Schwab U.S. Large-Cap Growth ETF (NY:SCHG)

Price and Volume

Detailed Quote| Volume | 14,264,465 |

| Open | 30.43 |

| Bid (Size) | 30.78 (100) |

| Ask (Size) | 30.79 (900) |

| Prev. Close | 30.48 |

| Today's Range | 30.30 - 30.83 |

| 52wk Range | 21.37 - 33.74 |

| Shares Outstanding | 15,259,000 |

| Dividend Yield | 0.42% |

Top News

More NewsPerformance

More News

Read More

The Best Growth Index ETF to Invest $100 in Right Now ↗

January 09, 2026

Could This Growth ETF Outperform the Market by 25% in 5 Years? ↗

December 23, 2025

3 High-Powered ETFs That Have Doubled in Value in Just 3 Years ↗

December 12, 2025

3 Growth ETFs to Buy With $5,000 and Hold Forever ↗

November 29, 2025

SPY Tops ETF Charts As Investors Tune Out The Fed And Chase The Rally ↗

November 04, 2025

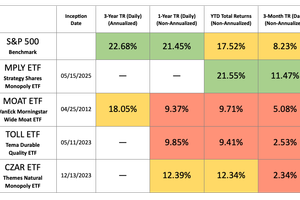

MPLY vs MOAT: Why The Newest Monopoly ETF Is Crushing The Old Guard ↗

November 03, 2025

XML Financial Sells Off 293K BND Shares in $21.6 Million Exit ↗

October 29, 2025

Prediction: These 3 Growth ETFs Could Crush the S&P 500 Over the Long Term ↗

September 27, 2025

U.S.-China Trade Deal: Which Stocks to Buy ↗

June 04, 2025

Will April 2 Reciprocal Tariffs Bring More Pain? ↗

March 22, 2025

Frequently Asked Questions

Is Schwab U.S. Large-Cap Growth ETF publicly traded?

Yes, Schwab U.S. Large-Cap Growth ETF is publicly traded.

What exchange does Schwab U.S. Large-Cap Growth ETF trade on?

Schwab U.S. Large-Cap Growth ETF trades on the New York Stock Exchange

What is the ticker symbol for Schwab U.S. Large-Cap Growth ETF?

The ticker symbol for Schwab U.S. Large-Cap Growth ETF is SCHG on the New York Stock Exchange

What is the current price of Schwab U.S. Large-Cap Growth ETF?

The current price of Schwab U.S. Large-Cap Growth ETF is 30.80

When was Schwab U.S. Large-Cap Growth ETF last traded?

The last trade of Schwab U.S. Large-Cap Growth ETF was at 02/24/26 06:30 PM ET

What is the market capitalization of Schwab U.S. Large-Cap Growth ETF?

The market capitalization of Schwab U.S. Large-Cap Growth ETF is 469.98M

How many shares of Schwab U.S. Large-Cap Growth ETF are outstanding?

Schwab U.S. Large-Cap Growth ETF has 470M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.