iShares Latin America 40 ETF (NY:ILF)

Price and Volume

Detailed Quote| Volume | 5,062,036 |

| Open | 36.44 |

| Bid (Size) | 36.80 (100) |

| Ask (Size) | 37.29 (500) |

| Prev. Close | 35.63 |

| Today's Range | 36.26 - 36.94 |

| 52wk Range | 20.97 - 37.28 |

| Shares Outstanding | 675,000 |

| Dividend Yield | 1.10% |

Top News

More NewsPerformance

More News

Read More

Rare chart pattern setting up 3 stocks for upside trade

January 05, 2024

Market Recap - Crypto, Indices, Sectors ↗

December 15, 2023

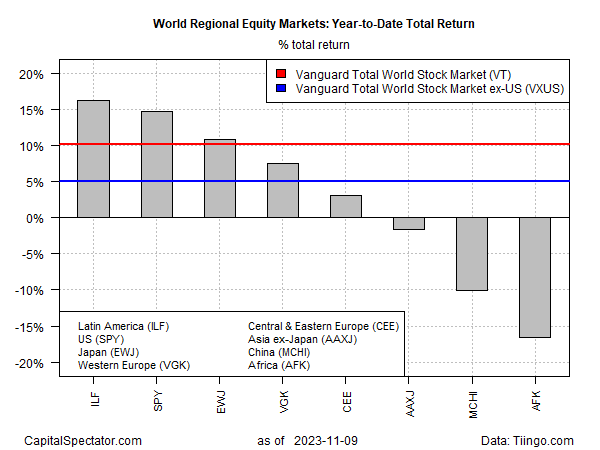

International Stocks On Track To Trail US Equities In 2023 ↗

