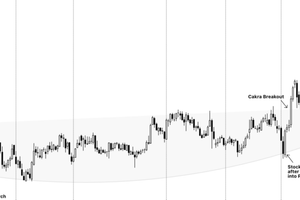

Garrett Motion Inc. - Common Stock (NQ:GTX)

Price and Volume

Detailed Quote| Volume | 1,347,197 |

| Open | 20.84 |

| Bid (Size) | 20.71 (1,000) |

| Ask (Size) | 20.73 (500) |

| Prev. Close | 20.80 |

| Today's Range | 20.54 - 21.21 |

| 52wk Range | 7.015 - 20.94 |

| Shares Outstanding | 65,062,181 |

| Dividend Yield | 1.54% |

Top News

More NewsPerformance

More News

Read More

3 Value Stocks We Find Risky

February 10, 2026

3 Value Stocks We Approach with Caution

February 05, 2026

1 Volatile Stock to Research Further and 2 Facing Challenges

February 01, 2026

Garrett Motion Stays in the Fast Lane with Scuderia Ferrari HP

January 30, 2026

Electrical Systems Stocks Q3 Highlights: Garrett Motion (NASDAQ:GTX)

January 18, 2026

3 Stocks Under $50 We Approach with Caution

January 15, 2026

3 Small-Cap Stocks We Keep Off Our Radar

January 12, 2026

1 Profitable Stock with Competitive Advantages and 2 We Find Risky

January 11, 2026

1 Russell 2000 Stock with Exciting Potential and 2 We Question

January 04, 2026

Garrett Motion (NASDAQ:GTX) Reports Bullish Q3 CY2025

January 01, 2026

Garrett Motion Announces $250 Million Share Repurchase Program for 2026

December 03, 2025

Garrett Motion's Bullishness In Motion: More Momentum Ahead? ↗

October 27, 2025

Why Garrett Motion Stock Skyrocketed Today ↗

October 23, 2025

Frequently Asked Questions

Is Garrett Motion Inc. - Common Stock publicly traded?

Yes, Garrett Motion Inc. - Common Stock is publicly traded.

What exchange does Garrett Motion Inc. - Common Stock trade on?

Garrett Motion Inc. - Common Stock trades on the Nasdaq Stock Market

What is the ticker symbol for Garrett Motion Inc. - Common Stock?

The ticker symbol for Garrett Motion Inc. - Common Stock is GTX on the Nasdaq Stock Market

What is the current price of Garrett Motion Inc. - Common Stock?

The current price of Garrett Motion Inc. - Common Stock is 20.72

When was Garrett Motion Inc. - Common Stock last traded?

The last trade of Garrett Motion Inc. - Common Stock was at 02/12/26 02:40 PM ET

What is the market capitalization of Garrett Motion Inc. - Common Stock?

The market capitalization of Garrett Motion Inc. - Common Stock is 1.35B

How many shares of Garrett Motion Inc. - Common Stock are outstanding?

Garrett Motion Inc. - Common Stock has 1B shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.