ProShares Ultra 7-10 Year Treasury (NY:UST)

Price and Volume

Detailed Quote| Volume | 14,905 |

| Open | 44.81 |

| Bid (Size) | 43.91 (300) |

| Ask (Size) | 45.62 (200) |

| Prev. Close | 44.61 |

| Today's Range | 44.51 - 44.81 |

| 52wk Range | 37.60 - 46.00 |

| Shares Outstanding | 4,150 |

| Dividend Yield | 5.11% |

Top News

More NewsPerformance

More News

Read More

CoT: What Futures, Hedge Funds Positions Can Tell Us ↗

March 23, 2025

Are The Charts Starting To Cast Doubt On The Strong Economic Thesis? ↗

February 03, 2024

U.S. Steel Shares Surge 28% After Nippon’s $14.9B Deal ↗

December 18, 2023

Which Way Is The Stock Market Going To Break? ↗

November 10, 2023

The Bull Market's Moment Of Truth ↗

October 13, 2023

Is It Time To Panic? ↗

September 23, 2023

Budget Deficits Take Center Stage ↗

August 09, 2023

PAX Gold, Chiliz Among Top Crypto Movers In 24H ↗

May 18, 2022

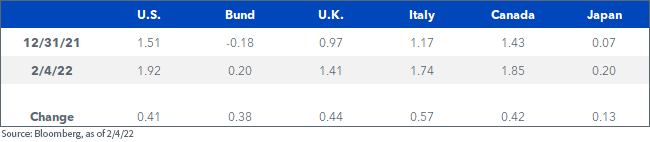

Negative Yields Are No Longer Spanning The Globe ↗

February 09, 2022

Frequently Asked Questions

Is ProShares Ultra 7-10 Year Treasury publicly traded?

Yes, ProShares Ultra 7-10 Year Treasury is publicly traded.

What exchange does ProShares Ultra 7-10 Year Treasury trade on?

ProShares Ultra 7-10 Year Treasury trades on the New York Stock Exchange

What is the ticker symbol for ProShares Ultra 7-10 Year Treasury?

The ticker symbol for ProShares Ultra 7-10 Year Treasury is UST on the New York Stock Exchange

What is the current price of ProShares Ultra 7-10 Year Treasury?

The current price of ProShares Ultra 7-10 Year Treasury is 44.59

When was ProShares Ultra 7-10 Year Treasury last traded?

The last trade of ProShares Ultra 7-10 Year Treasury was at 02/20/26 08:00 PM ET

What is the market capitalization of ProShares Ultra 7-10 Year Treasury?

The market capitalization of ProShares Ultra 7-10 Year Treasury is 185.05K

How many shares of ProShares Ultra 7-10 Year Treasury are outstanding?

ProShares Ultra 7-10 Year Treasury has 185K shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.