November 10, 2023

Weekly Market Pulse: History Lessons ↗

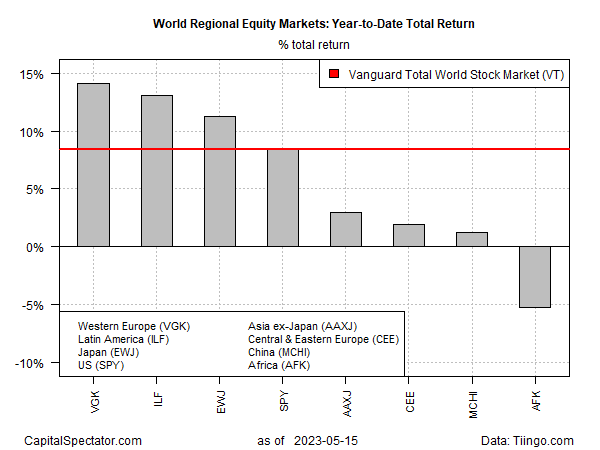

April 10, 2023

The 3 Best South American Stocks to Buy in 2023 ↗

January 26, 2023

Waiting (And Hoping) For A Bottom In Global Equity Markets ↗

November 30, 2022

Bullish Bias: 7 Stocks To Trade This Week ↗

October 23, 2022

Stocks In Latin America Are Outperforming This Year ↗

October 13, 2022

15 ETFs And Stocks With Exposure To Mexico ↗

May 05, 2022

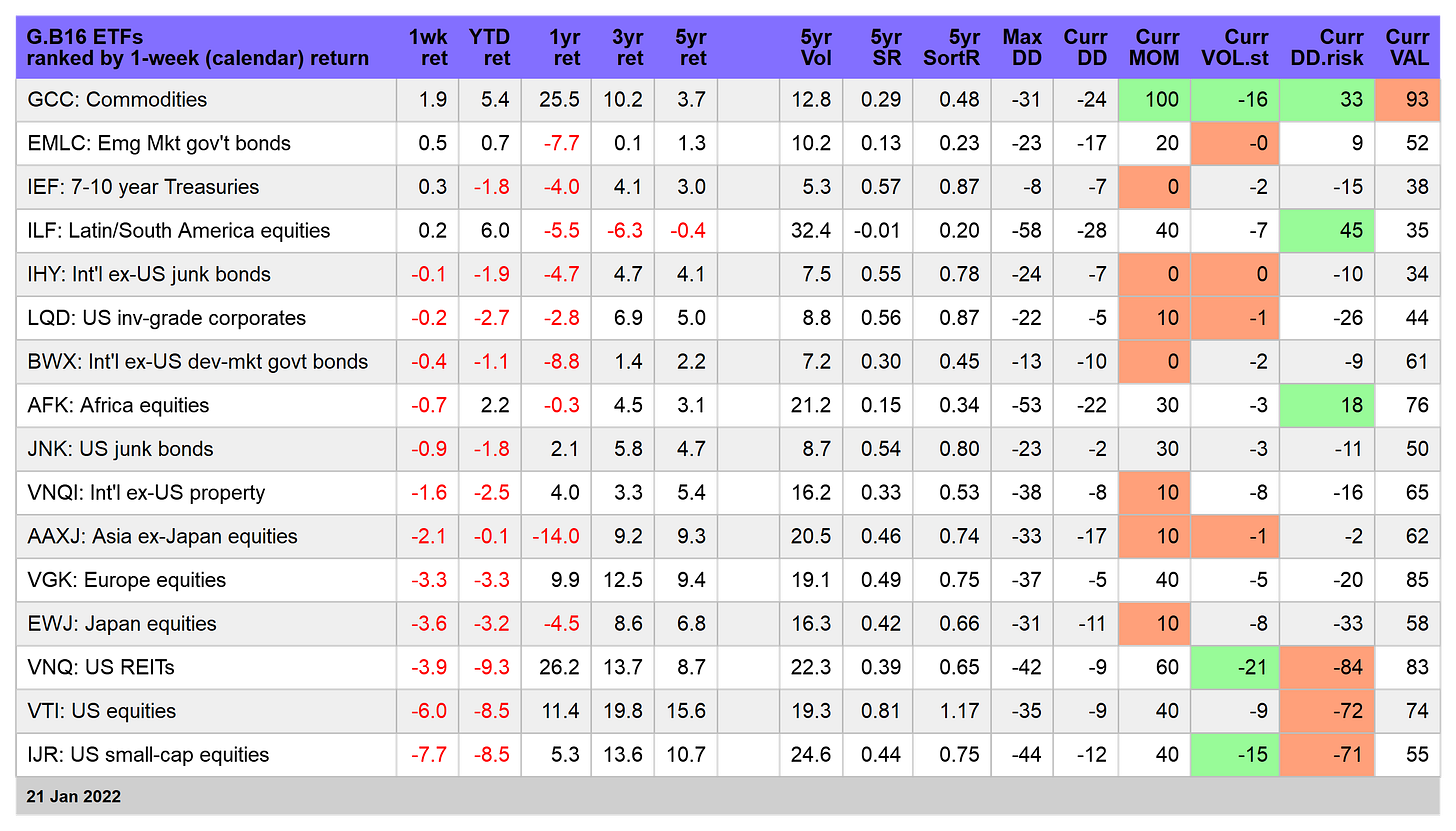

The ETF Portfolio Strategist: Saturday, Jan. 22 ↗

January 22, 2022

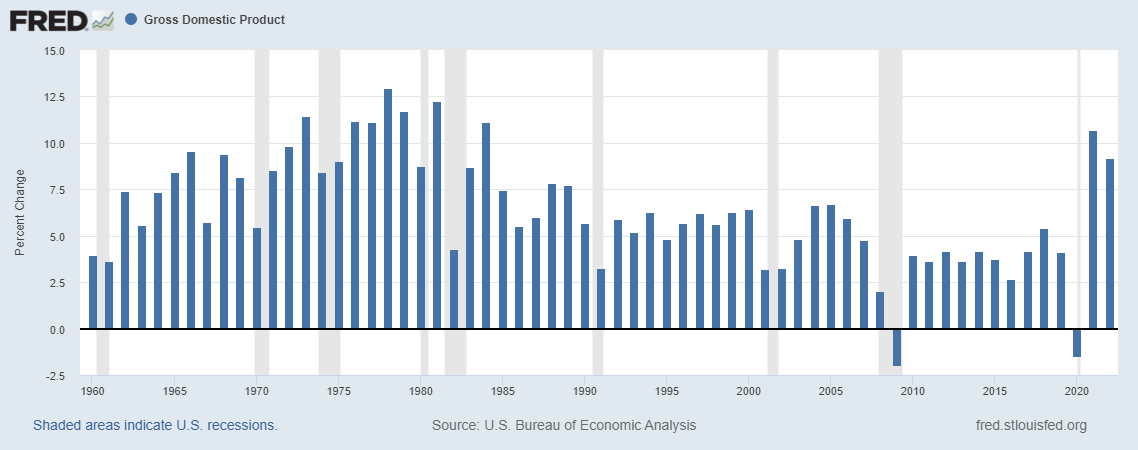

