Dividend stocks are among the most popular options for investors seeking income. However, not all dividend stocks are created equal. Some pay well, some don't.

In my case, I prefer the Dividend Aristocrats, S&P 500 listed companies that have increased their dividends for at least the last 25 consecutive years. Those with a higher dividend yield will be more attractive to income investors, but, not all are “a buy”. So, I came up with a list of three reliable Dividend Aristocrats with significant growth potential, that are worth buying today.

How I Came Up With The Following Stocks

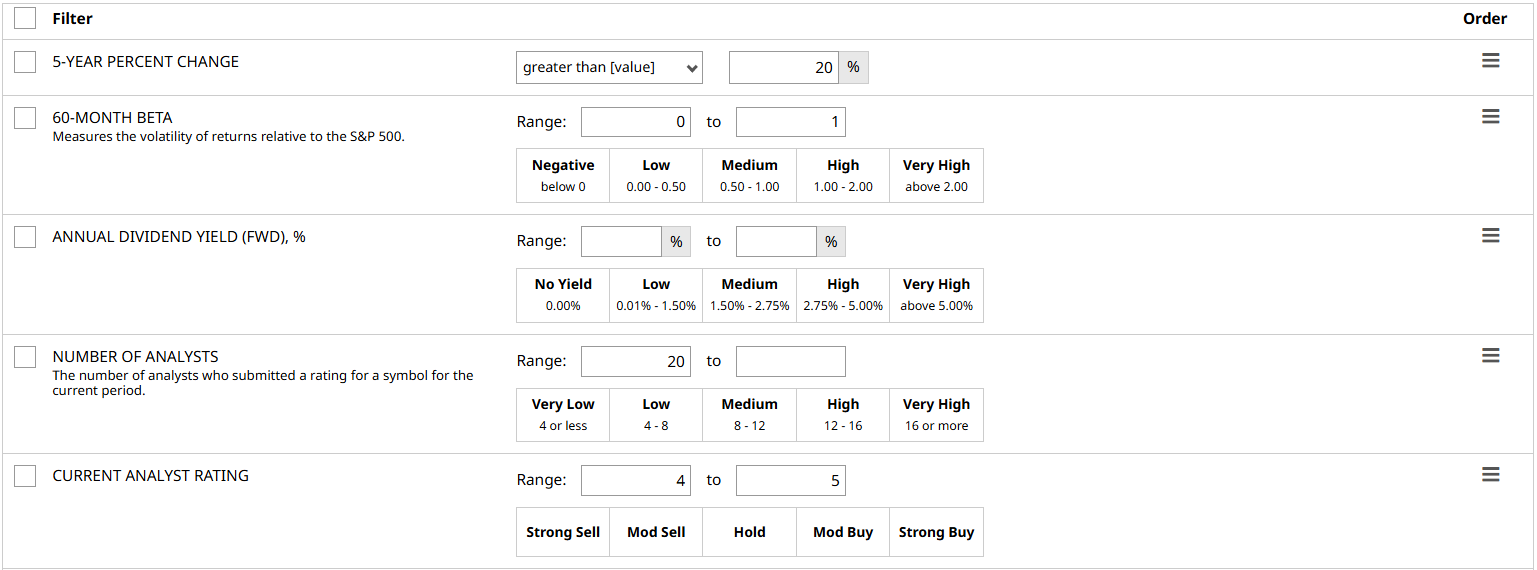

Using Barchart’s free screener tool, I set the following filters:

- Watchlist: Dividend Aristocrats

- Current Analyst Rating: 4 to 5, to get stocks with ratings very close to Strong Buy and a Strong Buy.

- Number of Analysts: 20 or more. The more analysts covering the stock, the more reliable the ratings it has.

- 5-YR Percent Change: More than 20%. I also prefer a little bit of capital appreciation potential and stocks that are generally on an upward trend.

- 60-Month Beta: 0 to 1. If this metric exceeds 1 , I consider it volatile. I prefer the stable ones relative to the broader market.

- Dividend Yield (FWD): I intentionally left this blank so I can easily sort the list from highest to lowest-yielding Aristocrats.

