- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

Articles published by Knightscope, Inc.

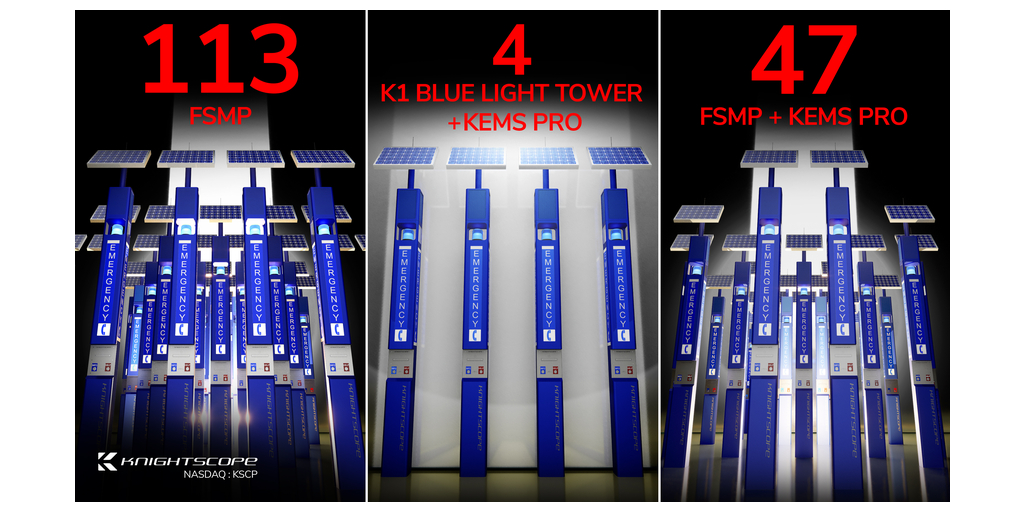

Knightscope Closes Contracts in 12 States

November 26, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Knightscope Announces Pricing of $12.1 Million Public Offering

November 21, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Knightscope Announces Proposed Public Offering

November 21, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Verizon Partners with Knightscope to Power Connectivity for Advanced Public Safety Technologies

