- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

Articles published by MaxLinear, Inc.

MaxLinear Launches Single-Port 1G Ethernet PHY Family Aimed at Both Consumer and Industrial IOT Applications

November 08, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

MaxLinear, Inc. Announces Financial Conference Participation for the Fourth Quarter 2023

November 06, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

MaxLinear, Inc. Announces Third Quarter 2023 Financial Results

October 25, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

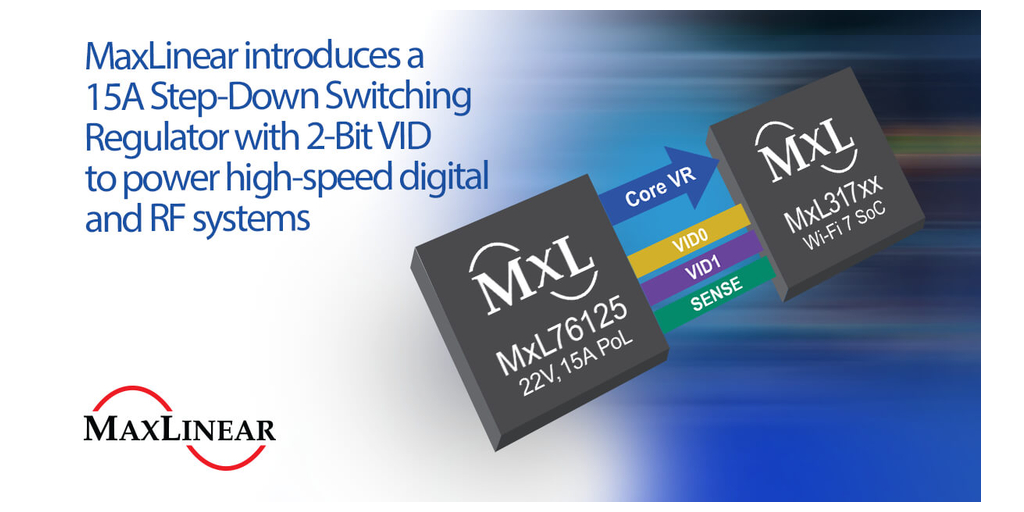

MaxLinear Advanced Power Management Delivers Sub-5-Watt for Wi-Fi 7 XGS-PON Home Routers and Gateway Platforms

October 23, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

MaxLinear PRX 10G PON Chip Powers Gemtek’s Most Fully Featured PON Home Gateway Units

October 23, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

MaxLinear Announces Availability of Puma™ 8, its DOCSIS® 4.0 Cable Modem and Gateway Platform

October 17, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

MaxLinear and Positron Partner to Accelerate Broadband Deployment with Fiber Speeds to the Home

October 16, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

MaxLinear, Inc. Announces Financial Conference Participation for the Third Quarter 2023

August 08, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

MaxLinear Comments on Letter from Silicon Motion Regarding Previously Terminated Transaction

