iShares S&P Mid-Cap 400 Value ETF (NY:IJJ)

Price and Volume

Detailed Quote| Volume | 79,477 |

| Open | 133.75 |

| Bid (Size) | 133.33 (100) |

| Ask (Size) | 134.08 (100) |

| Prev. Close | 133.74 |

| Today's Range | 133.23 - 133.80 |

| 52wk Range | 102.24 - 136.20 |

| Shares Outstanding | 618,500 |

| Dividend Yield | 1.71% |

Top News

More NewsPerformance

More News

Read More

IWN vs. IJJ: Which iShares Value-Focused ETF Reigns Supreme? ↗

December 18, 2025

Carlyle Group Stock Slips After Q4 Profit Miss: Retail Remains Neutral ↗

February 11, 2025

Macy's Stock Dips After Lower Sales Outlook: Retail Mood Sours ↗

January 13, 2025

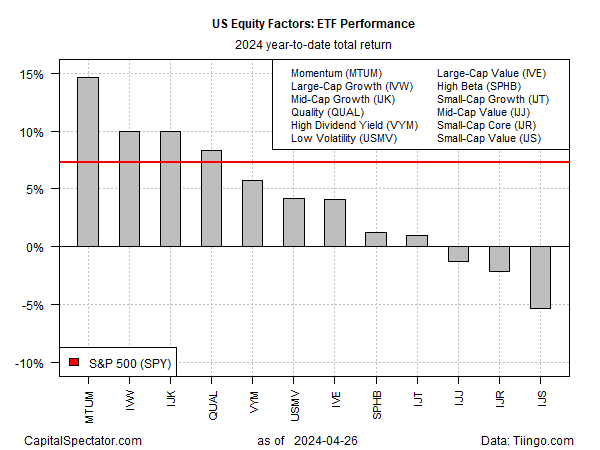

Momentum Retains Solid Lead For 2024 Equity Factor Returns ↗

April 29, 2024

Perspective On A New Year ↗

January 08, 2024

A Monthly Market Review… [Dirty Dozen] ↗

July 03, 2023

Strong Jobs Report But Look Under The Hood ↗

November 07, 2022

Choppy & Sloppy Markets And Year ↗

June 09, 2022

This Rally Is Brought To You By Some Old, Familiar Leaders ↗

March 29, 2022

Fed Chair Powell Gets Antsy - Near-Term Risk ↗

March 02, 2022

This Rally Just Got Really, Really Weird ↗

November 19, 2021

There's Nowhere To Hide From the Market's Carnage... Except Here ↗

October 05, 2021

5 Mid-Cap ETFs for Outperformance Amid Volatility ↗

August 10, 2021

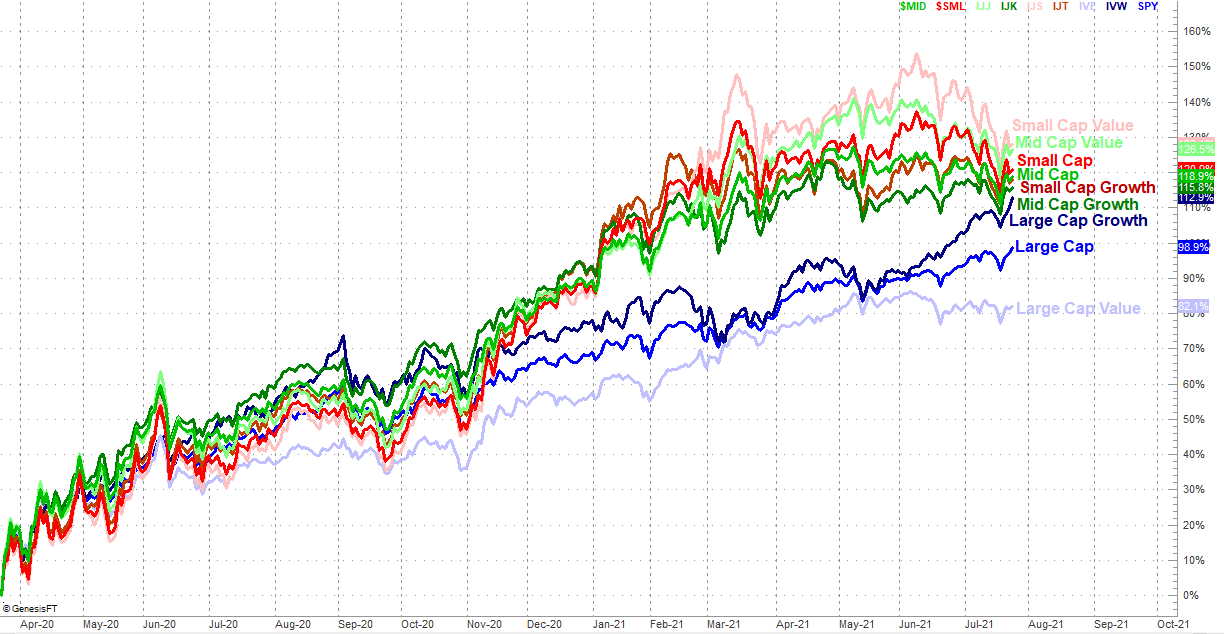

Large Cap Growth Leaves Small Cap Growth in the Dust ↗

July 28, 2021

This Rally Remains (Strangely) Poorly Balanced ↗

July 23, 2021

Into Large Cap Growth, Out Of... Everything Else ↗

July 05, 2021

Frequently Asked Questions

Is iShares S&P Mid-Cap 400 Value ETF publicly traded?

Yes, iShares S&P Mid-Cap 400 Value ETF is publicly traded.

What exchange does iShares S&P Mid-Cap 400 Value ETF trade on?

iShares S&P Mid-Cap 400 Value ETF trades on the New York Stock Exchange

What is the ticker symbol for iShares S&P Mid-Cap 400 Value ETF?

The ticker symbol for iShares S&P Mid-Cap 400 Value ETF is IJJ on the New York Stock Exchange

What is the current price of iShares S&P Mid-Cap 400 Value ETF?

The current price of iShares S&P Mid-Cap 400 Value ETF is 133.73

When was iShares S&P Mid-Cap 400 Value ETF last traded?

The last trade of iShares S&P Mid-Cap 400 Value ETF was at 12/26/25 08:00 PM ET

What is the market capitalization of iShares S&P Mid-Cap 400 Value ETF?

The market capitalization of iShares S&P Mid-Cap 400 Value ETF is 82.71M

How many shares of iShares S&P Mid-Cap 400 Value ETF are outstanding?

iShares S&P Mid-Cap 400 Value ETF has 83M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.