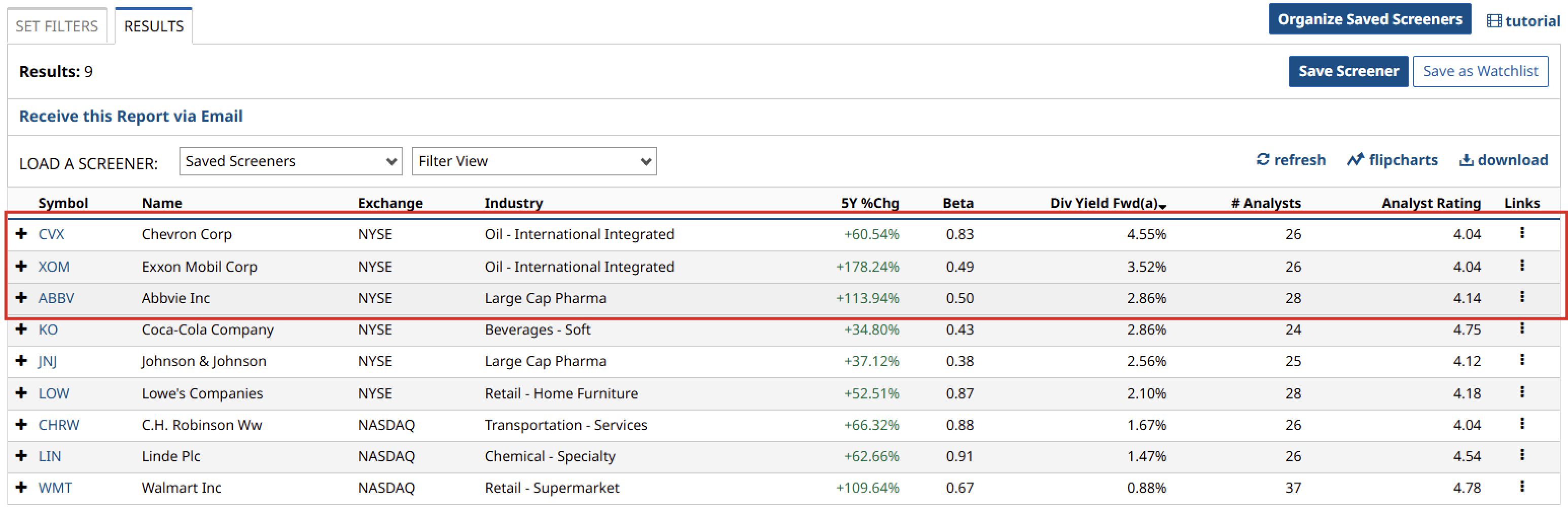

After running the filters, I was left with nine companies. So I sorted the list by clicking the Div Yield Fwd(a) option, and I got my top three highest-yielding and most reliable Dividend Aristocrats.

Chevron Corp (CVX)

Starting with Chevron, they are one of the biggest oil companies in the world, with core operations revolving around drilling and refining oil into usable products like gasoline. In recent years, the company has also ventured into renewable energy.

Right now, the stock trades at $148.53 per share. Over the past 5 years, the stock gained nearly 60%. Its 60-month beta is 0.83, which tells me that the stock is rather stable compared to the broader market.

Chevron pays a dividend of $1.71 every quarter, or $6.84 per share, per year, which translates to a forward yield of aprox. 4.5%. The company’s payout ratio is 56.25%, so it’s still within a very acceptable territory as it leaves room for the company to grow the dividend.

Financials-wise, annual revenue rose nearly 1% to $202.79 billion, while its net income declined 17.35% to $17.66 billion, or 9.76 in terms of basic EPS as a result of lower revenue from continuing operations.

