iShares 0-1 Year Treasury Bond ETF (NQ:SHV)

Price and Volume

Detailed Quote| Volume | 0 |

| Open | 110.32 |

| Bid (Size) | 110.32 (4,700) |

| Ask (Size) | 110.33 (8,000) |

| Prev. Close | 110.32 |

| Today's Range | 110.32 - 110.32 |

| 52wk Range | 110.02 - 110.50 |

| Shares Outstanding | N/A |

| Dividend Yield | 3.72% |

Top News

More News

BlackRock to Change Primary Listing Venue for Four iShares ETFs

January 16, 2026

Performance

More News

Read More

Trust Co Goes Big on Bonds With $15 Million BND Buy ↗

October 12, 2025

Did Stocks Just Make A Major Low? ↗

April 12, 2025

Momentum And Large-Cap Growth Still Lead Equity Factor Returns ↗

August 28, 2024

Time To Invest in Cash-Like ETFs? ↗

August 14, 2024

Major Asset Classes January 2024 Performance Review ↗

February 01, 2024

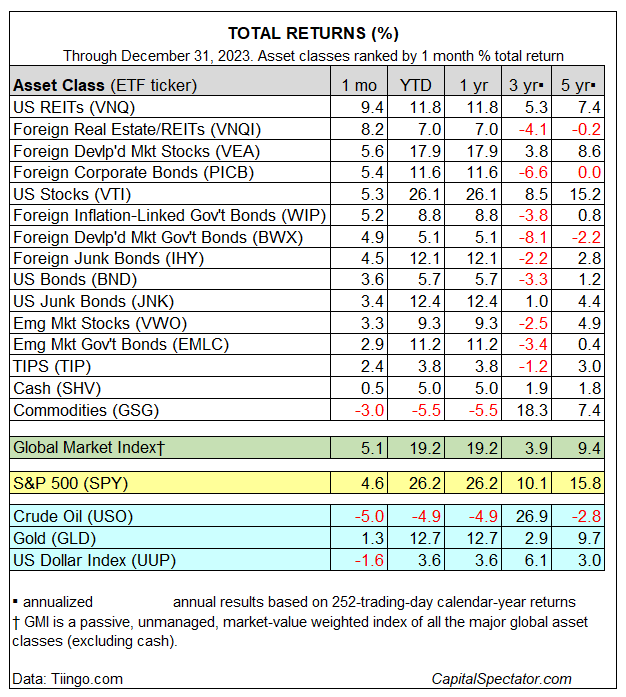

Major Asset Classes December 2023 Performance Review ↗

January 02, 2024

Will US Stocks Lead Again In 2024? Big-Tech Has The Answer ↗

November 27, 2023

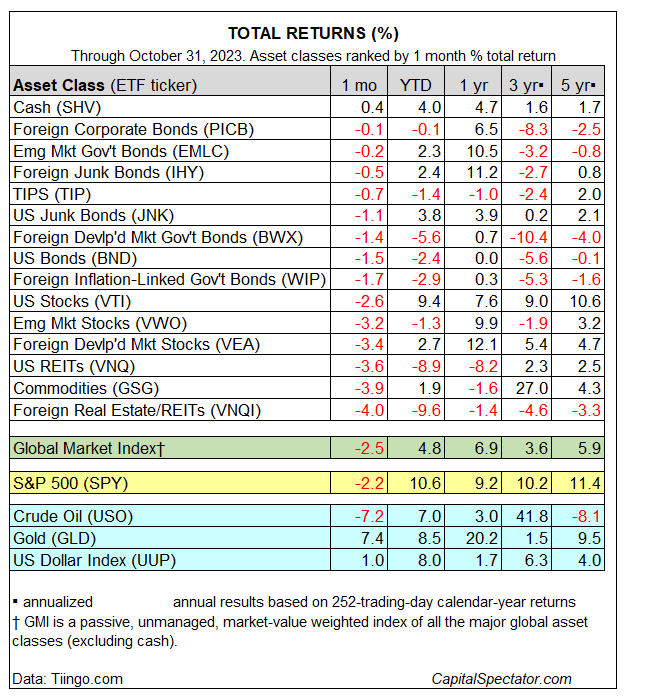

Major Asset Classes Performance Review ↗

November 01, 2023

How To Earn $500 Monthly Income With These Cash-Like Treasury ETFs ↗

October 09, 2023

Major Asset Classes: September 2023 - Performance Review ↗

October 02, 2023

Yes, Gold Is An Alternative Form Of Money ↗

September 08, 2023

Major Asset Classes: August 2023 Performance Review ↗

September 02, 2023

Frequently Asked Questions

Is iShares 0-1 Year Treasury Bond ETF publicly traded?

Yes, iShares 0-1 Year Treasury Bond ETF is publicly traded.

What exchange does iShares 0-1 Year Treasury Bond ETF trade on?

iShares 0-1 Year Treasury Bond ETF trades on the Nasdaq Stock Market

What is the ticker symbol for iShares 0-1 Year Treasury Bond ETF?

The ticker symbol for iShares 0-1 Year Treasury Bond ETF is SHV on the Nasdaq Stock Market

What is the current price of iShares 0-1 Year Treasury Bond ETF?

The current price of iShares 0-1 Year Treasury Bond ETF is 110.32

When was iShares 0-1 Year Treasury Bond ETF last traded?

The last trade of iShares 0-1 Year Treasury Bond ETF was at 02/20/26 04:15 PM ET

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.