Direxion Financial Bull 3X Shares (NY:FAS)

168.32

-3.92

(-2.28%)

Streaming Delayed Price

Updated: 3:59 PM EST, Dec 31, 2025

Add to My Watchlist

Price and Volume

Detailed Quote| Volume | 382,442 |

| Open | 172.54 |

| Bid (Size) | 168.21 (200) |

| Ask (Size) | 168.43 (200) |

| Prev. Close | 172.24 |

| Today's Range | 168.19 - 173.07 |

| 52wk Range | 92.66 - 189.23 |

| Shares Outstanding | 156,992 |

| Dividend Yield | 0.93% |

Top News

More NewsPerformance

More News

Read More

5 Best Leveraged ETFs Of 2024 ↗

January 01, 2025

Top 3 ETFs for Bullish Investors Post-Election

November 25, 2024

Leveraged ETFs: Is Volatility Your Best Friend or Worst Enemy? ↗

October 29, 2021

5 Leveraged ETFs With Double-Digit Gains In August ↗

September 03, 2024

Looming Threat Of A Rising Wedge ↗

March 06, 2024

Trade Bitcoin With Confidence: TTM Squeeze Strategies Revealed ↗

August 13, 2023

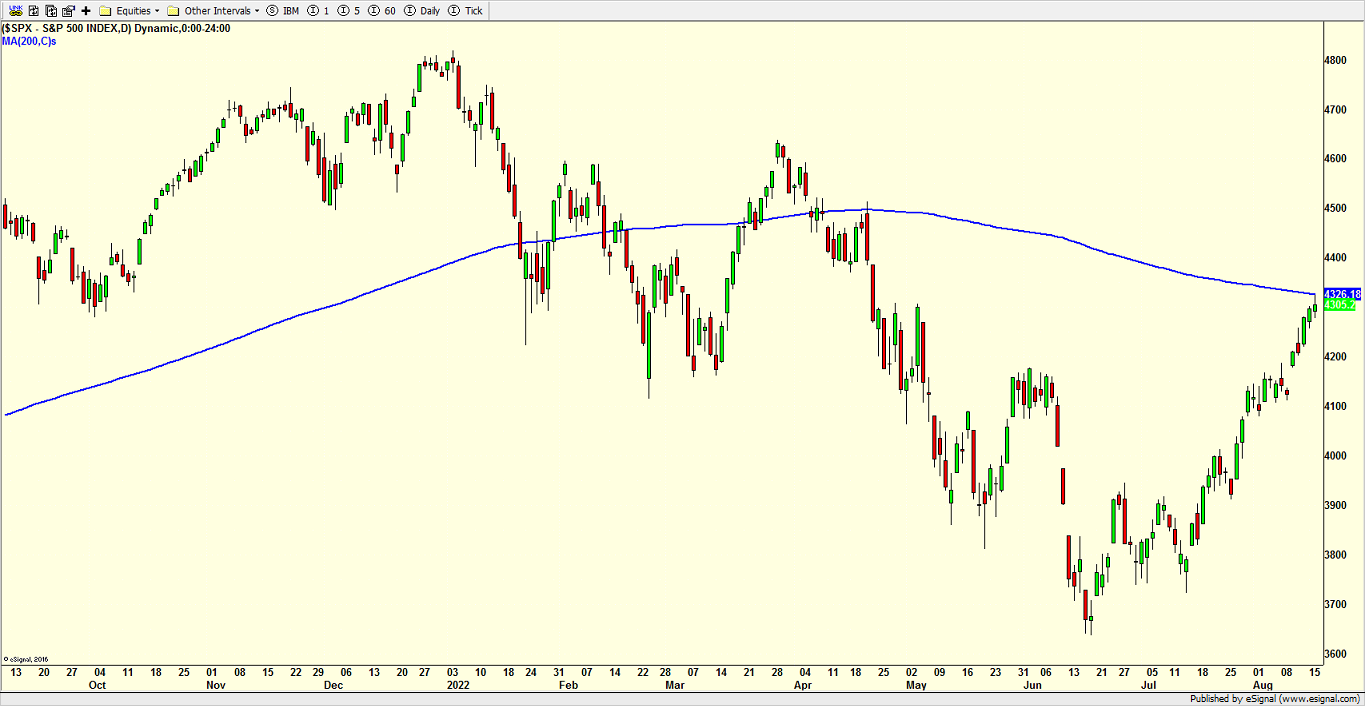

The Magical & Mystical 200 Day Moving Average ↗

August 17, 2022

Leveraged ETFs That Have More Than Doubled This Year ↗

December 17, 2021

A Bull Case For Commodities Beyond Inflation ↗

November 27, 2021

Leveraged ETFs In 2021 ↗

September 14, 2021

Frequently Asked Questions

Is Direxion Financial Bull 3X Shares publicly traded?

Yes, Direxion Financial Bull 3X Shares is publicly traded.

What exchange does Direxion Financial Bull 3X Shares trade on?

Direxion Financial Bull 3X Shares trades on the New York Stock Exchange

What is the ticker symbol for Direxion Financial Bull 3X Shares?

The ticker symbol for Direxion Financial Bull 3X Shares is FAS on the New York Stock Exchange

What is the current price of Direxion Financial Bull 3X Shares?

The current price of Direxion Financial Bull 3X Shares is 168.32

When was Direxion Financial Bull 3X Shares last traded?

The last trade of Direxion Financial Bull 3X Shares was at 12/31/25 03:59 PM ET

What is the market capitalization of Direxion Financial Bull 3X Shares?

The market capitalization of Direxion Financial Bull 3X Shares is 26.42M

How many shares of Direxion Financial Bull 3X Shares are outstanding?

Direxion Financial Bull 3X Shares has 26M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.