Hermes Intl S.A. ADR (OP:HESAY)

264.60

+4.04

(+1.55%)

Streaming Delayed Price

Updated: 9:56 AM EST, Jan 14, 2026

Add to My Watchlist

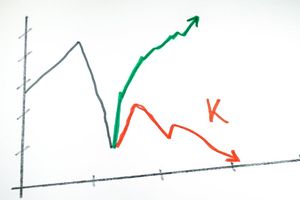

Price and Volume

Detailed Quote| Volume | 3,822 |

| Open | 265.16 |

| Bid (Size) | N/A (0) |

| Ask (Size) | N/A (0) |

| Prev. Close | 260.56 |

| Today's Range | 263.68 - 265.89 |

| 52wk Range | 209.94 - 303.00 |

| Shares Outstanding | N/A |

| Dividend Yield | N/A |

Top News

More NewsPerformance

More News

Read More

4 Stocks To Consider Buying As Luxury Spending Keeps Rising ↗

November 12, 2025

US Dollar Drops on Report of Trump Tariff Plan Shift ↗

January 09, 2025

Hermès: A Fantastic Business ↗

July 31, 2024

Hermès International Hits Record €13.4B Annual Revenue, Up 21% In Q4 ↗

February 09, 2024

This Luxury Giant’s Stock Is Dirt-Cheap ↗

January 31, 2024

6 Stocks to Buy as European Markets Soar ↗

February 26, 2025

European Stock Gains May Falter On Geopolitical, Economic Fears ↗

September 30, 2024

3 French Luxury Stocks You Can Snag for a Bargain ↗

July 24, 2024

3 Luxury Stocks That Are Worth the Splurge ↗

June 05, 2024

3 Luxury Retail Stocks Tailor-Made for Growth ↗

January 08, 2024

7 Stocks Making Bank on the Heels of Increased Consumer Spending ↗

November 07, 2023

Frequently Asked Questions

Is Hermes Intl S.A. ADR publicly traded?

Yes, Hermes Intl S.A. ADR is publicly traded.

What exchange does Hermes Intl S.A. ADR trade on?

Hermes Intl S.A. ADR trades on the OTC Traded

What is the ticker symbol for Hermes Intl S.A. ADR?

The ticker symbol for Hermes Intl S.A. ADR is HESAY on the OTC Traded

What is the current price of Hermes Intl S.A. ADR?

The current price of Hermes Intl S.A. ADR is 264.60

When was Hermes Intl S.A. ADR last traded?

The last trade of Hermes Intl S.A. ADR was at 01/14/26 09:56 AM ET

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.