WT Offshore (NY:WTI)

Price and Volume

Detailed Quote| Volume | 3,679,607 |

| Open | 2.680 |

| Bid (Size) | 2.610 (700) |

| Ask (Size) | 2.670 (2,000) |

| Prev. Close | 2.670 |

| Today's Range | 2.550 - 2.770 |

| 52wk Range | 1.090 - 2.770 |

| Shares Outstanding | 147,357,587 |

| Dividend Yield | 1.53% |

Top News

More News

Earnings Scheduled For November 5, 2025 ↗

November 05, 2025

Performance

More News

Read More

W&T Offshore (WTI) Q2 2025 Earnings Transcript ↗

August 05, 2025

W&T Offshore (WTI) Q2 Revenue Falls 14% ↗

August 05, 2025

Earnings Scheduled For August 4, 2025 ↗

August 04, 2025

Earnings Scheduled For May 6, 2025 ↗

May 06, 2025

Should The US Import Oil From Venezuela Instead Of Canada? ↗

March 23, 2025

Earnings Scheduled For March 3, 2025 ↗

March 03, 2025

The Energy Report: Venezuela Off Balance ↗

February 27, 2025

The Energy Report: The Great Negotiator. ↗

February 26, 2025

US Futures Jump Ahead Of Nvidia Earnings, Europe Hits Another Record ↗

February 26, 2025

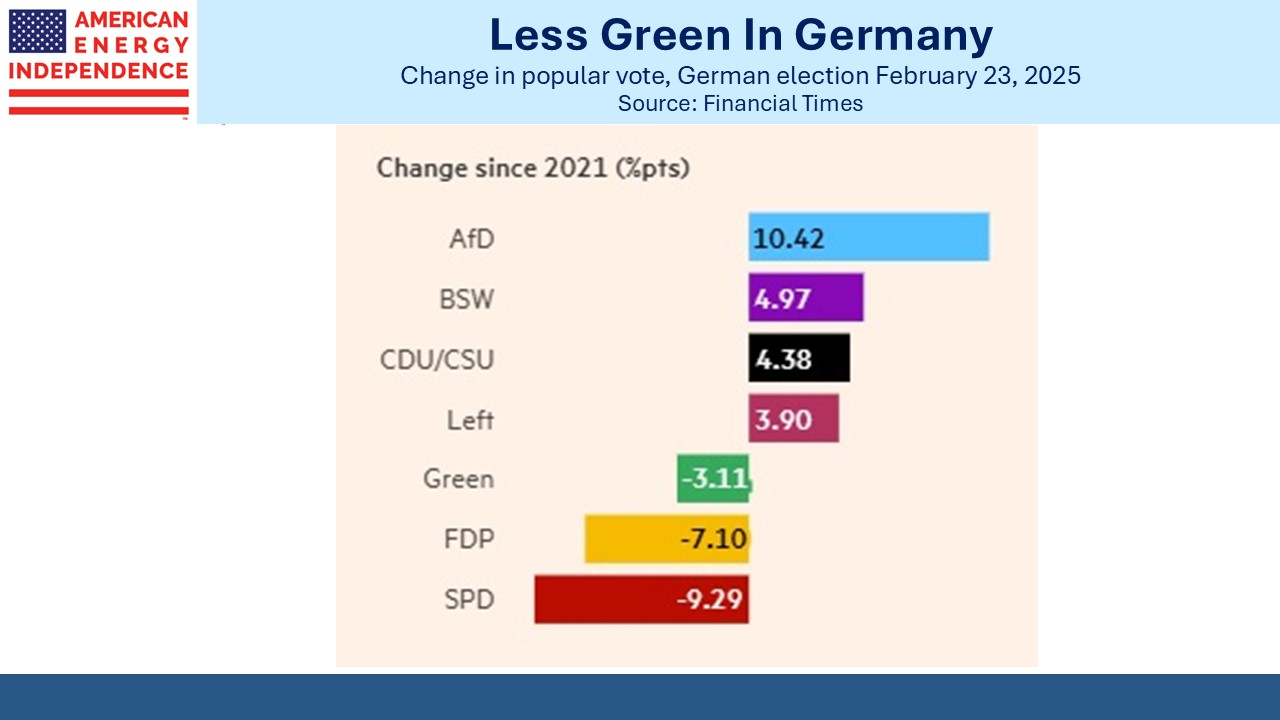

The Receding Energy Crisis ↗

February 26, 2025

The Energy Report : Cold As Ice ↗

February 21, 2025

The Energy Report: Stable Instability - Tuesday, February 18 ↗

February 18, 2025

Futures Flat Ahead Of PPI, Reciprocal Tariffs ↗

February 13, 2025

The Commodities Feed: Oil Edges Lower ↗

February 13, 2025

The Energy Report: Peace In Pieces ↗

February 12, 2025

WTI Price Analysis: Oil Prices Rise After NFP Data ↗

February 08, 2025

The Energy Report: The New Trump World Oil Order ↗

February 07, 2025

OPEC+ Likely To Continue Gradual Output Increase Strategy ↗

February 03, 2025

WTI Crudeoil Oil Commodity Elliott Wave Technical Analysis ↗

February 03, 2025

Frequently Asked Questions

Is WT Offshore publicly traded?

Yes, WT Offshore is publicly traded.

What exchange does WT Offshore trade on?

WT Offshore trades on the New York Stock Exchange

What is the ticker symbol for WT Offshore?

The ticker symbol for WT Offshore is WTI on the New York Stock Exchange

What is the current price of WT Offshore?

The current price of WT Offshore is 2.610

When was WT Offshore last traded?

The last trade of WT Offshore was at 02/23/26 07:00 PM ET

What is the market capitalization of WT Offshore?

The market capitalization of WT Offshore is 384.60M

How many shares of WT Offshore are outstanding?

WT Offshore has 385M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

.thumb.png.c2c06c7d56f2b9239f87ff999c687c68.png)