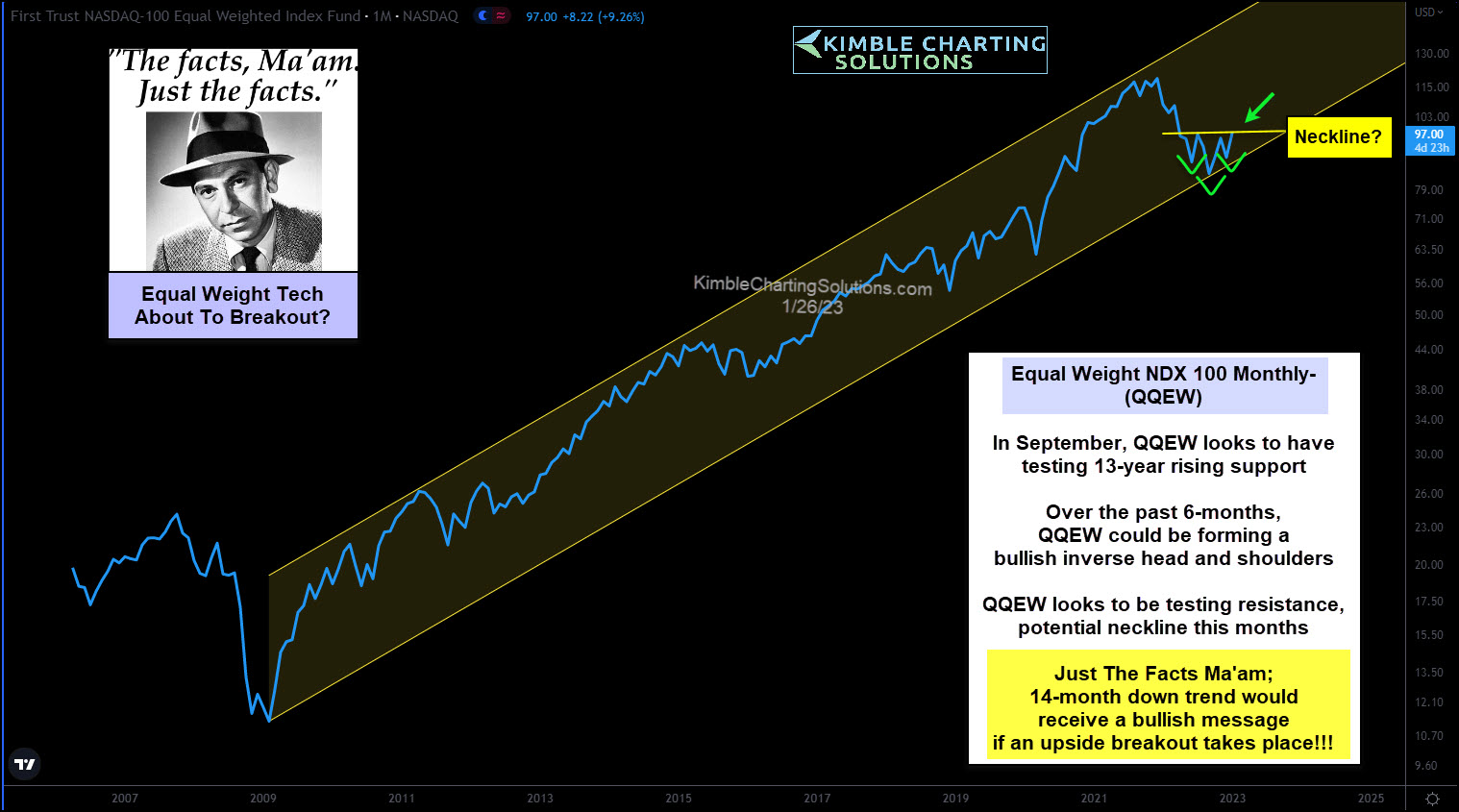

First Trust Nasdaq-100 Select Equal Weight ETF (NQ:QQEW)

Price and Volume

Detailed Quote| Volume | 0 |

| Open | 131.92 |

| Bid (Size) | 132.00 (2,000) |

| Ask (Size) | 134.07 (1,900) |

| Prev. Close | 131.92 |

| Today's Range | 131.92 - 131.92 |

| 52wk Range | 104.28 - 146.54 |

| Shares Outstanding | N/A |

| Dividend Yield | 0.57% |

Top News

More NewsPerformance

More News

Read More

It’s Time To Get Tactical, Not Scared ↗

January 05, 2025

Walmart Shares: Great Fundamentals But At A Frothy Price ↗

November 20, 2024

Tech Stocks Struggling At Double Top Fibonacci Resistance ↗

April 17, 2024

Nasdaq ETFs Set For Further Growth In 2024 ↗

June 22, 2024

Will Tech Stocks Turn Bearish Here? ↗

May 31, 2024

What's In The Cards For Nasdaq ETFs? ↗

May 27, 2024

Investor Sentiment Getting Greedy? Seems Unwarranted ↗

March 08, 2024

Large Cap Tech Stocks Possibly Repeating 2021 Pattern ↗

January 05, 2024

What Awaits Nasdaq ETFs In 2024 After Best Year Since 2020? ↗

January 02, 2024

The Fed Pivots And The Party Starts. Will It Continue? ↗

December 17, 2023

A Guide To Nasdaq ETF Investing ↗

December 15, 2023

Why These 3 Equal-Weighted ETFs Deserve a Portfolio Spot

October 19, 2023

Are Technology Stocks About To Send Risk-Off Signal? ↗

August 18, 2023

Remembering The Past & Looking To The Future ↗

May 28, 2023

5 ETFs To Ride On As Nasdaq Clocks Best January In 20 Years ↗

February 01, 2023

Tech Bulls Eye Potentially Explosive Stock Market Pattern ↗

January 27, 2023

Frequently Asked Questions

Is First Trust Nasdaq-100 Select Equal Weight ETF publicly traded?

Yes, First Trust Nasdaq-100 Select Equal Weight ETF is publicly traded.

What exchange does First Trust Nasdaq-100 Select Equal Weight ETF trade on?

First Trust Nasdaq-100 Select Equal Weight ETF trades on the Nasdaq Stock Market

What is the ticker symbol for First Trust Nasdaq-100 Select Equal Weight ETF?

The ticker symbol for First Trust Nasdaq-100 Select Equal Weight ETF is QQEW on the Nasdaq Stock Market

What is the current price of First Trust Nasdaq-100 Select Equal Weight ETF?

The current price of First Trust Nasdaq-100 Select Equal Weight ETF is 131.92

When was First Trust Nasdaq-100 Select Equal Weight ETF last traded?

The last trade of First Trust Nasdaq-100 Select Equal Weight ETF was at 02/24/26 04:15 PM ET

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.