- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

Articles published by AST SpaceMobile, Inc.

AST SpaceMobile Announces Proposed Private Offering of $400.0 Million of Convertible Senior Notes Due 2032

January 22, 2025

Via Business Wire

Tickers

ASTS

AST SpaceMobile Announces Definitive Commercial Agreement with Vodafone Through 2034

December 09, 2024

Via Business Wire

Tickers

ASTS

AST SpaceMobile Announces Participation in Upcoming Conferences

November 18, 2024

Via Business Wire

Tickers

ASTS

AST SpaceMobile Provides Business Update and Third Quarter 2024 Results

November 14, 2024

Via Business Wire

Tickers

ASTS

Via Business Wire

Tickers

ASTS

AST SpaceMobile Successfully Completes Unfolding of First Five Commercial Satellites in Low Earth Orbit

October 25, 2024

Via Business Wire

Tickers

ASTS

Via Business Wire

Tickers

ASTS

Via Business Wire

Tickers

ASTS

AST SpaceMobile Announces Successful Orbital Launch of Its First Five Commercial Satellites

September 12, 2024

Via Business Wire

Tickers

ASTS

AST SpaceMobile Provides Interim Business Update to Confirm Upcoming Orbital Launch and Warrant Redemption

September 04, 2024

Via Business Wire

Tickers

ASTS

AST SpaceMobile Announces Redemption of Public Warrants

August 28, 2024

Via Business Wire

Tickers

ASTS

AST SpaceMobile Offers Retail Shareholders a Chance to Attend the BlueBird 1-5 Launch

August 16, 2024

Via Business Wire

Tickers

ASTS

Via Business Wire

Tickers

ASTS

AST SpaceMobile’s Commercial Satellites Arrive at Cape Canaveral For Upcoming Launch

August 08, 2024

Via Business Wire

Tickers

ASTS

Via Business Wire

Tickers

ASTS

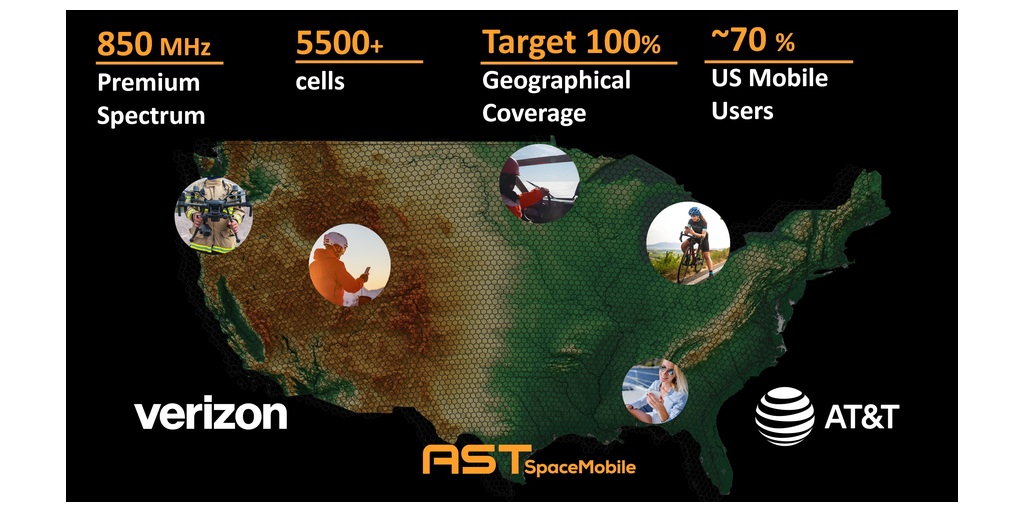

AST SpaceMobile Announces Executive Leadership Team for Next Phase of Accelerated Growth

June 25, 2024

Via Business Wire

Tickers

ASTS

Via Business Wire

Tickers

ASTS

Via Business Wire

Tickers

ASTS

Via Business Wire

Tickers

ASTS

Via Business Wire

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.