Vanguard Intermediate-Term Treasury ETF (NQ:VGIT)

Price and Volume

Detailed Quote| Volume | 2,029,121 |

| Open | 60.33 |

| Bid (Size) | 60.00 (900) |

| Ask (Size) | 60.50 (1,100) |

| Prev. Close | 60.30 |

| Today's Range | 60.23 - 60.33 |

| 52wk Range | 58.26 - 60.57 |

| Shares Outstanding | N/A |

| Dividend Yield | 3.86% |

Top News

More NewsPerformance

More News

Read More

How Does BND's Broad Bond Exposure Compare to VGIT's Lower Risk? ↗

February 08, 2026

Treasuries or Munis: VGIT vs. MUB for Conservative Portfolios ↗

January 26, 2026

Hara Capital Adds Noble Corp. Equity ↗

January 15, 2026

Retireful Liquidates 44K VGIT Shares Worth $2.7 Million ↗

October 21, 2025

Lam Research Quietly Strengthens Its Place in the AI Chip Boom ↗

October 20, 2025

3 Vanguard ETFs to Buy With $500 ↗

April 19, 2025

5 ETFs That Gained Investors Love In February ↗

March 05, 2024

Traders May Need Frequent Portfolio Adjustments In 2024: BlackRock ↗

December 14, 2023

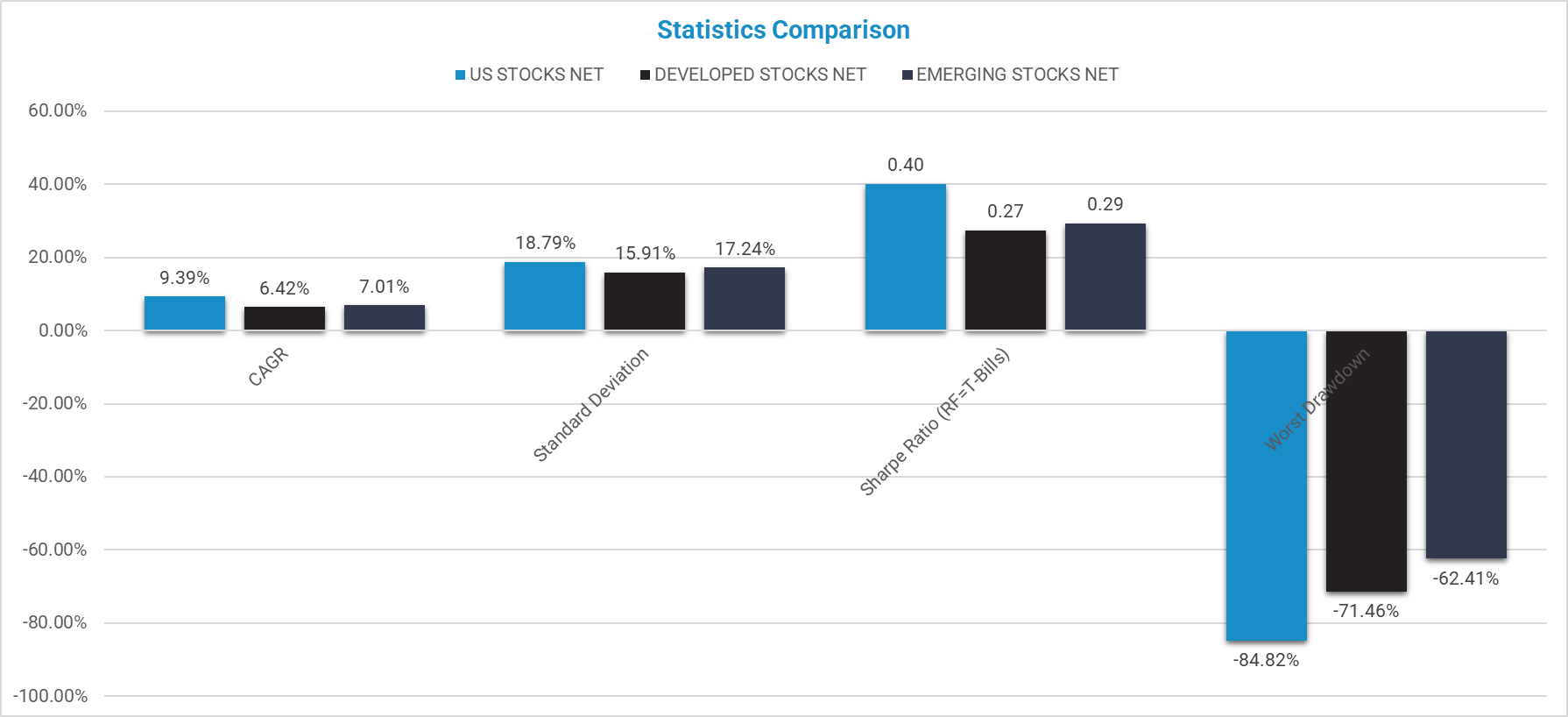

Emerging Market Investing: Does It Make Sense? ↗

June 18, 2022

Frequently Asked Questions

Is Vanguard Intermediate-Term Treasury ETF publicly traded?

Yes, Vanguard Intermediate-Term Treasury ETF is publicly traded.

What exchange does Vanguard Intermediate-Term Treasury ETF trade on?

Vanguard Intermediate-Term Treasury ETF trades on the Nasdaq Stock Market

What is the ticker symbol for Vanguard Intermediate-Term Treasury ETF?

The ticker symbol for Vanguard Intermediate-Term Treasury ETF is VGIT on the Nasdaq Stock Market

What is the current price of Vanguard Intermediate-Term Treasury ETF?

The current price of Vanguard Intermediate-Term Treasury ETF is 60.32

When was Vanguard Intermediate-Term Treasury ETF last traded?

The last trade of Vanguard Intermediate-Term Treasury ETF was at 02/20/26 04:15 PM ET

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.