Invesco DB Agriculture Fund (NY:DBA)

Price and Volume

Detailed Quote| Volume | 359,593 |

| Open | 25.98 |

| Bid (Size) | 25.88 (500) |

| Ask (Size) | 26.05 (200) |

| Prev. Close | 25.90 |

| Today's Range | 25.86 - 26.05 |

| 52wk Range | 25.27 - 28.01 |

| Shares Outstanding | 44,500,000 |

| Dividend Yield | 3.50% |

Top News

More NewsPerformance

More News

Read More

Gold and Commodities: Is the Bull Case Gaining Momentum?

June 13, 2025

From Bad To Worse, But There’s Hope ↗

April 06, 2025

Post FOMC - A Look At 2 Commodity ETFs ↗

March 19, 2025

Mag 3 Meets FOMC ↗

January 31, 2025

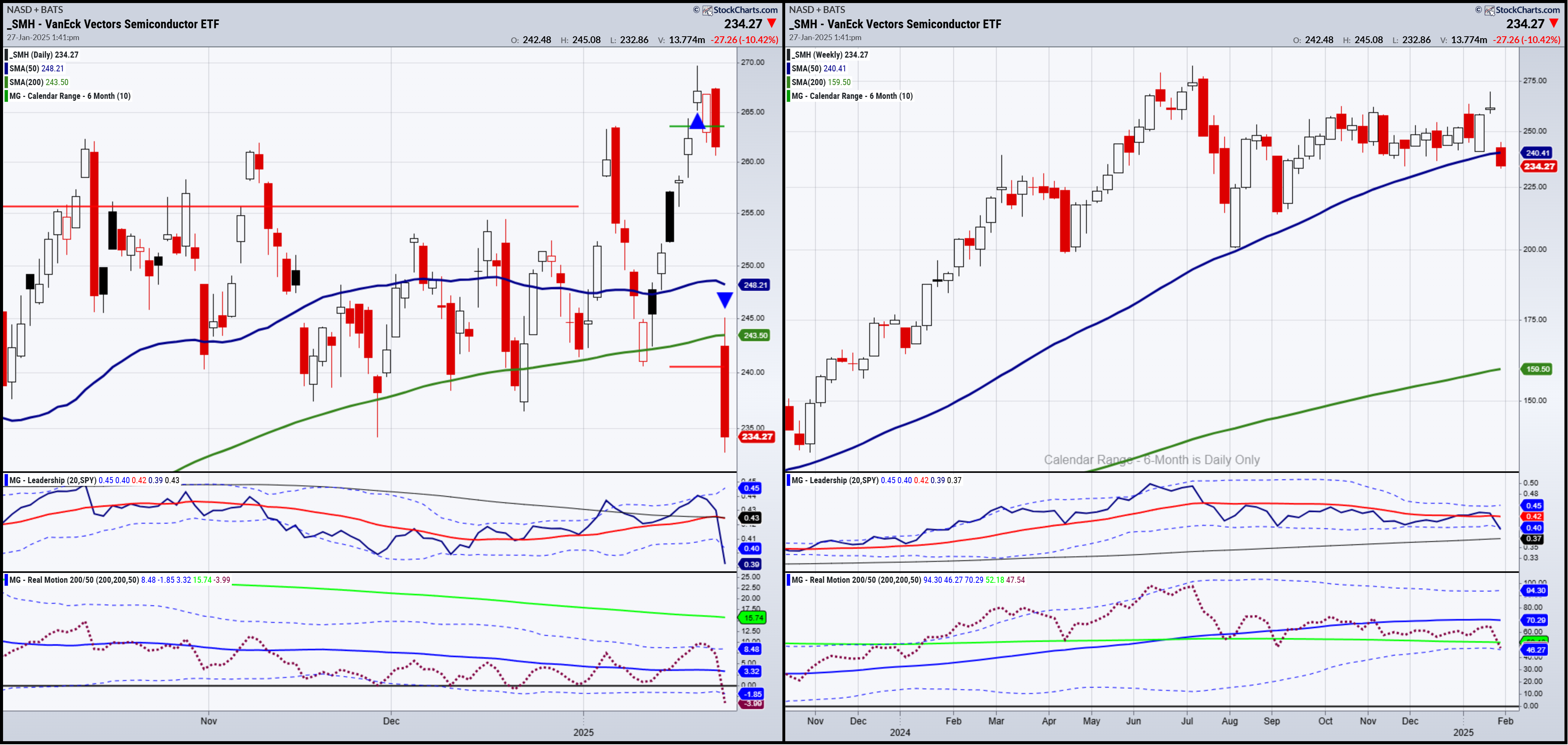

DeepSeek Is Not New - The Rotation Away From Tech Is ↗

January 27, 2025

Commodities And The January Trend Trade ↗

January 26, 2025

Slide In Energy Contrasts With Rallies Elsewhere In Commodities ↗

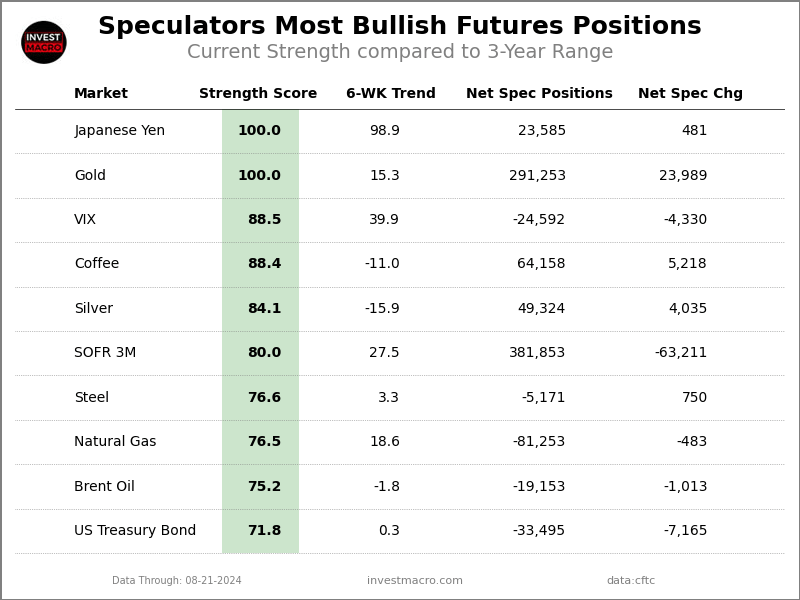

September 27, 2024

Unstoppable: What Does The Fed Know That We Don't? ↗

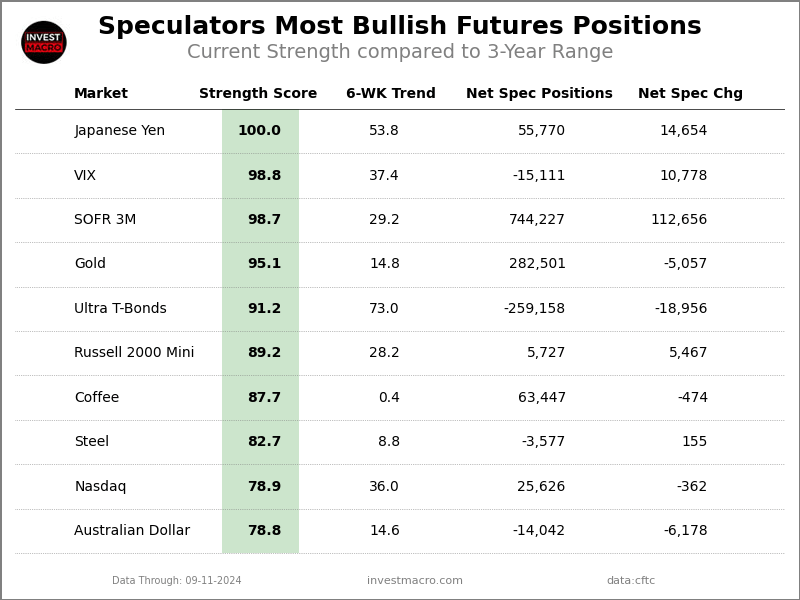

September 22, 2024

FOMC Lowers Rates Aggressively On Hump Wednesday ↗

