RUS3K ETF (NY:IWV)

Price and Volume

Detailed Quote| Volume | 311,378 |

| Open | 389.08 |

| Bid (Size) | 383.00 (600) |

| Ask (Size) | 391.36 (600) |

| Prev. Close | 392.69 |

| Today's Range | 388.18 - 391.00 |

| 52wk Range | 273.60 - 397.05 |

| Shares Outstanding | 451,000 |

| Dividend Yield | 1.10% |

Top News

More NewsPerformance

More News

Read More

Why Is INBX Stock Rising Today? ↗

October 24, 2025

Great Diamond Liquidates Entire Stake in FTGC Worth $7.8 Million ↗

October 30, 2025

Enanta Pharmaceuticals Stock Rises 58% – Here’s An Important Update ↗

September 29, 2025

Beware Of FOMO ↗

March 15, 2025

Total Return Forecasts: Major Asset Classes - Tuesday, Feb. 4 ↗

February 04, 2025

Total Return Forecasts: Major Asset Classes - Friday, Jan. 3 ↗

January 03, 2025

Walmart Teams Up With China's Meituan to Boost E-Commerce ↗

December 17, 2024

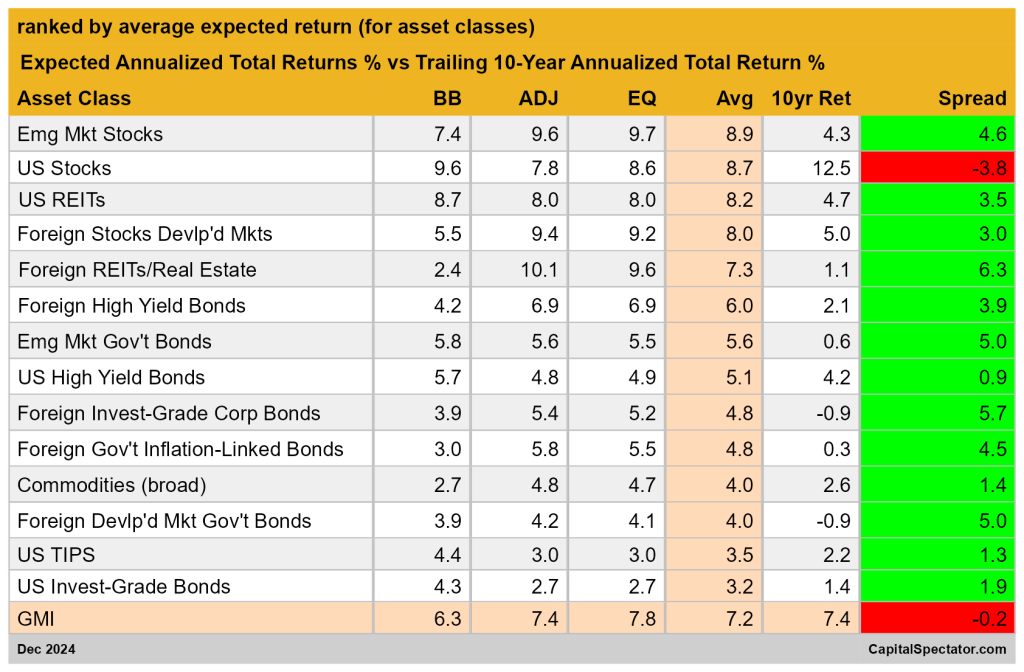

Total Return Forecasts: Major Asset Classes - Tuesday, Dec. 3 ↗

December 03, 2024

Total Return Forecasts: Major Asset Classes - Monday, Nov. 4 ↗

November 04, 2024

Momentum And Large-Cap Growth Still Lead Equity Factor Returns ↗

August 28, 2024

Total Return Forecasts: Major Asset Classes ↗

July 02, 2024

Total Return Forecasts: Major Asset Classes ↗

June 04, 2024

ETFs Worth A Look On Russell Indexes' Shake-Up ↗

June 03, 2024

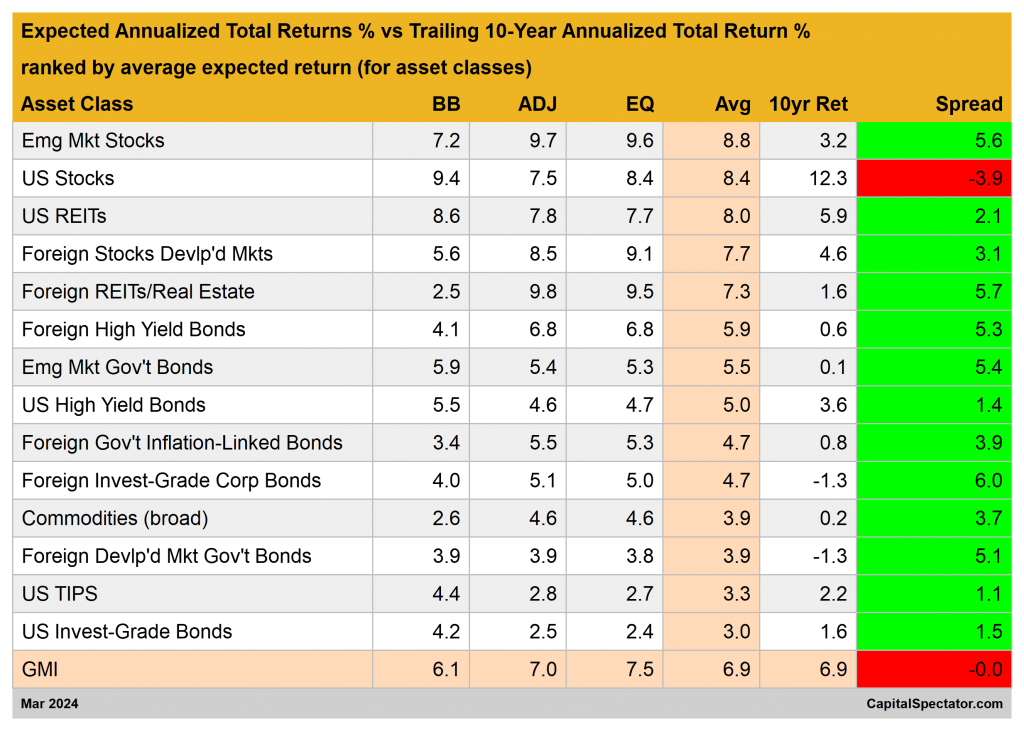

Total Return Forecasts: Major Asset Classes ↗

April 02, 2024

Frequently Asked Questions

Is RUS3K ETF publicly traded?

Yes, RUS3K ETF is publicly traded.

What exchange does RUS3K ETF trade on?

RUS3K ETF trades on the New York Stock Exchange

What is the ticker symbol for RUS3K ETF?

The ticker symbol for RUS3K ETF is IWV on the New York Stock Exchange

What is the current price of RUS3K ETF?

The current price of RUS3K ETF is 390.66

When was RUS3K ETF last traded?

The last trade of RUS3K ETF was at 02/27/26 08:00 PM ET

What is the market capitalization of RUS3K ETF?

The market capitalization of RUS3K ETF is 176.19M

How many shares of RUS3K ETF are outstanding?

RUS3K ETF has 176M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.