November 14, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

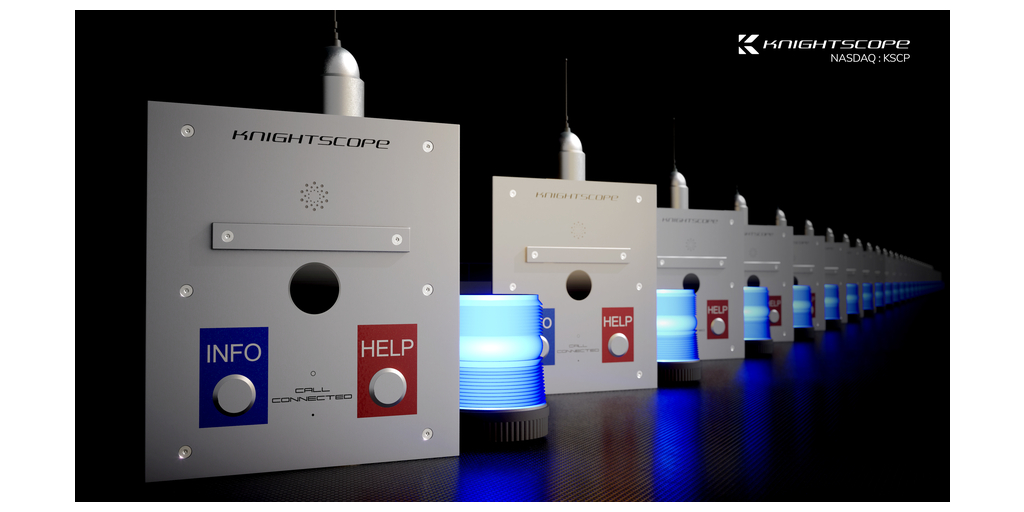

Knightscope Healthcare Clients Add Service Contracts for E-Phones

October 17, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

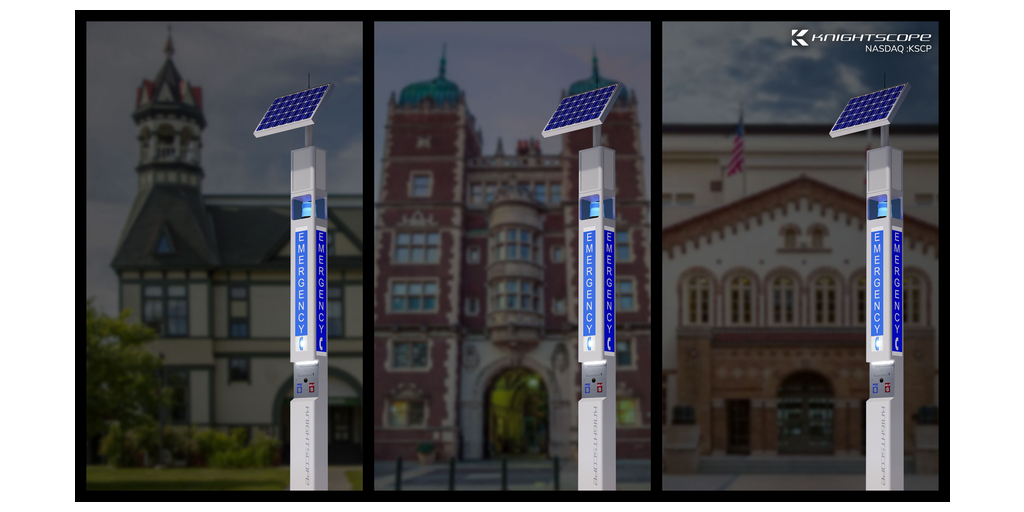

Three Universities Scale Up Emergency Communications Contracts

October 15, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

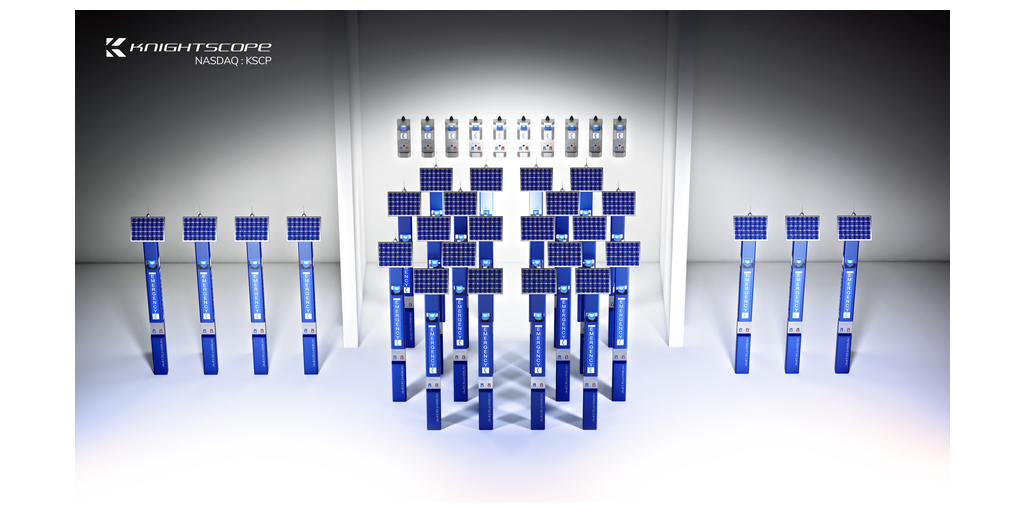

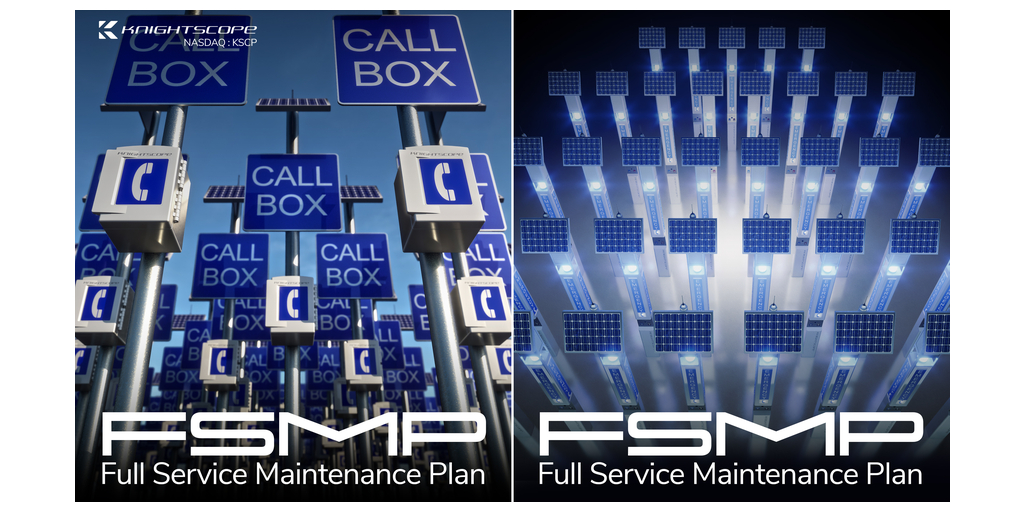

