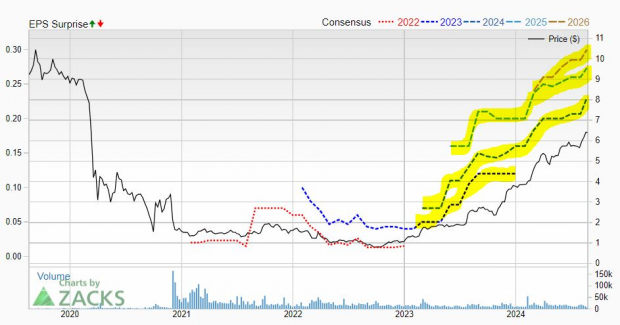

Rolls Royce Hldgs S/Adr (OP:RYCEY)

Price and Volume

Detailed Quote| Volume | 7,501,145 |

| Open | 17.64 |

| Bid (Size) | N/A (0) |

| Ask (Size) | N/A (0) |

| Prev. Close | 18.62 |

| Today's Range | 17.64 - 18.60 |

| 52wk Range | 8.010 - 18.98 |

| Shares Outstanding | N/A |

| Dividend Yield | N/A |

Top News

More NewsPerformance

More News

Read More

Is Oklo a Buy, Sell, or Hold in 2026? ↗

February 10, 2026

Why Oklo Stock Dropped Again Today ↗

December 01, 2025

Should You Invest $1,000 in GE Stock Right Now? ↗

September 22, 2025

This Aircraft Supply Company Is Soaring Under the Radar ↗

September 16, 2025

Why Sam Altman-Backed Oklo Stock Soared Today ↗

July 14, 2025

Boeing or Airbus: Which Is the Better Stock? ↗

July 01, 2025

Defense Spending Booms -- Underwater and in Britain ↗

February 15, 2025

Can Rolls-Royce Ride High on Seasonal Strength And Defence Wins ↗

January 29, 2025

From Luxury Cars To Powerful Engines, Rolls-Royce Does It All ↗

September 07, 2024

3 Nuclear Energy Stocks To Buy And Hold Forever ↗

August 24, 2024

Frequently Asked Questions

Is Rolls Royce Hldgs S/Adr publicly traded?

Yes, Rolls Royce Hldgs S/Adr is publicly traded.

What exchange does Rolls Royce Hldgs S/Adr trade on?

Rolls Royce Hldgs S/Adr trades on the OTC Traded

What is the ticker symbol for Rolls Royce Hldgs S/Adr?

The ticker symbol for Rolls Royce Hldgs S/Adr is RYCEY on the OTC Traded

What is the current price of Rolls Royce Hldgs S/Adr?

The current price of Rolls Royce Hldgs S/Adr is 18.37

When was Rolls Royce Hldgs S/Adr last traded?

The last trade of Rolls Royce Hldgs S/Adr was at 03/02/26 04:00 PM ET

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.