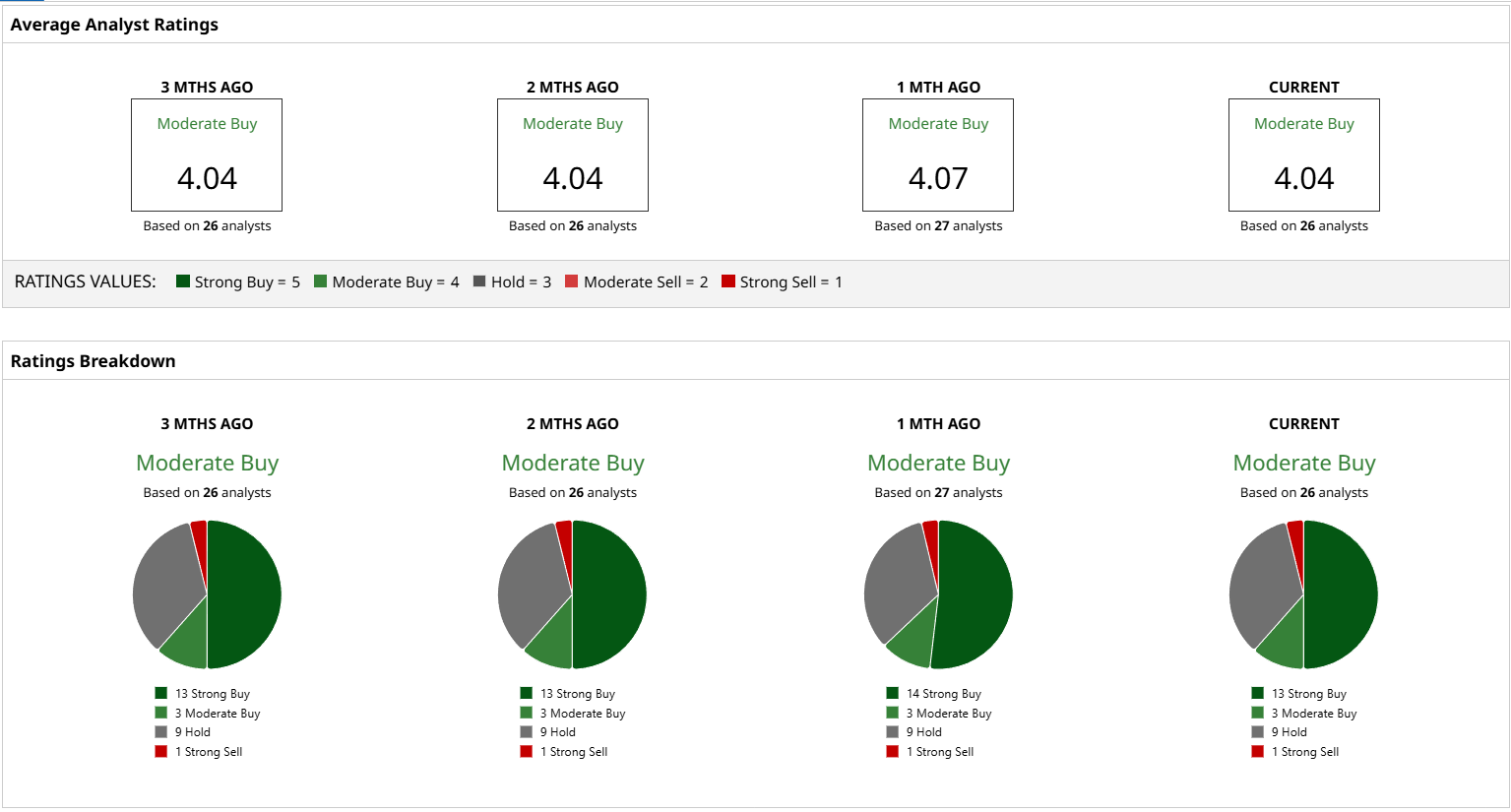

Meanwhile, a consensus average of 26 analysts rates Chevron a Moderate Buy with a score of 4.04 out of 5, a rating that has been stable over the past 3 months. The high price target is $204 per share, which suggests as much as ~37% upside potential from current levels.

Exxon Mobil Corp (XOM)

Like Chevron, Exxon Mobil is also an oil titan that specializes in oil exploration, extraction, refinery, and everything in between before selling its products to the market. To diversify away from fossil fuels, Exxon has also been focusing on renewable energy.

Exxon stock now trades at around $114.50 per share and has gained about 175% over the past 5 years. Despite the massive gains, the stock trades at a 60-month beta of only 0.49, so it’s also relatively stable compared to the broader market.

Dividend-wise, Exxon Mobil pays an annualized dividend of $4.12 per share, distributed as $1.030 every quarter, which then translates to a forward yield of aprox. 3.6%. The dividend payout is 56.25% of Chevron’s earnings, so it’s within a very acceptable range.

In terms of Exxon's financials, annual revenue rose roughly 1.5% to ~$350 billion, and similar to Chevron, net income declined 6.5% to $33.68 billion, or $7.84 per share.