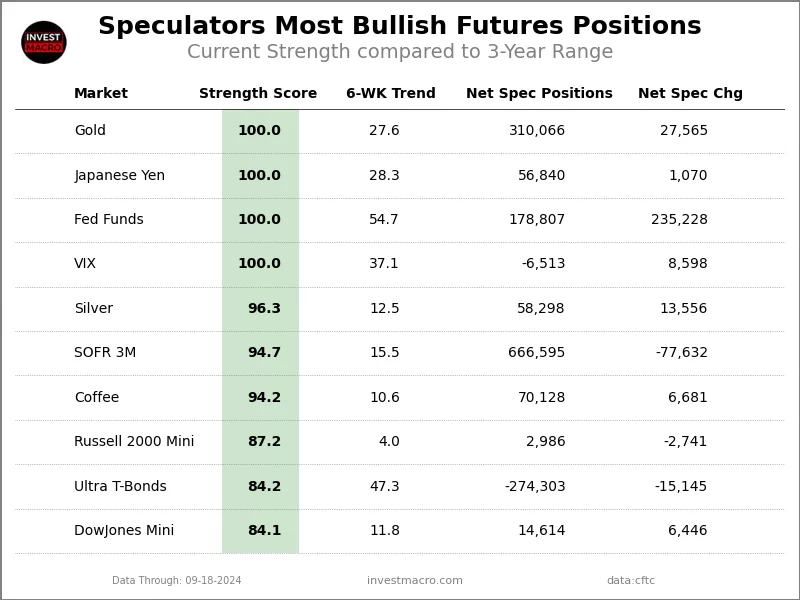

September 18, 2024

The Commodity Kings: 3 Stocks to Dig Into Now ↗

May 25, 2024

Frequently Asked Questions

Is Invesco DB Agriculture Fund publicly traded?

Yes, Invesco DB Agriculture Fund is publicly traded.

What exchange does Invesco DB Agriculture Fund trade on?

Invesco DB Agriculture Fund trades on the New York Stock Exchange

What is the ticker symbol for Invesco DB Agriculture Fund?

The ticker symbol for Invesco DB Agriculture Fund is DBA on the New York Stock Exchange

What is the current price of Invesco DB Agriculture Fund?

The current price of Invesco DB Agriculture Fund is 26.03

When was Invesco DB Agriculture Fund last traded?

The last trade of Invesco DB Agriculture Fund was at 02/20/26 08:00 PM ET

What is the market capitalization of Invesco DB Agriculture Fund?

The market capitalization of Invesco DB Agriculture Fund is 1.16B

How many shares of Invesco DB Agriculture Fund are outstanding?

Invesco DB Agriculture Fund has 1B shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.