weekly active users slipped 3% to 21.6 million, which suggests the company is getting better at making money from its user base, even with slightly lower activity.

Net loss improved to $13 million from $15 million a year earlier, and adjusted EBITDA moved from a $1 million loss to a $4 million profit, a meaningful step for a company still working toward consistent profitability. Nextdoor also ended the quarter with about $403 million in cash, cash equivalents, and marketable securities, which gives it time and flexibility to keep investing while the market decides whether this rally can hold.

What’s Powering Nextdoor’s Growth

Nextdoor has rolled out AI-powered ad optimizations and new video ad formats inside Nextdoor Advertising Manager, built to help brands get better results from campaigns and reach their 100M+ high-intent users across 345,000 neighborhoods with more relevant, engaging creative. The AI piece is meant to get more out of Nextdoor’s hyperlocal targeting by making it simpler for advertisers to adjust campaigns, improve performance, and feel confident putting more ad dollars into the platform when the results start to improve.

Moreover, Nextdoor is testing locally personalized ads that reflect where people live and what they care about nearby, which matches the community-first feel that separates it from bigger, more general social networks. That same “neighborhood intelligence” idea also shows up in its partnership with Waze, which brings real-time traffic and road alerts into Nextdoor Alerts.

By turning Waze data into practical updates people can react to and talk about, such as accidents, road closures, or local delays, Nextdoor adds another reason for neighbors to check the app more often and use it as part of their day-to-day local awareness.

Street Targets: Is $4 Within Reach?

Earnings estimates for the current quarter ending December 2025 call for a loss of $0.03 per share. For the full year, Wall Street is looking for a 2025 loss of $0.16 versus $0.20 last year, which points to a 20.00% year-over-year improvement.

That expectation frames the debate around the $4 target. The Street-high $4 price target tied to the bullish case comes from Craig-Hallum analyst Jason Kreyer, who started coverage with a “Buy” rating and set that $4 objective back in January 2025. It’s basically the high end of what analysts think the stock could do if Nextdoor executes well and sentiment stays supportive. On the more cautious side, Citigroup analyst James Michael Sherman-Lewis stuck with a “Neutral” rating on Nov. 10 but cut his price target to $2.20 from $2.40, an 8.33% reduction, citing near-term challenges tied to profitability and operating leverage.

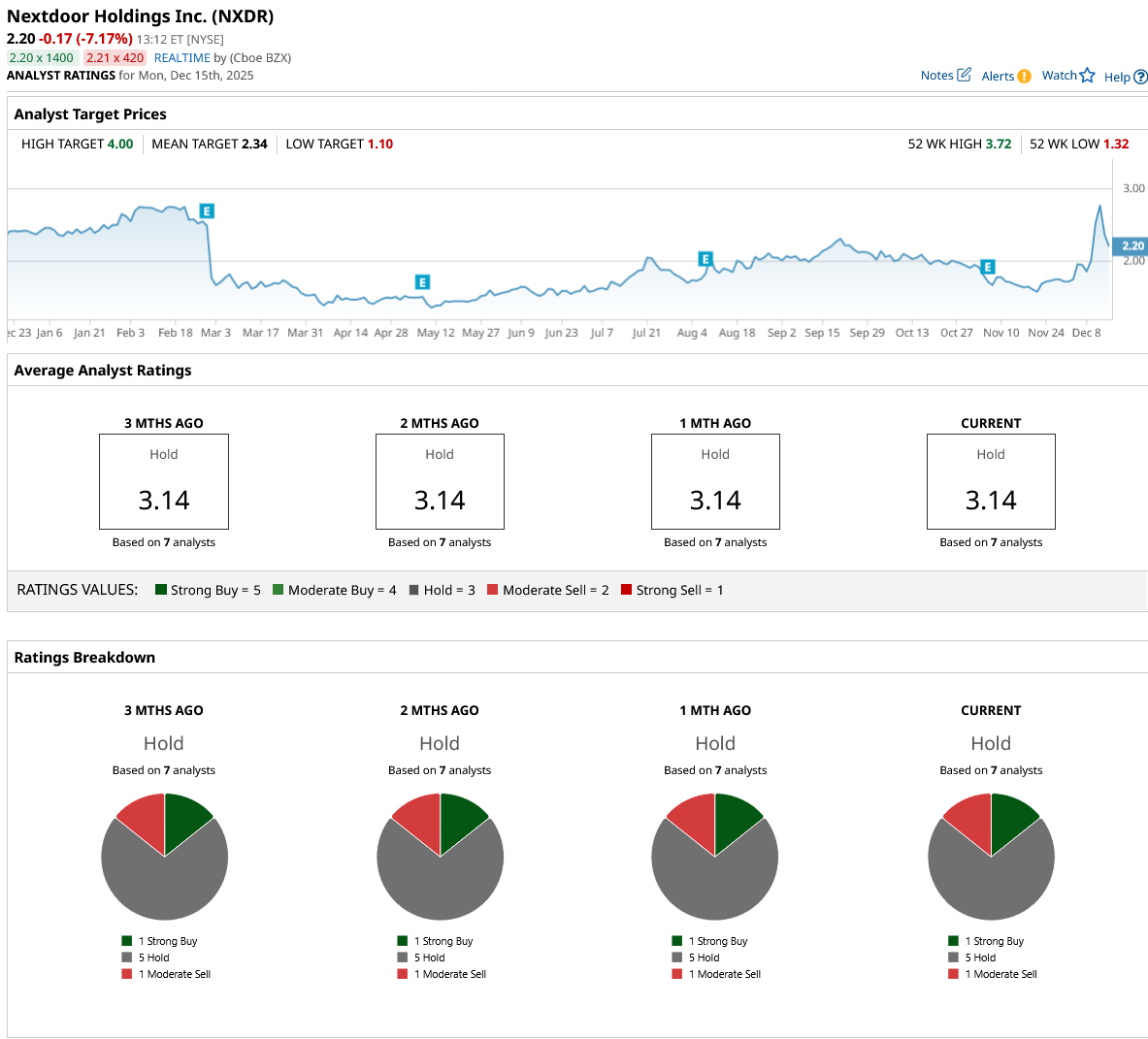

Zooming out, the broader analyst view is still careful. The seven analysts surveyed by Barchart rate the stock a consensus “Hold,” and only one gives NXDR a “Strong Buy,” and the rest say “Hold” or “Moderate Sell.” The average price target sits at $2.34, even though shares are trading around $2.20. That puts the stock roughly 6% below the Street’s mean target.

Conclusion

Hitting $4 before the end of 2025 looks possible, but it’s not the most probable base case. It likely requires the rally energy around Eric Jackson’s endorsement to stay hot and for buyers to keep paying up ahead of profits. With the stock already trading just below the average analyst target, the setup is basically “sentiment vs. fundamentals,” and that’s a tough mix to rely on for a clean, repeatable move. Most likely, shares chop around and cool off unless another catalyst reignites momentum; still, if the meme-style bid returns, $4 is within striking distance.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart