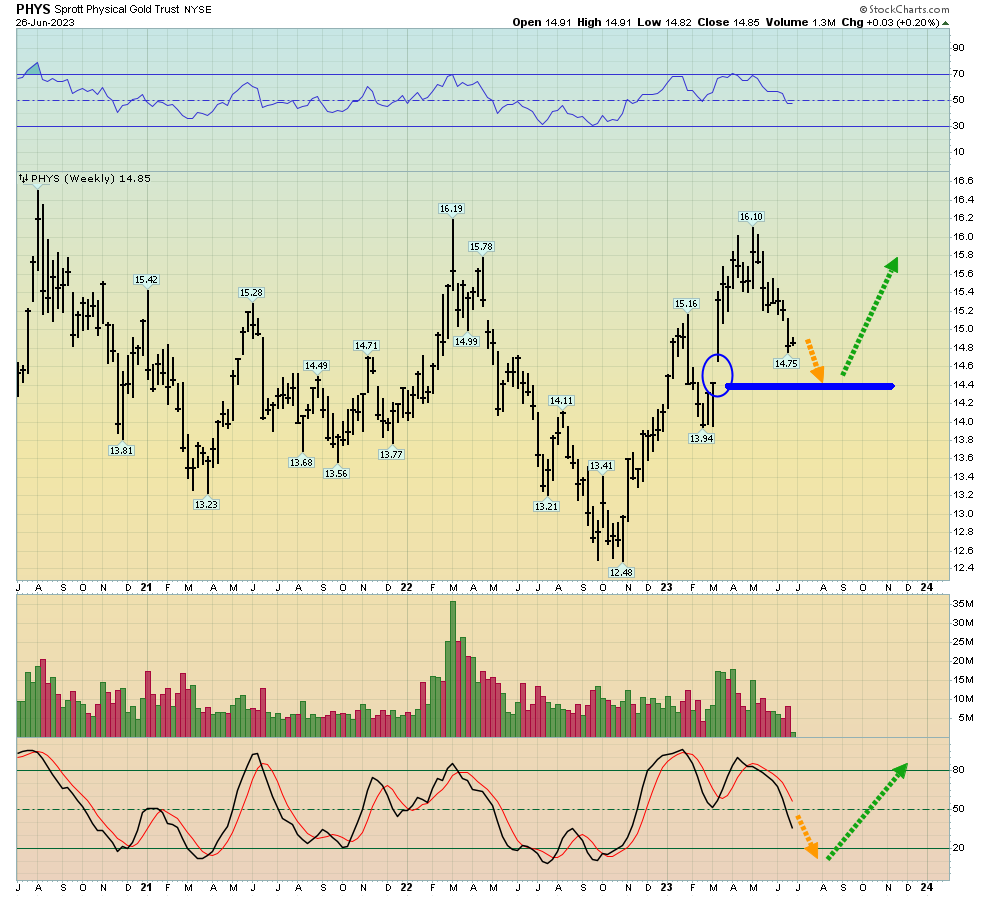

Sprott Physical Gold Trust ETV (NY:PHYS)

Price and Volume

Detailed Quote| Volume | 35,338 |

| Open | 38.54 |

| Bid (Size) | 38.40 (300) |

| Ask (Size) | 38.44 (100) |

| Prev. Close | 38.54 |

| Today's Range | 38.54 - 38.54 |

| 52wk Range | 21.96 - 42.07 |

| Shares Outstanding | 4,640,702 |

| Dividend Yield | N/A |

Top News

More NewsPerformance

More News

Read More

These 3 ETFs Let You Hold Real Gold Without the Vault

April 28, 2025

Time To Lock In Gold Gains ↗

February 14, 2025

The Best Way to Invest in Gold Is...

January 31, 2025

Why Chinese Traders Might Push Gold (And Silver) Prices Higher ↗

September 12, 2024

Top 3 Michael Burry Stock Picks to Watch in 2024

August 22, 2024

Some Needed Perspective On Gold And Silver ↗

October 09, 2023

Gold Price Sale Key Tactics For Investors ↗

June 27, 2023

My Favorite Indicator Is Confirming The Gold/Silver Rally ↗

April 09, 2023

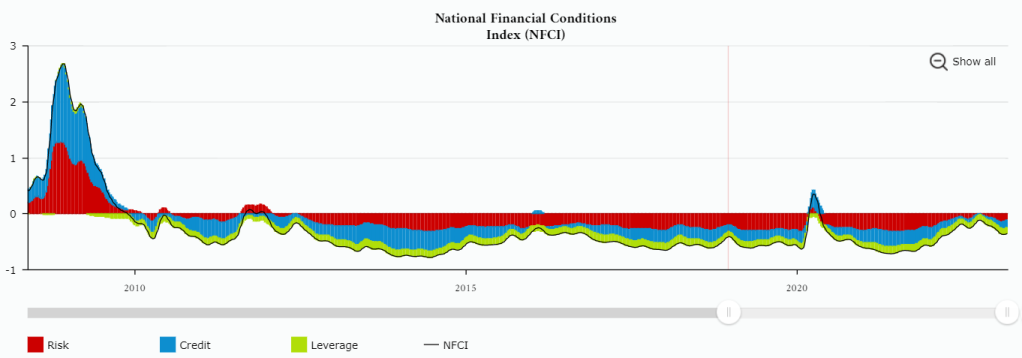

Don’t Blame The Fed: The Fed Gives Us What We Want ↗

March 22, 2023

Frequently Asked Questions

Is Sprott Physical Gold Trust ETV publicly traded?

Yes, Sprott Physical Gold Trust ETV is publicly traded.

What exchange does Sprott Physical Gold Trust ETV trade on?

Sprott Physical Gold Trust ETV trades on the New York Stock Exchange

What is the ticker symbol for Sprott Physical Gold Trust ETV?

The ticker symbol for Sprott Physical Gold Trust ETV is PHYS on the New York Stock Exchange

What is the current price of Sprott Physical Gold Trust ETV?

The current price of Sprott Physical Gold Trust ETV is 38.54

When was Sprott Physical Gold Trust ETV last traded?

The last trade of Sprott Physical Gold Trust ETV was at 02/09/26 08:00 PM ET

What is the market capitalization of Sprott Physical Gold Trust ETV?

The market capitalization of Sprott Physical Gold Trust ETV is 178.85M

How many shares of Sprott Physical Gold Trust ETV are outstanding?

Sprott Physical Gold Trust ETV has 179M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.