JNK (NY:JNK)

Price and Volume

Detailed Quote| Volume | 2,906,566 |

| Open | 97.33 |

| Bid (Size) | 96.91 (100) |

| Ask (Size) | 97.59 (100) |

| Prev. Close | 97.30 |

| Today's Range | 97.19 - 97.34 |

| 52wk Range | 90.41 - 98.24 |

| Shares Outstanding | 836,746 |

| Dividend Yield | 6.58% |

Top News

More NewsPerformance

More News

Read More

Are We On The Cusp Of Another Global Crisis? ↗

April 05, 2025

The Short-Term Uptrends Hint At A Bear Market ↗

March 29, 2025

Bears Still Wrong – 47,000 Up Next ↗

November 27, 2024

Desperately Seeking Yield - Tuesday, Nov. 19 ↗

November 19, 2024

Stocks: The Good, Bad, And The Ugly ↗

March 29, 2025

Will April 2 Reciprocal Tariffs Bring More Pain? ↗

March 22, 2025

Short-Term Selling Will Become Exhausted ↗

March 09, 2025

The Odds Favor Higher Prices ↗

February 16, 2025

Desperately Seeking Yield - Wednesday, Feb. 12 ↗

February 12, 2025

Big Market Movement In A Wild Week ↗

February 02, 2025

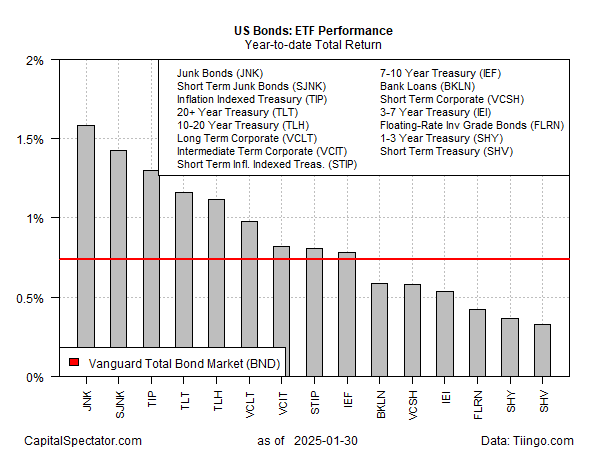

US Bond Market Rebounds So Far In 2025 ↗

January 31, 2025

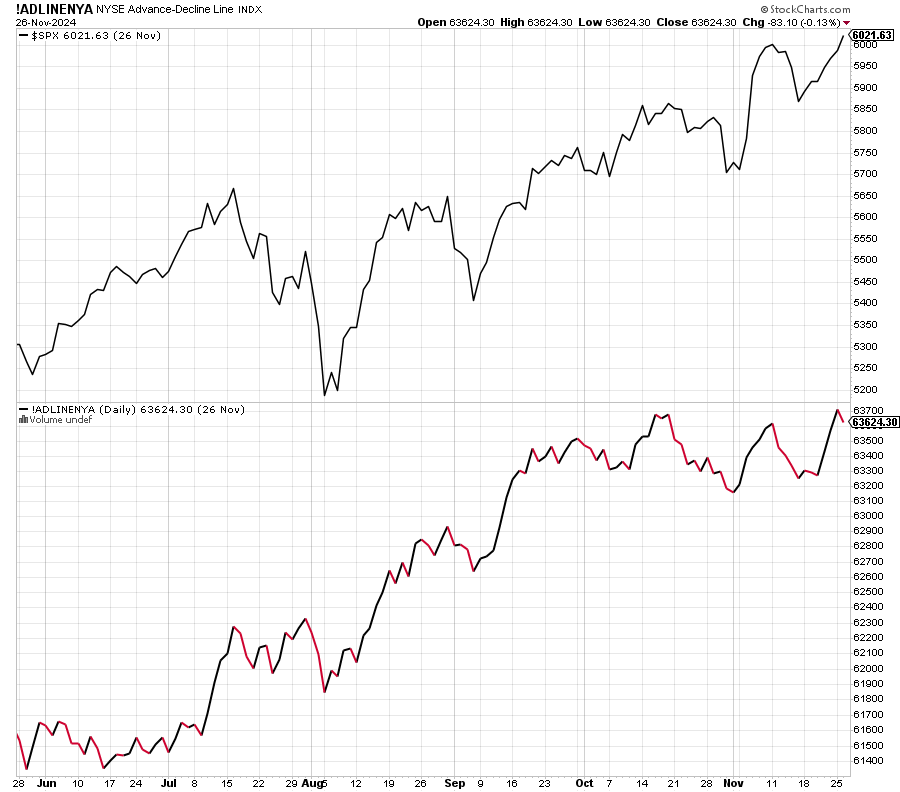

The Short-Term Uptrend Continues; The SPX Reaches New Price High ↗

January 26, 2025

A New Short-Term Uptrend Finally Appeared ↗

January 18, 2025

The Downtrend Continues Unexpectedly ↗

January 11, 2025

A Downtrend Despite Friday's Surprising Strength ↗

January 04, 2025

A Rather Scary Sell-Off ↗

December 22, 2024

Kick-Save And A Beauty; Two New Swing Positions ↗

December 21, 2024

Time To Buy In A Short-Term Downtrend? ↗

December 14, 2024

Has A New Short-Term Downtrend Begun? ↗

December 07, 2024

Major Asset Classes November 2024 Performance Review ↗

December 02, 2024

Pushing To Higher Highs ↗

November 24, 2024

HeadlineCharts Saturday, November 16, 2024 ↗

November 16, 2024

Frequently Asked Questions

Is JNK publicly traded?

Yes, JNK is publicly traded.

What exchange does JNK trade on?

JNK trades on the New York Stock Exchange

What is the ticker symbol for JNK?

The ticker symbol for JNK is JNK on the New York Stock Exchange

What is the current price of JNK?

The current price of JNK is 97.21

When was JNK last traded?

The last trade of JNK was at 12/31/25 08:00 PM ET

What is the market capitalization of JNK?

The market capitalization of JNK is 81.34M

How many shares of JNK are outstanding?

JNK has 81M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.