- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

Articles published by XPeng Inc.

XPENG Reports Third Quarter 2022 Unaudited Financial Results

November 30, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPENG to Report Third Quarter 2022 Financial Results on Wednesday, November 30, 2022

November 09, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPENG Announces Vehicle Delivery Results for October 2022

November 01, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

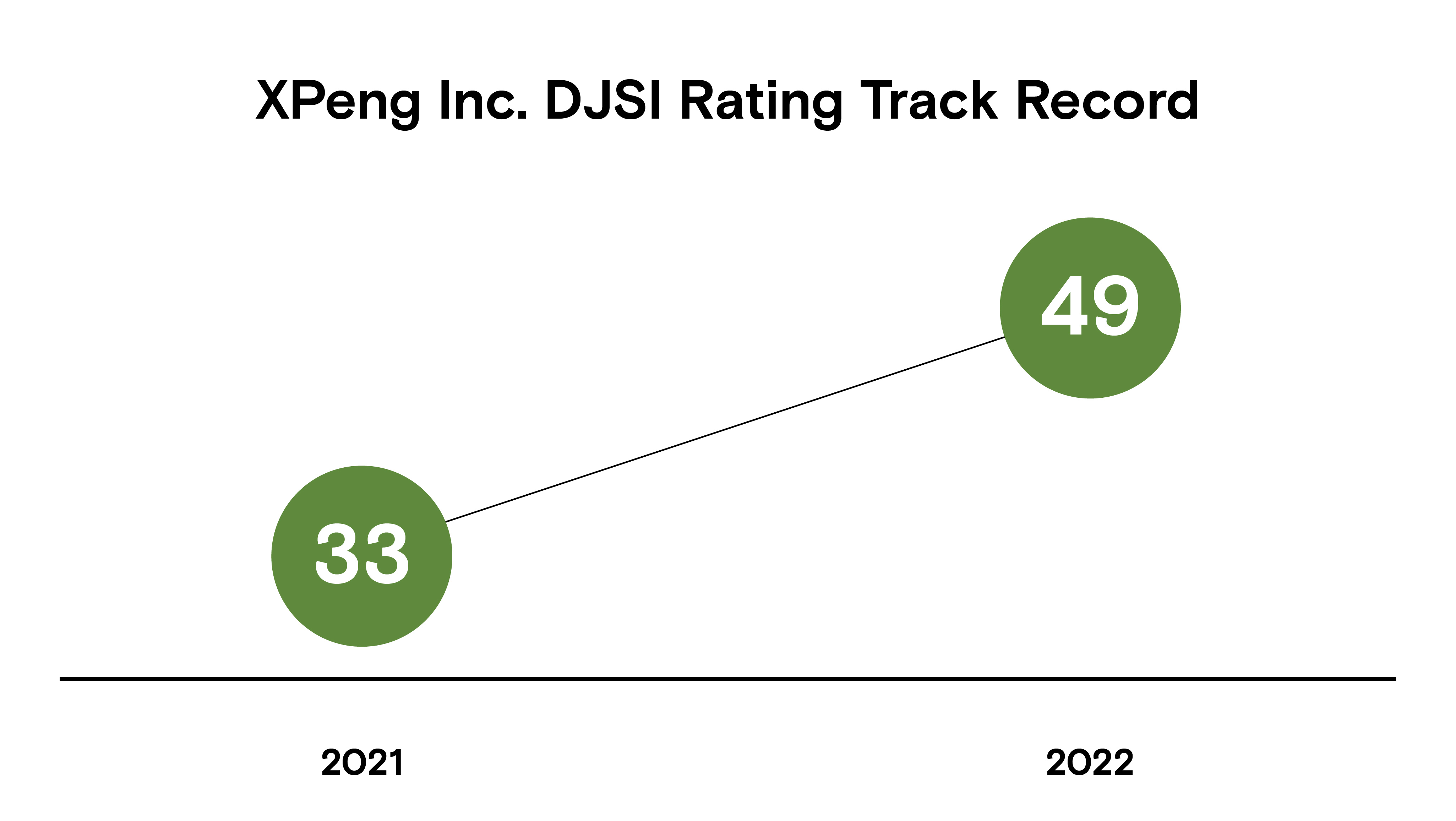

XPENG Receives Third Consecutive MSCI ESG Rating of AA

Achieves Industry-leading DJSI Scores

October 02, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng Adjusts Configurations of G9 Flagship SUV in Response to High Demand for Optional Specs of Cutting-Edge Technologies

September 23, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng Debuts City NGP Pilot Program

September 18, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng to Launch Flagship G9 SUV on September 21, 2022

September 17, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng Announces Vehicle Delivery Results for August 2022

September 01, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng Reports Second Quarter 2022 Unaudited Financial Results

August 23, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng Announces Vehicle Delivery Results for July 2022

August 01, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng Announces Vehicle Delivery Results for May 2022

June 01, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

From XPeng Inc.

Via Business Wire

Tickers

XPEV

From XPeng Inc.

Via Business Wire

Tickers

XPEV

From XPeng Inc.

Via Business Wire

Tickers

XPEV

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng Files 2021 Annual Report on Form 20-F

April 28, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

From XPeng Inc.

Via Business Wire

Tickers

XPEV

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng to be Added to The Hang Seng TECH Index as a Constituent Stock

February 18, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng Announces Inclusion of Its Shares in the Shenzhen-Hong Kong Stock Connect Program

February 08, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng Announces Vehicle Delivery Results for January 2022

February 01, 2022

From XPeng Inc.

Via Business Wire

Tickers

XPEV

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng Announces Vehicle Delivery Results for November 2021

December 01, 2021

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPeng Reports Third Quarter 2021 Unaudited Financial Results

November 23, 2021

From XPeng Inc.

Via Business Wire

Tickers

XPEV

XPENG to Unveil New Smart EV Model at Auto Guangzhou 2021

November 12, 2021

From XPeng Inc.

Via Business Wire

Tickers

XPEV

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.