- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

Articles published by Oklo Inc.

Oklo Engaging with U.S. Nuclear Regulatory Commission in Pre-Application Readiness Assessment

March 24, 2025

From Oklo Inc.

Via Business Wire

Tickers

OKLO

From Oklo Inc.

Via Business Wire

Tickers

OKLO

From Oklo Inc.

Via Business Wire

Tickers

OKLO

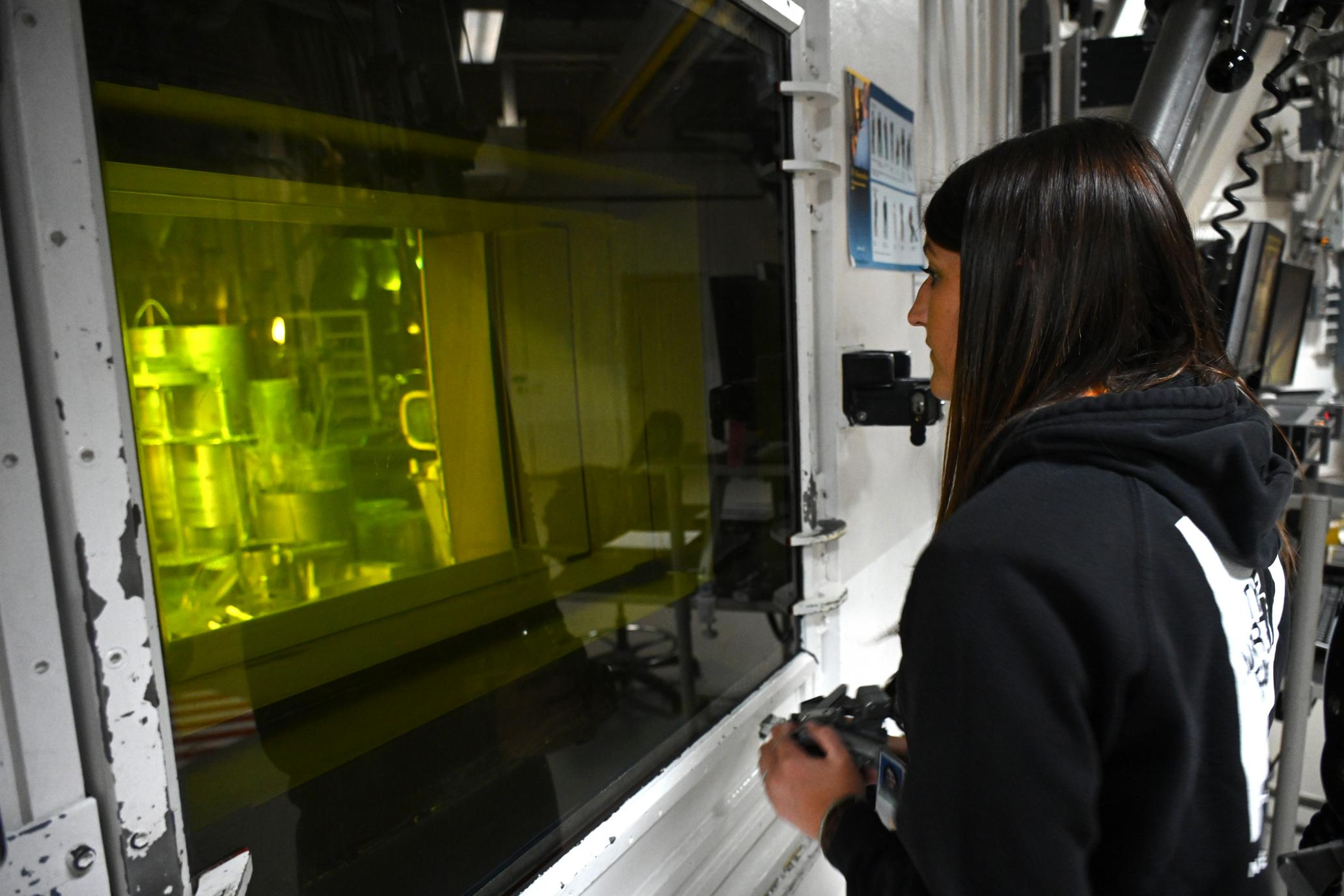

Oklo Collaborates with the U.S. DOE and Oak Ridge National Laboratory to Advance Next Generation Materials Development

February 25, 2025

From Oklo Inc.