Knightscope Reseller TS&L Issues Purchase Orders for 37 New Devices

October 10, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

FDNY and PANYNJ Expand Emergency Communication Contracts

October 08, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

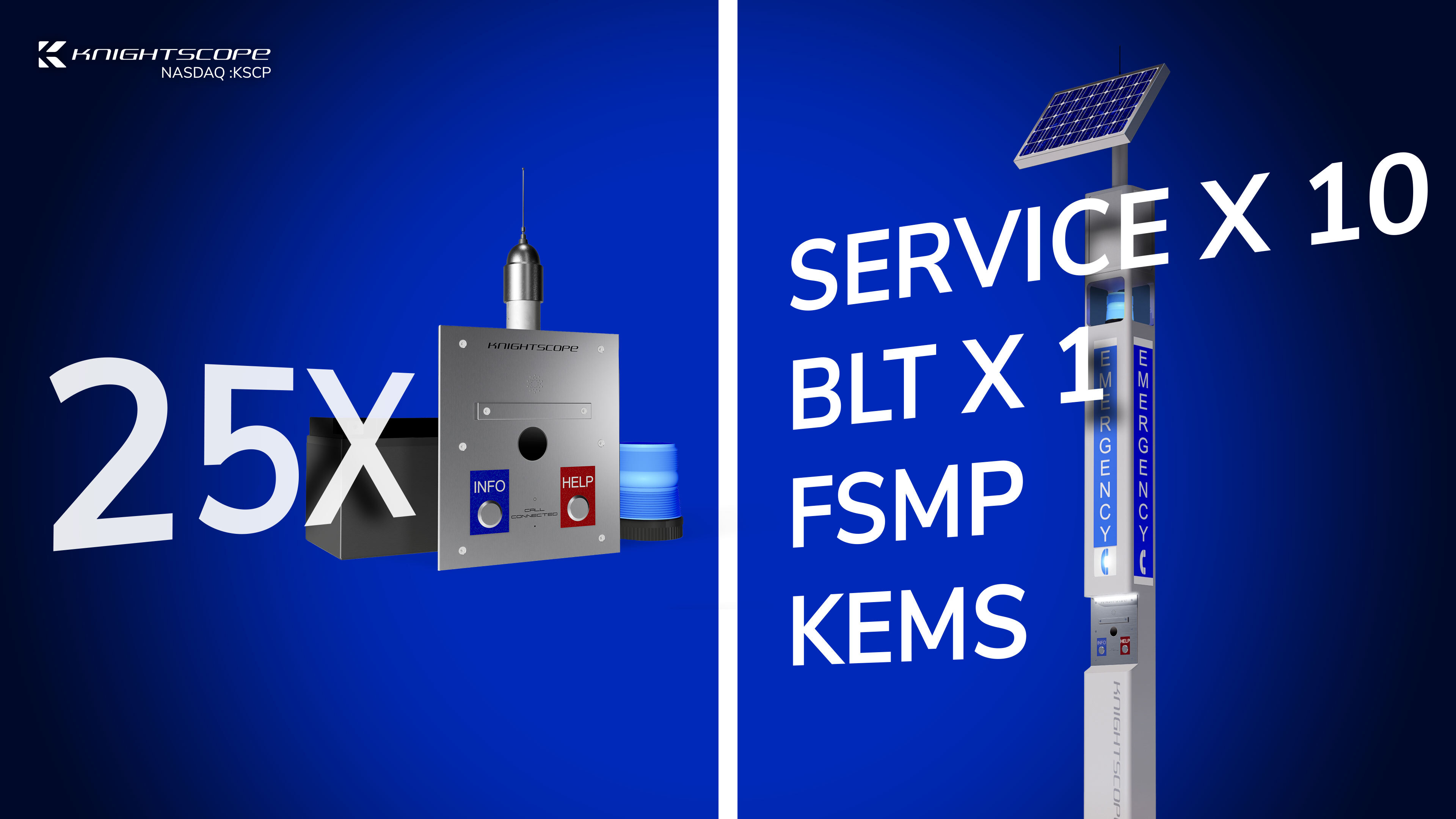

Three Knightscope Emergency Communications Clients Scale Up

October 03, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Knightscope Regains Full Compliance with Nasdaq Listing Standards

