iShares MSCI ACWI ETF (NQ:ACWI)

Price and Volume

Detailed Quote| Volume | 4,232,759 |

| Open | 142.55 |

| Bid (Size) | 141.07 (100) |

| Ask (Size) | 142.00 (100) |

| Prev. Close | 142.41 |

| Today's Range | 141.48 - 142.90 |

| 52wk Range | 101.25 - 143.24 |

| Shares Outstanding | N/A |

| Dividend Yield | 1.36% |

Top News

More NewsPerformance

More News

Read More

Nvidia's Market Dominance Now Dwarfs Japan, China, Germany, UK ↗

October 07, 2025

Concentration Risk ↗

December 17, 2024

Is The Market Open On Labor Day? ↗

September 02, 2024

AT&T Gains FCC Approval to Replace Copper Lines With Wireless Tech ↗

December 24, 2024

Walmart Teams Up With China's Meituan to Boost E-Commerce ↗

December 17, 2024

What Does A Once-In-A-Generation Investment Opportunity Look Like? ↗

October 13, 2024

Stocks May Fall Further With More Yield Curve Steepening Ahead ↗

October 05, 2023

Bullish? Not So Much ↗

August 13, 2023

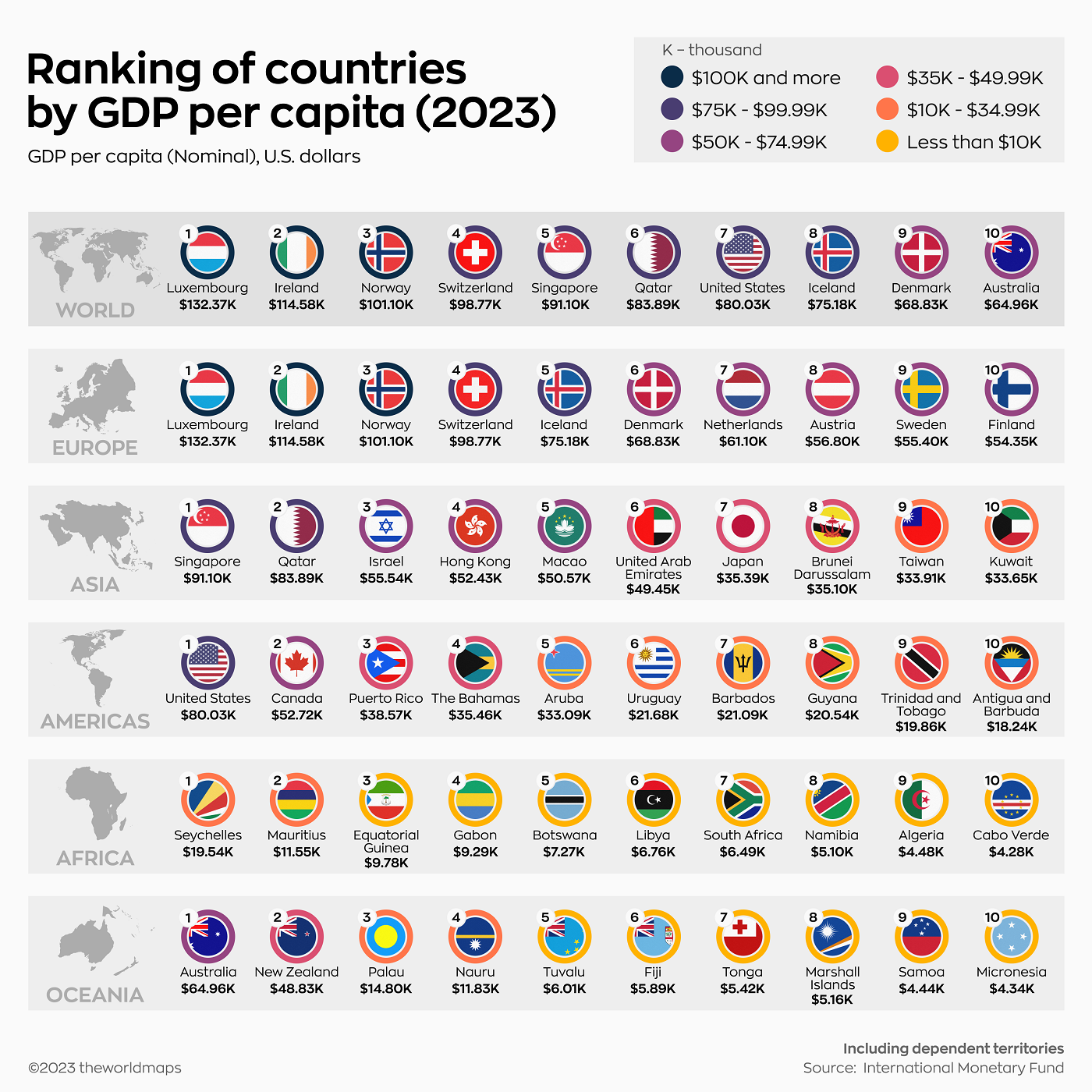

Top 10 Countries By GDP Per Capita, By Region ↗

June 25, 2023

The Quagmire: 6 Indexes At A Crossroads ↗

May 07, 2023

Frequently Asked Questions

Is iShares MSCI ACWI ETF publicly traded?

Yes, iShares MSCI ACWI ETF is publicly traded.

What exchange does iShares MSCI ACWI ETF trade on?

iShares MSCI ACWI ETF trades on the Nasdaq Stock Market

What is the ticker symbol for iShares MSCI ACWI ETF?

The ticker symbol for iShares MSCI ACWI ETF is ACWI on the Nasdaq Stock Market

What is the current price of iShares MSCI ACWI ETF?

The current price of iShares MSCI ACWI ETF is 141.49

When was iShares MSCI ACWI ETF last traded?

The last trade of iShares MSCI ACWI ETF was at 12/31/25 04:15 PM ET

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.