August 07, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

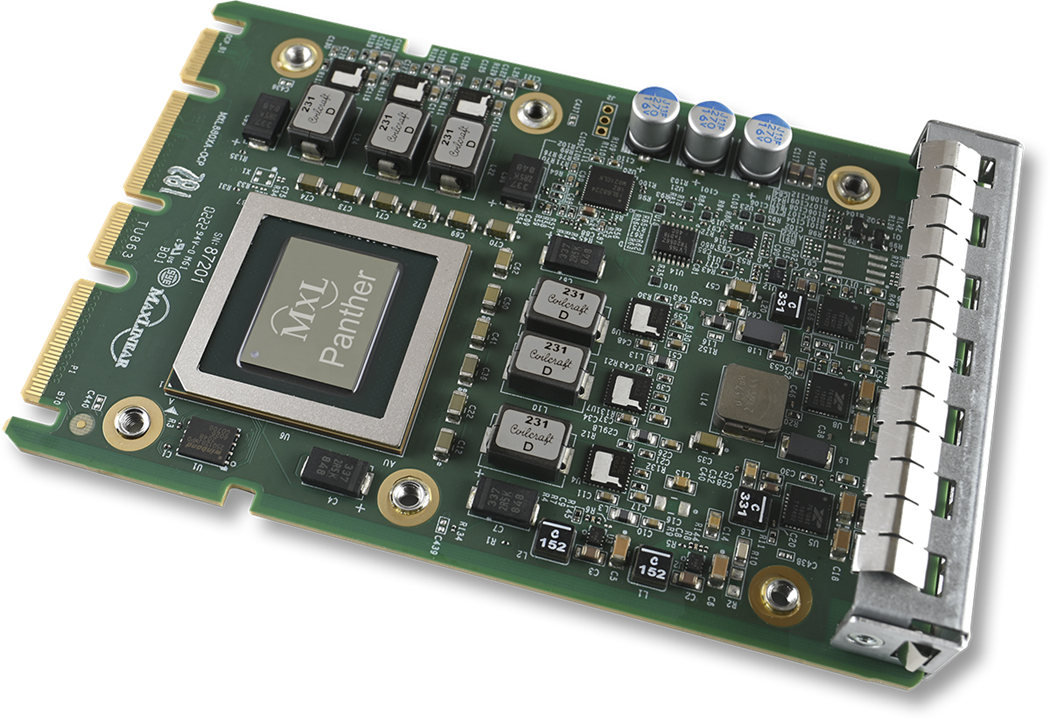

MaxLinear announces production availability of Panther III storage accelerator OCP adapter card

August 07, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

MaxLinear, Inc. Announces Conference Call to Review Second Quarter 2023 Financial Results

July 10, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

MaxLinear Achieves 32.44 Gbps Data Rates in Successful JESD204C Interoperability Testing

June 27, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

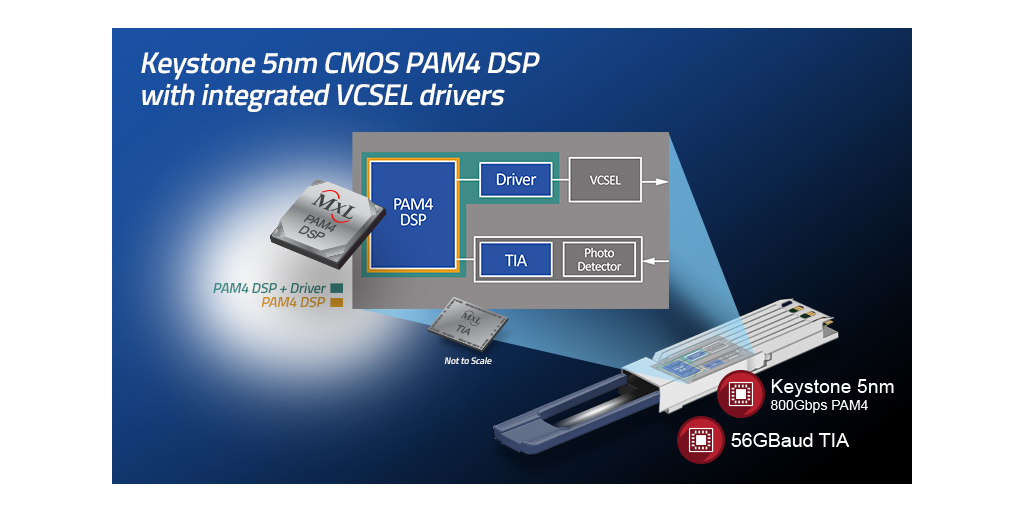

MaxLinear Partners with JPC Connectivity to Build Active Electrical Cables Using Keystone PAM4 DSP

May 25, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

MaxLinear, Inc. Announces Conference Call to Review First Quarter 2023 Financial Results

April 10, 2023

From MaxLinear, Inc.

Via Business Wire

Tickers

MXL

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.