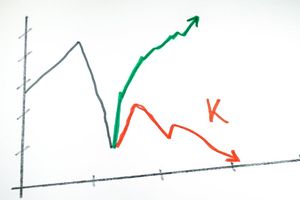

Ppr Sa ADR (OP:PPRUY)

Price and Volume

Detailed Quote| Volume | 72,410 |

| Open | 36.63 |

| Bid (Size) | N/A (0) |

| Ask (Size) | N/A (0) |

| Prev. Close | 36.24 |

| Today's Range | 36.34 - 37.12 |

| 52wk Range | 17.02 - 40.70 |

| Shares Outstanding | N/A |

| Dividend Yield | N/A |

Top News

More NewsPerformance

More News

Read More

Gucci's Owner Sells Beauty Arm To L'Oréal In $4.6 Billion Deal ↗

October 20, 2025

US Dollar Drops on Report of Trump Tariff Plan Shift ↗

January 09, 2025

Gen Z Is Rewriting Luxury — Can KLXY And FINE ETFs Keep Up? ↗

September 20, 2025

Italian Economy Stagnates As Manufacturing, Fashion Slow ↗

November 11, 2024

European Tariffs On China's EV Makers Could Backfire ↗

October 02, 2024

Roblox's Growth Beyond Kids: Stock Set for Major Moves

September 16, 2024

3 French Luxury Stocks You Can Snag for a Bargain ↗

July 24, 2024

3 Luxury Stocks That Are Worth the Splurge ↗

June 05, 2024

Can A Gucci Turnaround Lift Kering’s SA Share Price? ↗

April 27, 2024

3 High-End Retail Stocks to Drop Amid the Luxury Slump ↗

February 20, 2024

Burberry Trims Profit Outlook: Are Luxury Goods Losing Charm? ↗

January 12, 2024

Hedge Funds Favorite Short? 3 They Love to Bet Against ↗

November 29, 2023

Gucci Owner Kering Buys Iconic Fragrance Brand Creed ↗

June 26, 2023

Frequently Asked Questions

Is Ppr Sa ADR publicly traded?

Yes, Ppr Sa ADR is publicly traded.

What exchange does Ppr Sa ADR trade on?

Ppr Sa ADR trades on the OTC Traded

What is the ticker symbol for Ppr Sa ADR?

The ticker symbol for Ppr Sa ADR is PPRUY on the OTC Traded

What is the current price of Ppr Sa ADR?

The current price of Ppr Sa ADR is 36.88

When was Ppr Sa ADR last traded?

The last trade of Ppr Sa ADR was at 01/09/26 03:59 PM ET

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.