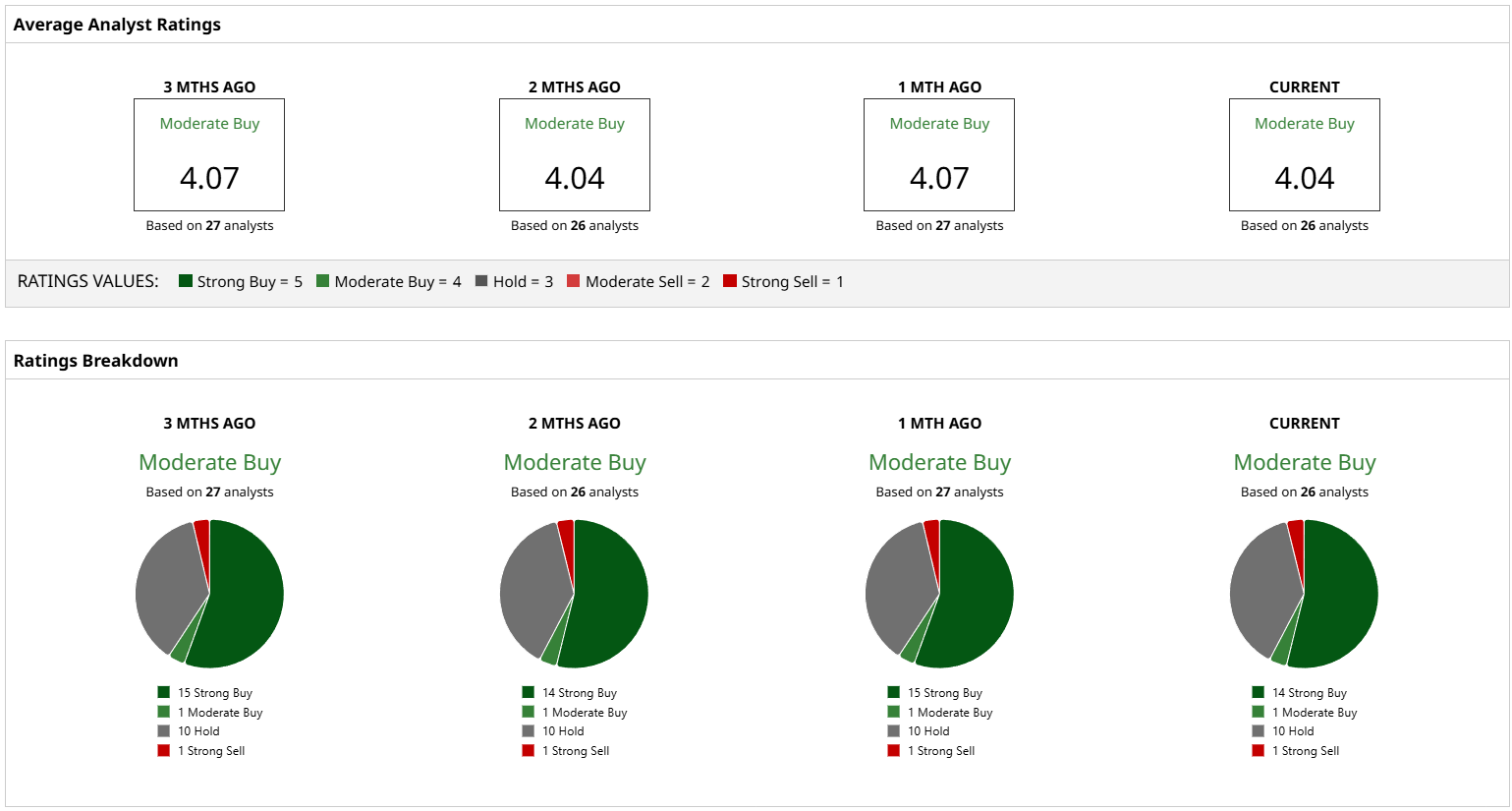

Meanwhile, a consensus among 26 analysts collectively rate the stock a Moderate Buy with a score of 4.04 out of 5, and that score has been relatively stable over the past three months. The high price target for Chevron stock is $156 per share, which translates to ~36% potential upside from where it is now.