Via Business Wire

Tickers

OKLO

Oklo Announces Board Transition Following Chris Wright’s Confirmation as Secretary of Energy

February 06, 2025

From Oklo Inc.

Via Business Wire

Tickers

OKLO

From Oklo Inc.

Via Business Wire

Tickers

OKLO

Oklo Publishes Third Quarter 2024 Financial Results and Business Update

November 14, 2024

From Oklo Inc.

Via Business Wire

Tickers

OKLO

Oklo Announces Proposed Acquisition of Atomic Alchemy to Expand into Radioisotope Market

November 14, 2024

From Oklo Inc.

Via Business Wire

Tickers

OKLO

From Oklo Inc.

Via Business Wire

Tickers

OKLO

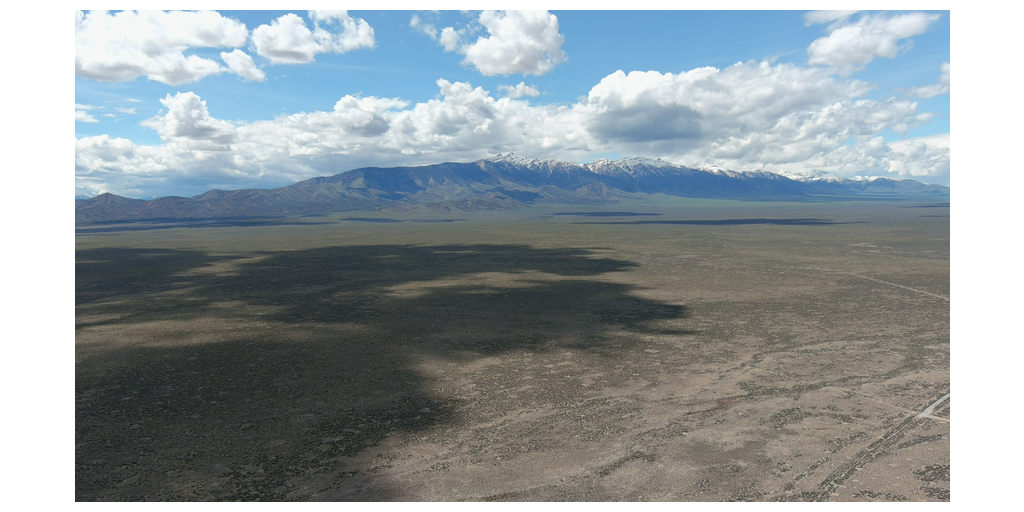

Oklo Completes Environmental Compliance Process to Begin Site Characterization for its Commercial Powerhouse in Idaho

November 07, 2024

From Oklo Inc.

Via Business Wire

Tickers

OKLO

Oklo Announces Date for Third Quarter 2024 Financial Results and Business Update Call

October 31, 2024

From Oklo Inc.

Via Business Wire

Tickers

OKLO

DOE Approves Conceptual Safety Design Report for Oklo’s Aurora Fuel Fabrication Facility

October 15, 2024

From Oklo Inc.

Via Business Wire

Tickers

OKLO

Oklo Finalizes Agreement with the Department of Energy to Advance to the Next Phase of Siting

September 25, 2024

From Oklo Inc.

Via Business Wire

Tickers

OKLO

Oklo Publishes Second Quarter 2024 Earnings and Business Update

August 13, 2024

From Oklo Inc.

Via Business Wire

Tickers

OKLO

Oklo Establishes Preferred Supplier Agreement for Steam Turbine Generator Products and Services

August 13, 2024

From Oklo Inc.

Via Business Wire

Tickers

OKLO

From Oklo Inc.

Via Business Wire

Tickers

OKLO

From Oklo Inc.

Via Business Wire

Tickers

OKLO

Oklo Provides Update on Recent Form S-1 Filing

June 20, 2024

From Oklo Inc.

Via Business Wire

Tickers

OKLO

From Oklo Inc.

Via Business Wire

Tickers

OKLO

From Oklo Inc.

Via Business Wire

Tickers

OKLO

From Oklo Inc.

Via Business Wire

Tickers

OKLO

From Oklo Inc.

Via Business Wire

From Oklo Inc.

Via Business Wire

Tickers

ALCC

From Oklo Inc.

Via Business Wire

U.S. DOE Approves the Safety Design Strategy for the Oklo Aurora Fuel Fabrication Facility

January 31, 2024

From Oklo Inc.

Via Business Wire

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.