A Rough Start For Global Equities In 2022 ↗

January 20, 2022

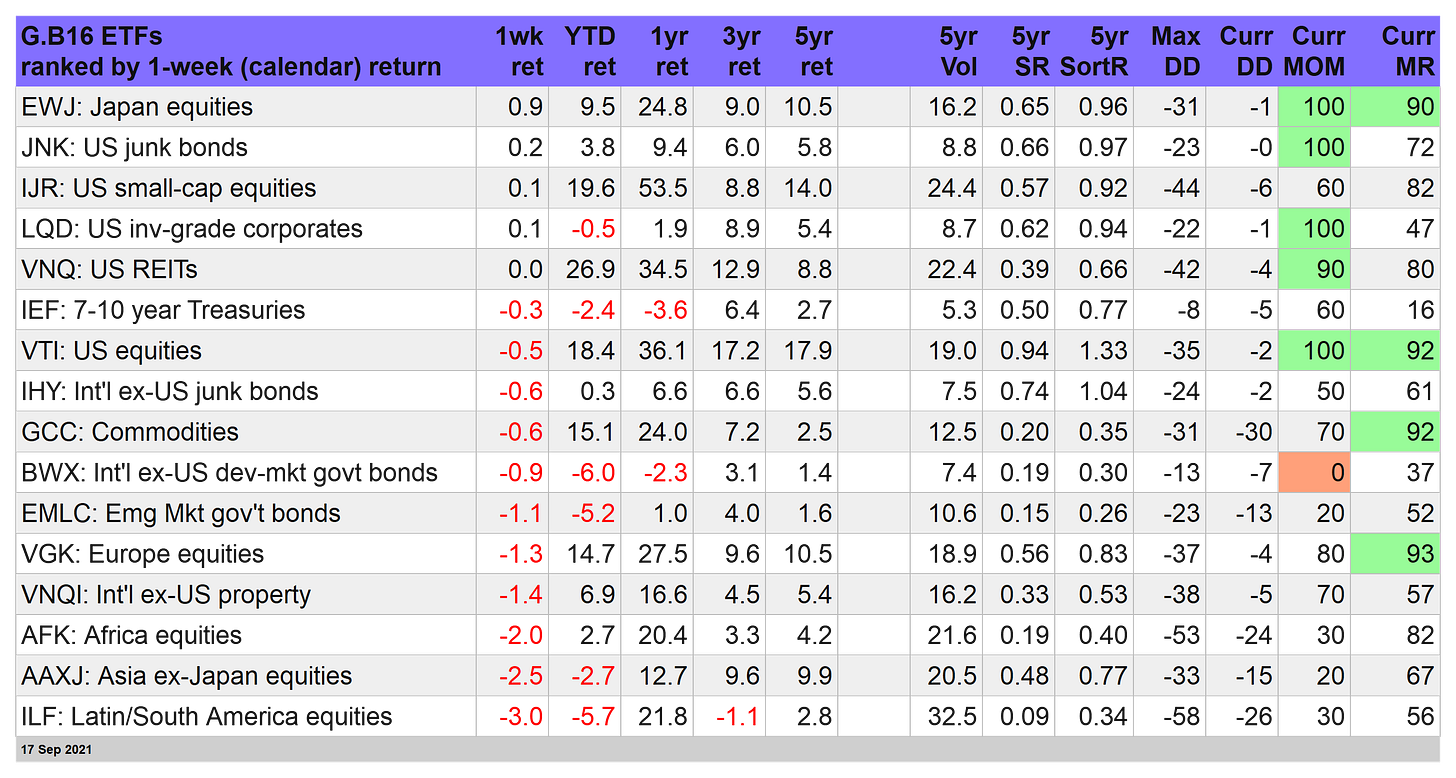

The ETF Portfolio Strategist - Saturday, Sept. 18 ↗

September 18, 2021

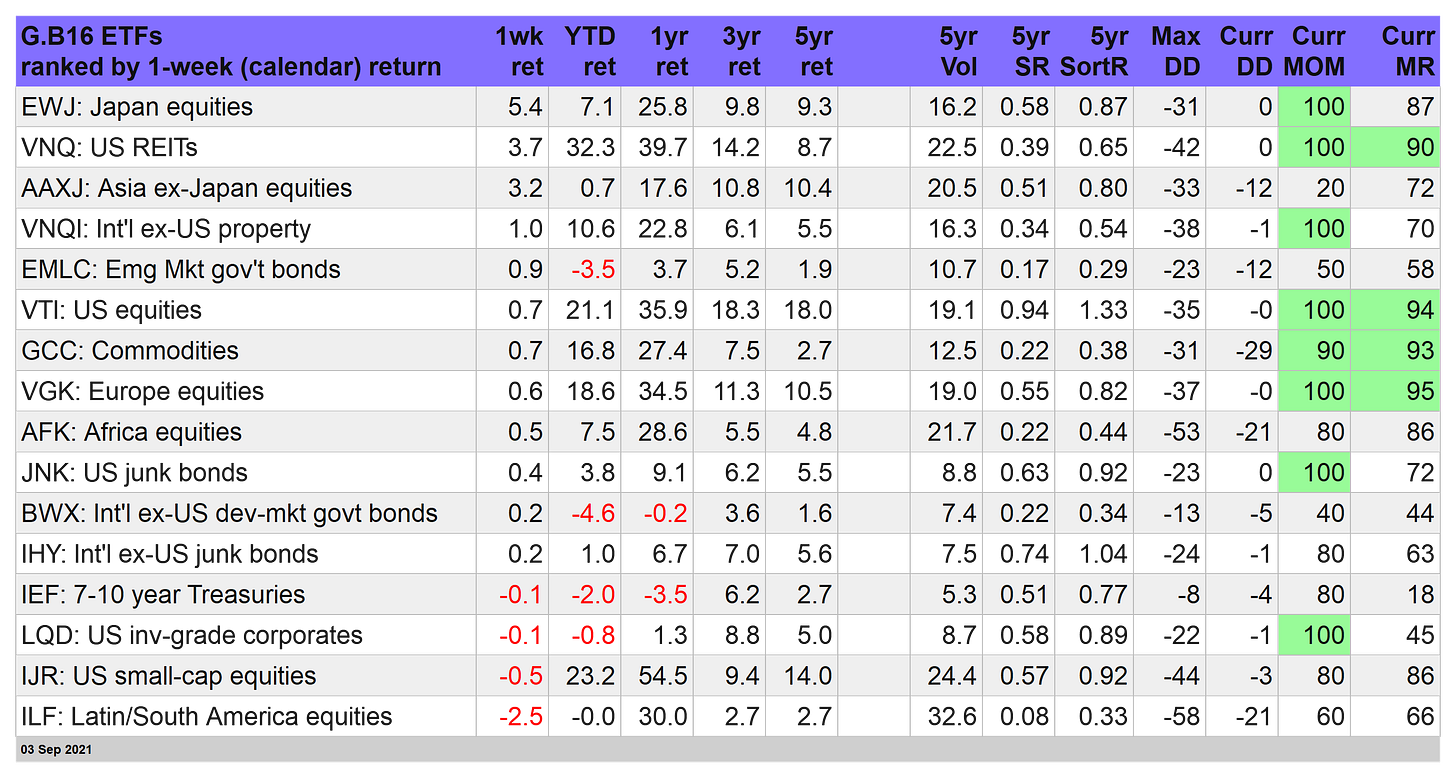

The ETF Portfolio Strategist - Saturday, Sept. 4 ↗

September 04, 2021

Frequently Asked Questions

Is iShares Latin America 40 ETF publicly traded?

Yes, iShares Latin America 40 ETF is publicly traded.

What exchange does iShares Latin America 40 ETF trade on?

iShares Latin America 40 ETF trades on the New York Stock Exchange

What is the ticker symbol for iShares Latin America 40 ETF?

The ticker symbol for iShares Latin America 40 ETF is ILF on the New York Stock Exchange

What is the current price of iShares Latin America 40 ETF?

The current price of iShares Latin America 40 ETF is 36.69

When was iShares Latin America 40 ETF last traded?

The last trade of iShares Latin America 40 ETF was at 02/03/26 04:10 PM ET

What is the market capitalization of iShares Latin America 40 ETF?

The market capitalization of iShares Latin America 40 ETF is 24.77M

How many shares of iShares Latin America 40 ETF are outstanding?

iShares Latin America 40 ETF has 25M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.