Vanguard Global ex-U.S. Real Estate ETF (NQ:VNQI)

Price and Volume

Detailed Quote| Volume | 248 |

| Open | 47.14 |

| Bid (Size) | 46.90 (200) |

| Ask (Size) | 47.30 (200) |

| Prev. Close | 47.14 |

| Today's Range | 47.14 - 47.14 |

| 52wk Range | 37.52 - 48.54 |

| Shares Outstanding | N/A |

| Dividend Yield | 4.57% |

Top News

More NewsPerformance

More News

Read More

Cypress Point Ups Its Global Real Estate Exposure ↗

October 29, 2025

2 Vanguard ETFs to Buy Hand Over Fist and 1 to Avoid ↗

April 07, 2025

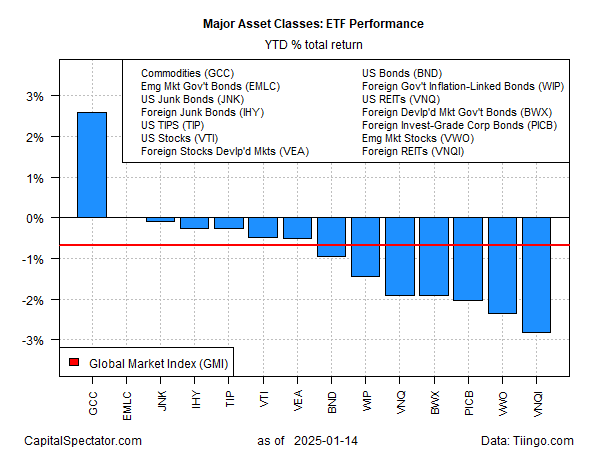

Commodities Are The Upside Outlier So Far This Year ↗

January 15, 2025

Major Asset Classes December 2024 Performance Review ↗

January 02, 2025

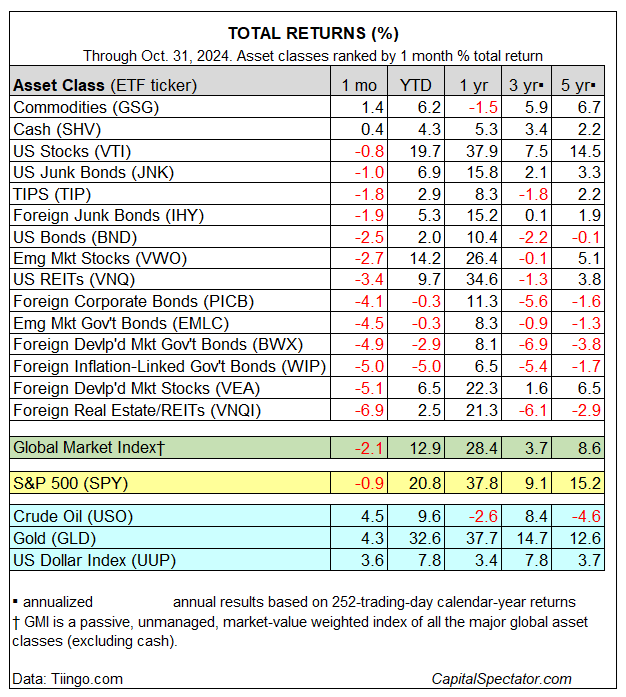

Major Asset Classes October 2024 Performance Review ↗

November 01, 2024

Major Asset Classes September 2024 ↗

October 01, 2024

Major Asset Classes - August 2024 - Performance Review ↗

September 03, 2024

Major Asset Classes July 2024 Performance Review ↗

August 01, 2024

Major Asset Classes June 2024 Performance Review ↗

July 01, 2024

Vanguard ETFs: An Overview ↗

April 27, 2024

Major Asset Classes Performance Review - March 2024 ↗

April 01, 2024

Losses Prevail For Major Asset Classes In January ↗

January 29, 2024

Desperately Seeking Yield: Monday, Jan. 8 ↗

January 08, 2024

Frequently Asked Questions

Is Vanguard Global ex-U.S. Real Estate ETF publicly traded?

Yes, Vanguard Global ex-U.S. Real Estate ETF is publicly traded.

What exchange does Vanguard Global ex-U.S. Real Estate ETF trade on?

Vanguard Global ex-U.S. Real Estate ETF trades on the Nasdaq Stock Market

What is the ticker symbol for Vanguard Global ex-U.S. Real Estate ETF?

The ticker symbol for Vanguard Global ex-U.S. Real Estate ETF is VNQI on the Nasdaq Stock Market

What is the current price of Vanguard Global ex-U.S. Real Estate ETF?

The current price of Vanguard Global ex-U.S. Real Estate ETF is 47.14

When was Vanguard Global ex-U.S. Real Estate ETF last traded?

The last trade of Vanguard Global ex-U.S. Real Estate ETF was at 01/09/26 04:15 PM ET

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.