Abbvie Inc (ABBV)

The last Dividend Aristocrat on my list today is AbbVie, a giant healthcare company that develops treatments for complex conditions such as cancer and other chronic diseases. Separately, they also manufacture medical devices used for traditional and modern treatments.

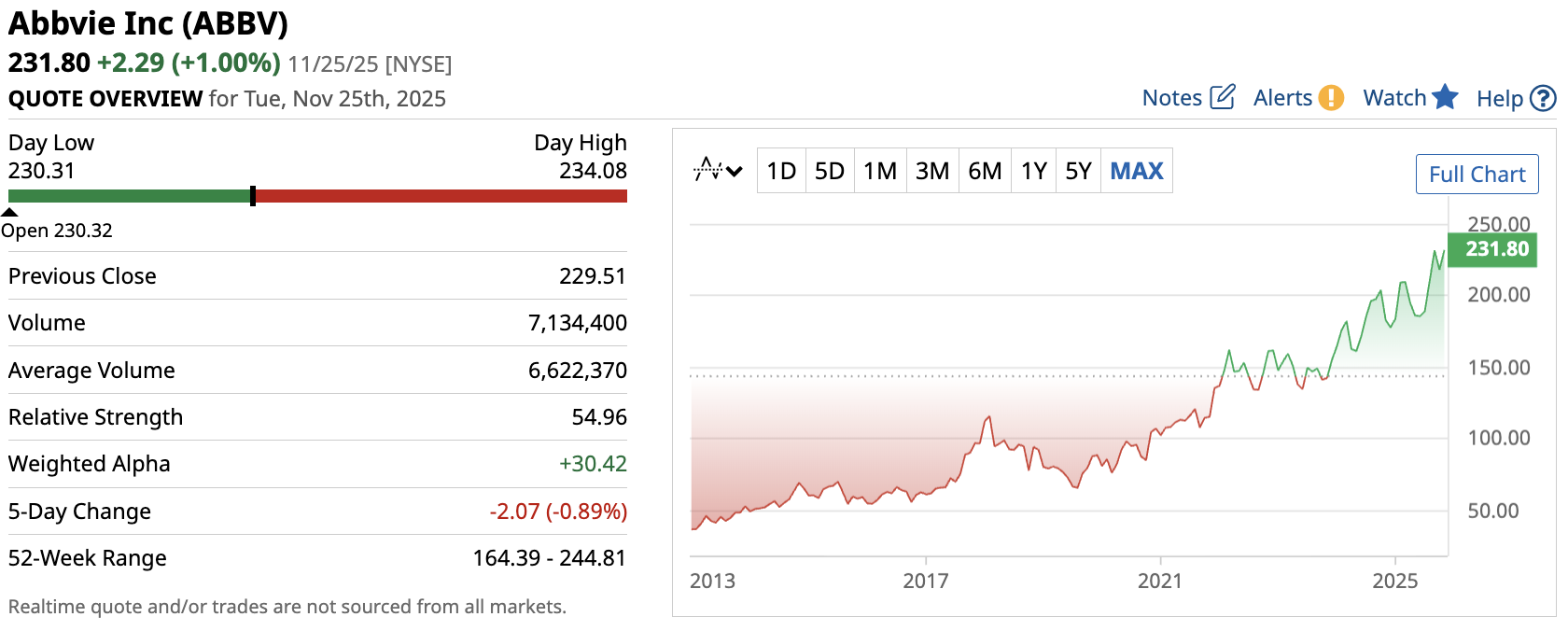

Today, AbbVie’s stock trades at $231.80 with a five-year gain of ~116%. Despite the impressive gains, the stock trades at a 60-month beta of 0.50, which tells me the stock swings much less compared to the broader market.

In terms of dividends, the company pays an annualized dividend of $6.56, or $1.64 every quarter. This translates to a respectable forward yield of 2.8%, with a payout ratio of 68.08%- which is still very acceptable.

In 2024, AbbVie’s annual revenue rose 3.7% to $56.33 billion, while net income declined 12% to around $4.28 billion as a result of notably higher annual operating expenses.

