Invesco Senior Loan ETF (NY:BKLN)

Price and Volume

Detailed Quote| Volume | 6,095,642 |

| Open | 21.01 |

| Bid (Size) | 21.00 (800) |

| Ask (Size) | 21.05 (500) |

| Prev. Close | 21.00 |

| Today's Range | 20.99 - 21.01 |

| 52wk Range | 20.02 - 21.15 |

| Shares Outstanding | 3,347,000 |

| Dividend Yield | 6.86% |

Top News

More NewsPerformance

More News

Read More

Top 3 ETFs to Hedge Against Inflation in 2025

December 28, 2024

Are Institutions Getting Defensive Before Election? ↗

November 02, 2024

Is The Nasdaq An Accident Waiting To Happen? ↗

June 08, 2024

Are The Charts Starting To Cast Doubt On The Strong Economic Thesis? ↗

February 03, 2024

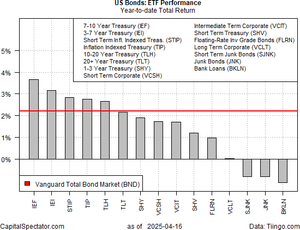

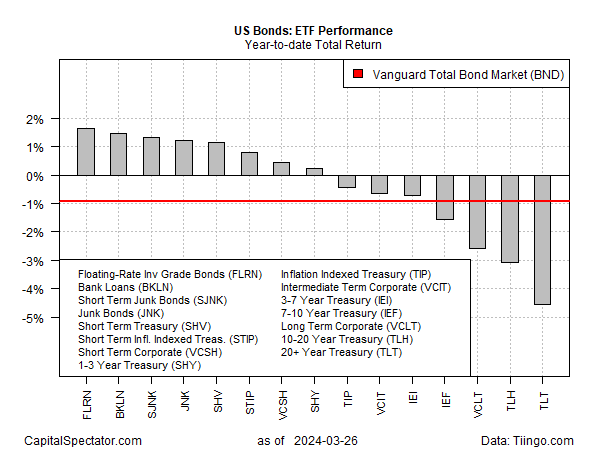

Several Corners Of Bond Market Manage To Shine This Year ↗

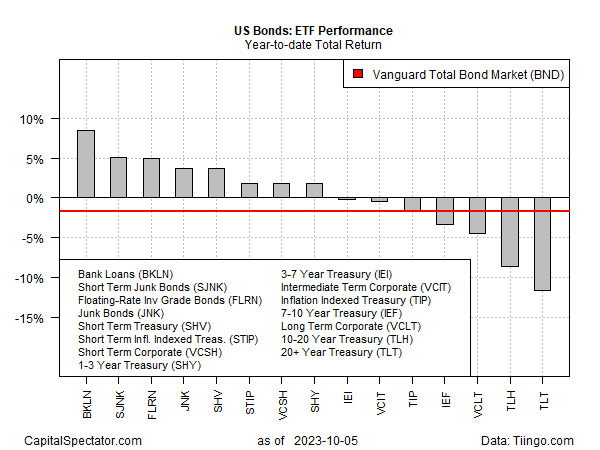

October 06, 2023

5 ETFs That Gained Investors' Love Last Week ↗

September 27, 2023

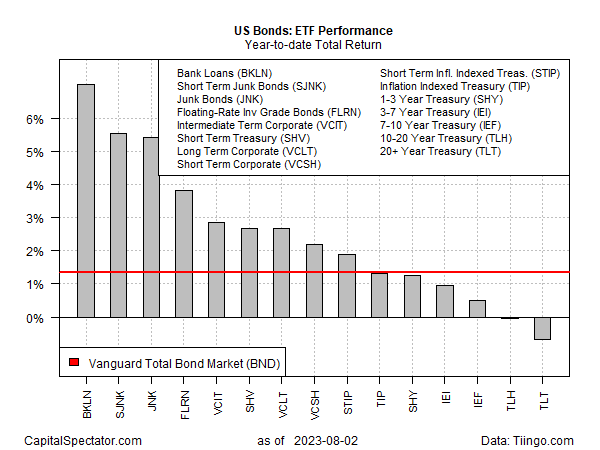

Bank Loans And Junk Bonds Are Having A Good Year ↗

September 21, 2023

An Introduction To Senior Loan ETFs ↗

September 16, 2023

Distributions Help Lift Most Slices Of US Bond Market In 2023 ↗

August 03, 2023

Cracks After CPI? What Markets Are Anticipating ↗

April 14, 2023

The Nasdaq Rope-A-Dope: Can It Wear Out The Bears? ↗

March 04, 2023

Risk Appetite: Do The Charts Favor The Bulls Or The Bears? ↗

February 04, 2023

Global Stocks: Breaking Out? ↗

January 28, 2023

Are New Bull Market Leaders Emerging? ↗

January 13, 2023

Key Levels For A Lasting Bottom In Stocks ↗

July 01, 2022

Dead Cat Or Start Of A Constructive Process? ↗

June 25, 2022

Contrarian Signs ↗

March 07, 2022

The Twelve Charts Of Christmas 2021 ↗

December 24, 2021

Frequently Asked Questions

Is Invesco Senior Loan ETF publicly traded?

Yes, Invesco Senior Loan ETF is publicly traded.

What exchange does Invesco Senior Loan ETF trade on?

Invesco Senior Loan ETF trades on the New York Stock Exchange

What is the ticker symbol for Invesco Senior Loan ETF?

The ticker symbol for Invesco Senior Loan ETF is BKLN on the New York Stock Exchange

What is the current price of Invesco Senior Loan ETF?

The current price of Invesco Senior Loan ETF is 21.00

When was Invesco Senior Loan ETF last traded?

The last trade of Invesco Senior Loan ETF was at 12/31/25 08:00 PM ET

What is the market capitalization of Invesco Senior Loan ETF?

The market capitalization of Invesco Senior Loan ETF is 70.29M

How many shares of Invesco Senior Loan ETF are outstanding?

Invesco Senior Loan ETF has 70M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.