- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

Articles published by Paychex, Inc.

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

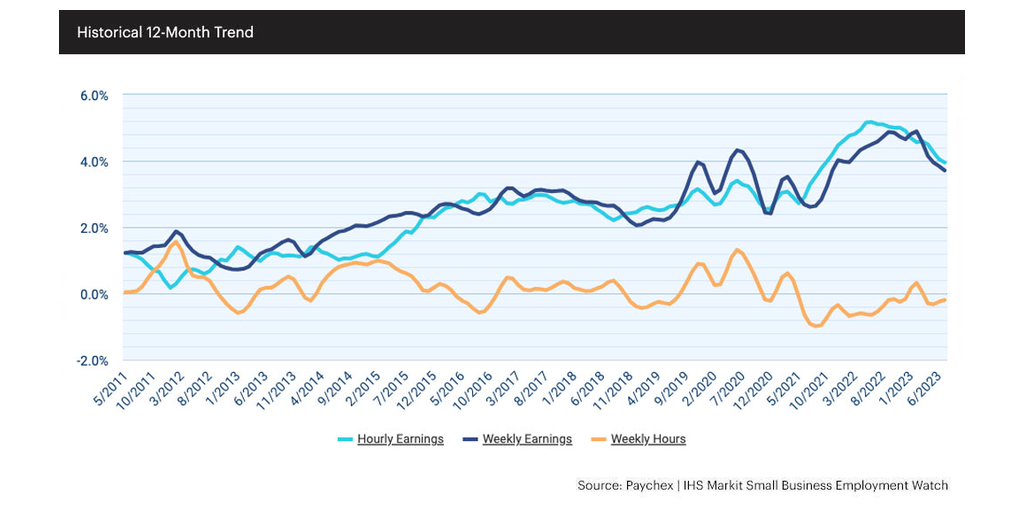

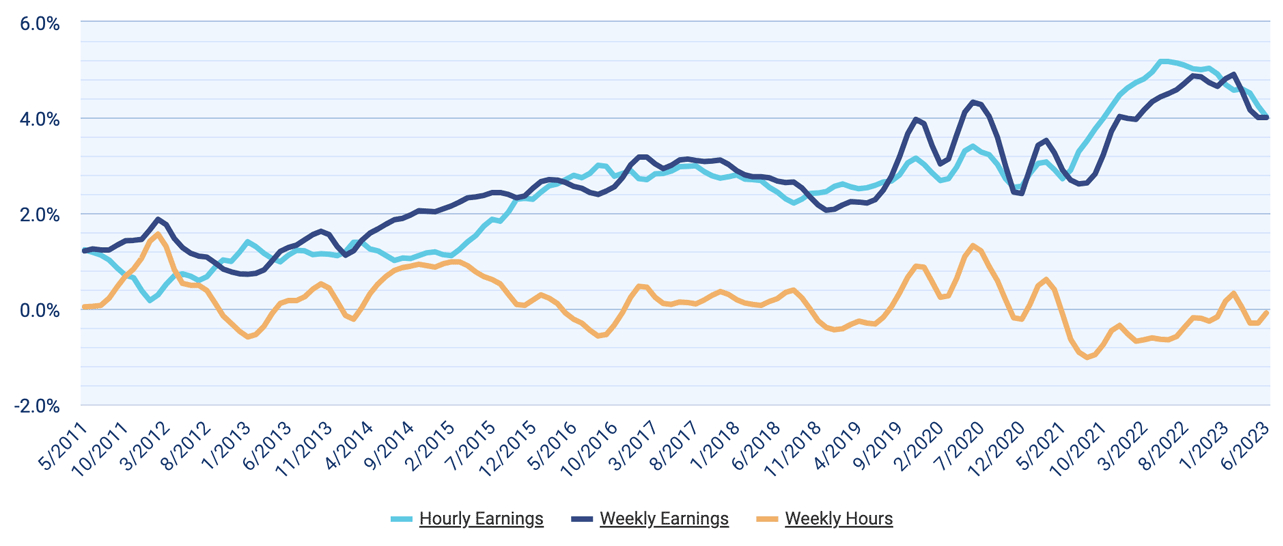

Job Market Remains Stable, Wage Growth Drops Below Four Percent

August 01, 2023

From Paychex, Inc.

Via Business Wire

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex Named a Leader in HCM Technology by NelsonHall

July 06, 2023

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex, Inc. Schedules Fourth Quarter Fiscal 2023 Earnings Conference Call for June 29, 2023

June 15, 2023

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Over 75% of HR Leaders Will Use AI in the Next Year, According to New Paychex Research

June 12, 2023

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex Declares a 13% Increase in Quarterly Dividend

April 28, 2023

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex, Inc. Schedules Third Quarter Fiscal 2023 Earnings Conference Call for March 29, 2023

March 15, 2023

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex, Inc. Schedules Second Quarter Fiscal 2023 Earnings Conference Call for December 22, 2022

December 08, 2022

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex Declares Quarterly Dividend

October 13, 2022

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex, Inc. Schedules First Quarter Fiscal 2023 Earnings Conference Call for September 28, 2022

September 14, 2022

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Martin Mucci of Paychex to Retire as CEO, Remains Chairman

August 24, 2022

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex, Inc. Schedules Fourth Quarter Fiscal 2022 Earnings Conference Call for June 29, 2022

June 15, 2022

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex Declares 20% Increase in Quarterly Dividend

April 29, 2022

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex, Inc. Reports Strong Third Quarter Results:

March 30, 2022

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex, Inc. Schedules Third Quarter Fiscal 2022 Earnings Conference Call for March 30, 2022

March 16, 2022

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex Declares Quarterly Dividend

January 14, 2022

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex, Inc. Schedules Second Quarter Fiscal 2022 Earnings Conference Call for December 22, 2021

December 08, 2021

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Paychex Declares Quarterly Dividend

October 14, 2021

From Paychex, Inc.

Via Business Wire

Tickers

PAYX

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.