October 02, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

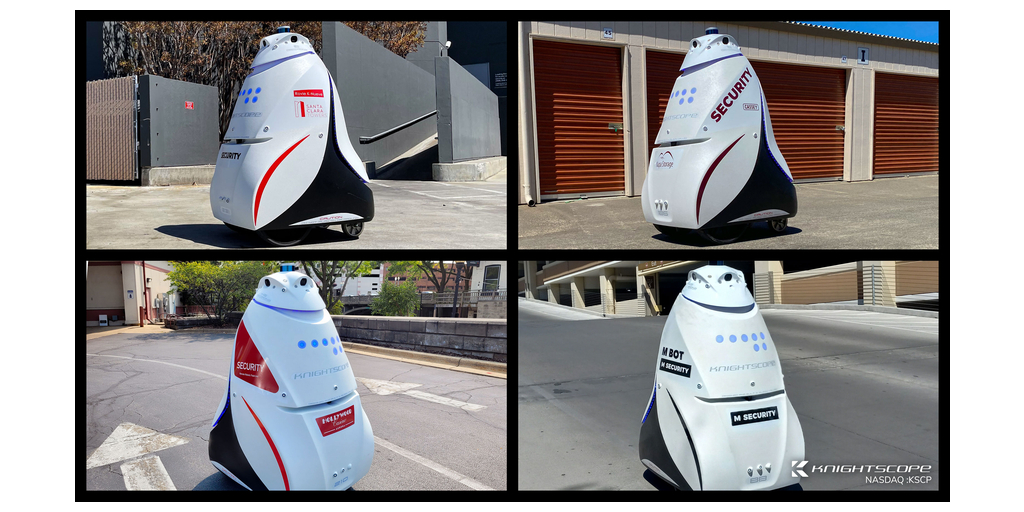

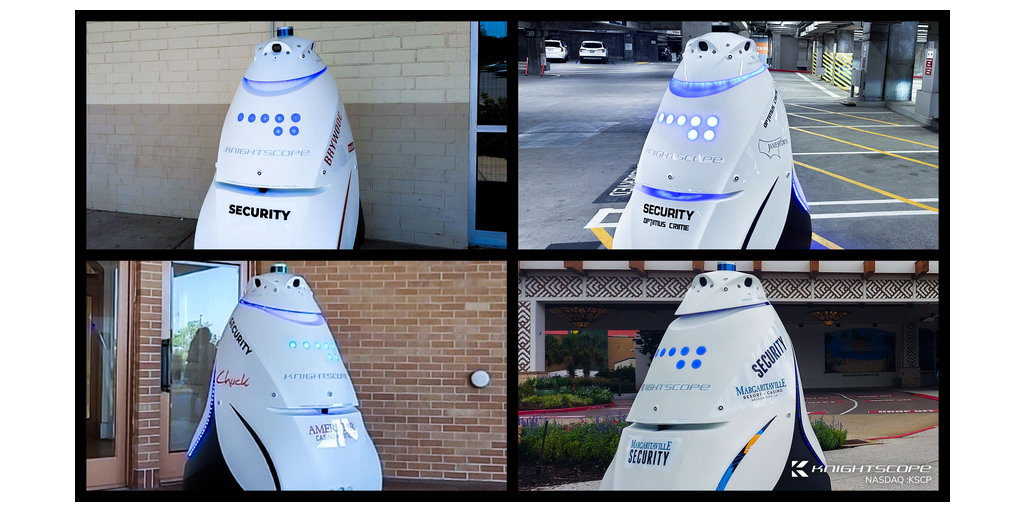

Knightscope Robot Growth Accelerates with Existing Clients

September 25, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Four Knightscope Clients Upgraded to 5th Generation Robot

September 23, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Knightscope Deploys Security Robots in Pennsylvania and Georgia

September 20, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Texas Client Renews Knightscope Security Robot Contract

September 19, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Three Knightscope Clients Renew Security Robot Contracts

September 16, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Knightscope Deploys Security Robots at Casino and International Airport

September 11, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Knightscope Secures Three New Emergency Communication Contracts

September 04, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

More Knightscope Clients Receive Upgrades to 5th-Gen Robot

August 28, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Knightscope Scores Two More Contracts in Education

August 27, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Casino Deploys Six Knightscope Security Robots at 9th Location

August 22, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Two New Sales for Knightscope’s Emergency Communications

August 08, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Huntington Park Police Renews Knightscope Contract for 6th Year

August 01, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

School and Transit Clients Expand Knightscope Contracts

July 31, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

University of Texas Expands Emergency Communications

July 29, 2024

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

From Knightscope, Inc.

Via Business Wire

Tickers

KSCP

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.