State Street SPDR S&P Dividend ETF (NY:SDY)

140.05

-0.07

(-0.05%)

Streaming Delayed Price

Updated: 9:56 AM EST, Dec 31, 2025

Add to My Watchlist

Price and Volume

Detailed Quote| Volume | 12,896 |

| Open | 140.08 |

| Bid (Size) | 140.01 (300) |

| Ask (Size) | 140.08 (500) |

| Prev. Close | 140.12 |

| Today's Range | 139.89 - 140.08 |

| 52wk Range | 119.83 - 143.49 |

| Shares Outstanding | 1,465,536 |

| Dividend Yield | 2.49% |

Top News

More NewsPerformance

More News

Read More

These 3 Dividend ETFs Offer Yield, Quality, and Diversification ↗

October 27, 2025

The Smartest Dividend ETF to Buy With $2,000 Right Now ↗

August 10, 2025

5 High-Yielding ETFs to Buy and Hold Forever ↗

June 30, 2025

Sit Out Market Drama With These 3 Dividend Funds ↗

April 04, 2025

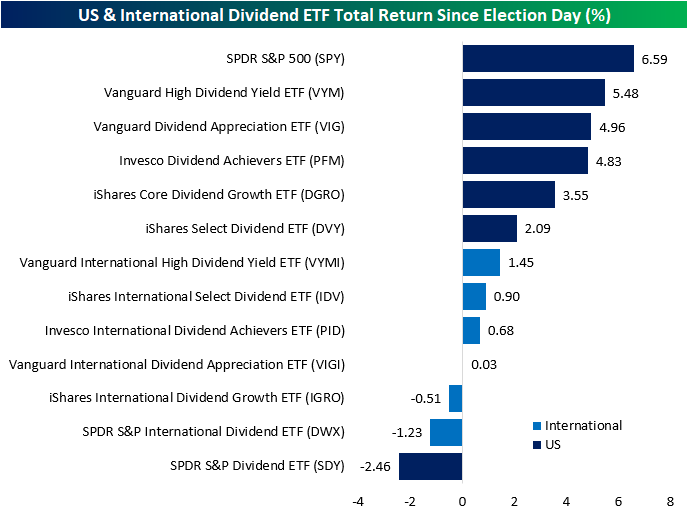

International Dividend Stocks Lag ↗

February 06, 2025

Retire Rich With These Blue-Chip Dividend Etfs ↗

January 25, 2025

9 Dividend ETFs to Buy With $200 and Hold Forever ↗

January 13, 2025

Top 3 best ETFs for value investors in 2025 ↗

December 22, 2024

Top 3 Best ETFs For Value Investors In 2025 ↗

December 21, 2024

Choosing Among A Broad Selection Of Dividend-Focused ETFs ↗

November 29, 2024

5 Dividend ETFs to Buy and Hold Forever

November 20, 2024

9 High-Yield Dividend ETFs to Buy to Generate Passive Income ↗

November 02, 2024

These 8 Index ETFs Are a Retiree's Best Friend ↗

October 19, 2024

3 ETFs to Buy for a Lifetime of Passive Income ↗

October 17, 2024

Frequently Asked Questions

Is State Street SPDR S&P Dividend ETF publicly traded?

Yes, State Street SPDR S&P Dividend ETF is publicly traded.

What exchange does State Street SPDR S&P Dividend ETF trade on?

State Street SPDR S&P Dividend ETF trades on the New York Stock Exchange

What is the ticker symbol for State Street SPDR S&P Dividend ETF?

The ticker symbol for State Street SPDR S&P Dividend ETF is SDY on the New York Stock Exchange

What is the current price of State Street SPDR S&P Dividend ETF?

The current price of State Street SPDR S&P Dividend ETF is 140.05

When was State Street SPDR S&P Dividend ETF last traded?

The last trade of State Street SPDR S&P Dividend ETF was at 12/31/25 09:56 AM ET

What is the market capitalization of State Street SPDR S&P Dividend ETF?

The market capitalization of State Street SPDR S&P Dividend ETF is 205.24M

How many shares of State Street SPDR S&P Dividend ETF are outstanding?

State Street SPDR S&P Dividend ETF has 205M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.