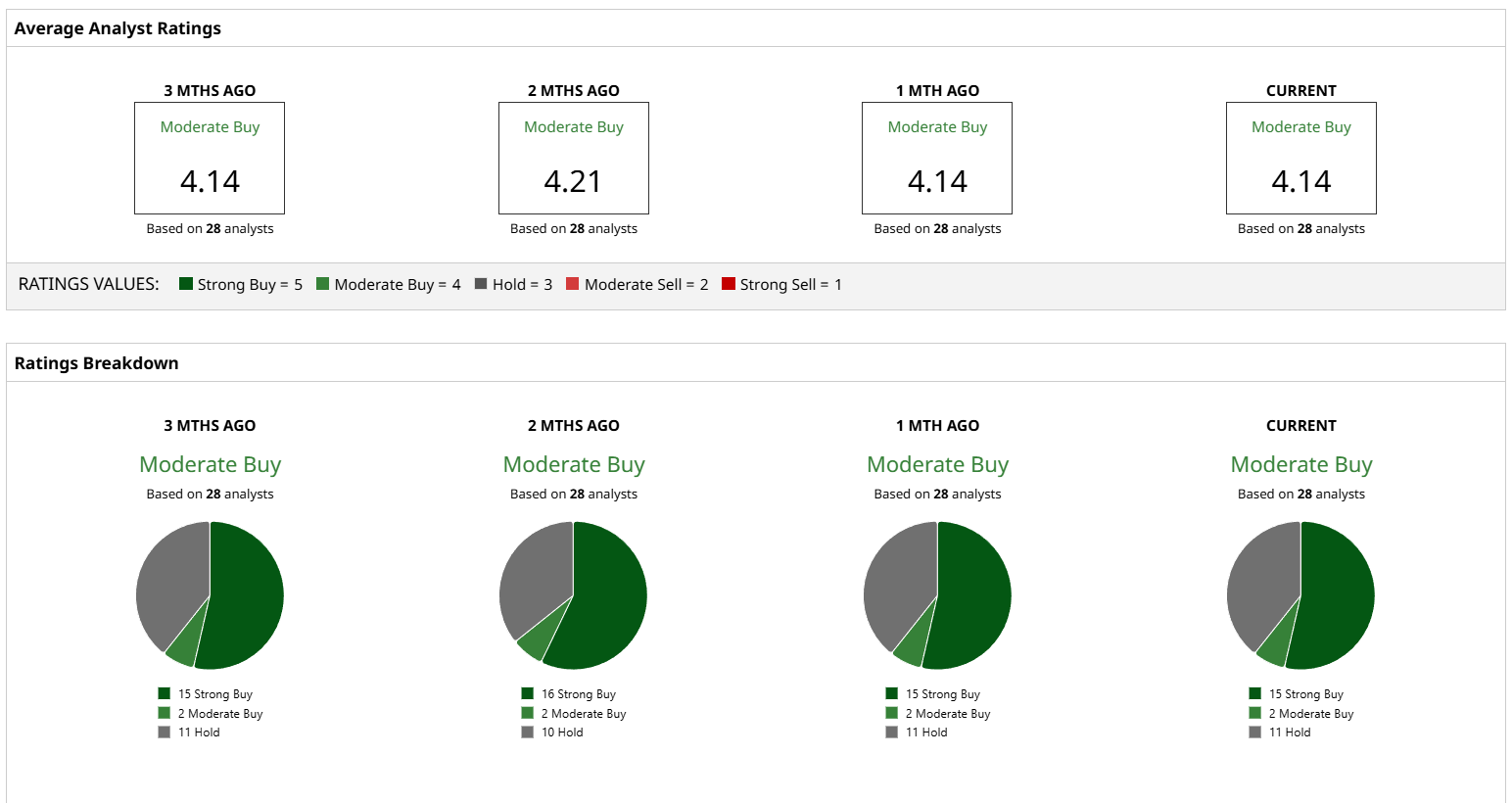

That said, a consensus average of 28 analysts covering the stock points to a Moderate Buy rating with a score of 4.14 out of 5, stable over the past three months. The high price target for the stock is $289 per share, reflecting roughly 25% upside potential for new investors at these levels.

Final Thoughts

Sure enough, these companies are among the most compelling investment options for those seeking safe, reliable dividend stocks.

However, there’s always market uncertainty, even for the most established companies, so it’s critical to examine them from various angles. On that subject, the data presented in this analysis can be used as a starting point for a much deeper analysis. All things being equal, I am convinced that these Dividend Aristocrats offer reliable investment opportunities and attractive income potential for investors.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart