With AI as the driving force, semiconductor stocks have been trending higher in 2025. Advanced Micro Devices (AMD) is no exception, with the stock having surged by almost 80% year-to-date (YTD).

However, even after the big rally, analysts have remained bullish on AMD stock. Recently, TD Cowen named AMD as one of its best ideas for 2026. A key reason for this bull thesis is AMD’s rollout of the Helios rack and MI450 accelerator in mid-2026.

It’s worth adding here that the MI500 Series is due for launch in 2027. TD Cowen therefore opines that the launch of these products will significantly drive top-line and earnings growth over the next few years.

Last month, Bank of America also reiterated its “Buy” rating for AMD stock. A BofA analyst opines that even with heightened competition, there is ample headroom for growth. The reason being the potential for 5x upside in total addressable market for the AI data center by the end of the decade.

About AMD Stock

Advanced Micro Devices is a semiconductor company with a global presence and has been driving innovation in high-performance computing, graphics, and visualization technologies.

Currently, AMD operates through three key segments: data center, client and gaming, and embedded segment. For Q3 2025, the company reported 36% year-on-year (YoY) revenue growth to $9.2 billion with a GAAP operating income of $1.3 billion. Further, AMD has guided for revenue of $9.6 billion in Q4, which would imply 25% YoY growth.

With a focus on innovation, ambitious growth plans, and a big addressable market, AMD stock has surged by 80% in the last six months.

Strong Growth Outlook

According to the World Semiconductor Trade Statistics, the global semiconductor market is expected to grow by 25% in 2026, reaching $975 billion. The market size is therefore significant, and AMD is well positioned to capitalize.

In November, AMD discussed its long-term plan targeted at leadership in data center and AI-related applications. With strategic partnerships coupled with a broadening product portfolio, the company has guided for top-line growth at a CAGR exceeding 35% for the next three to five years. For the same period, the company expects its non-GAAP operating margin to be greater than 35%.

In terms of specific segments, AMD expects to deliver more than 60% revenue CAGR for its data center business. Additionally, the company is targeting a leadership position in adaptive computing with 70% revenue market share.

Considering these targets, AMD stock appears to be attractive even after a meaningful rally. An important point to note is that AMD reported free cash flow of $1.5 billion for Q3 2025. This implies an annualized FCF potential of $6 billion. Additionally, AMD ended Q3 2025 with a cash buffer of $7.2 billion. With low debt and a healthy cash buffer, AMD has high financial flexibility to maintain the innovation edge.

What Analysts Say About AMD Stock

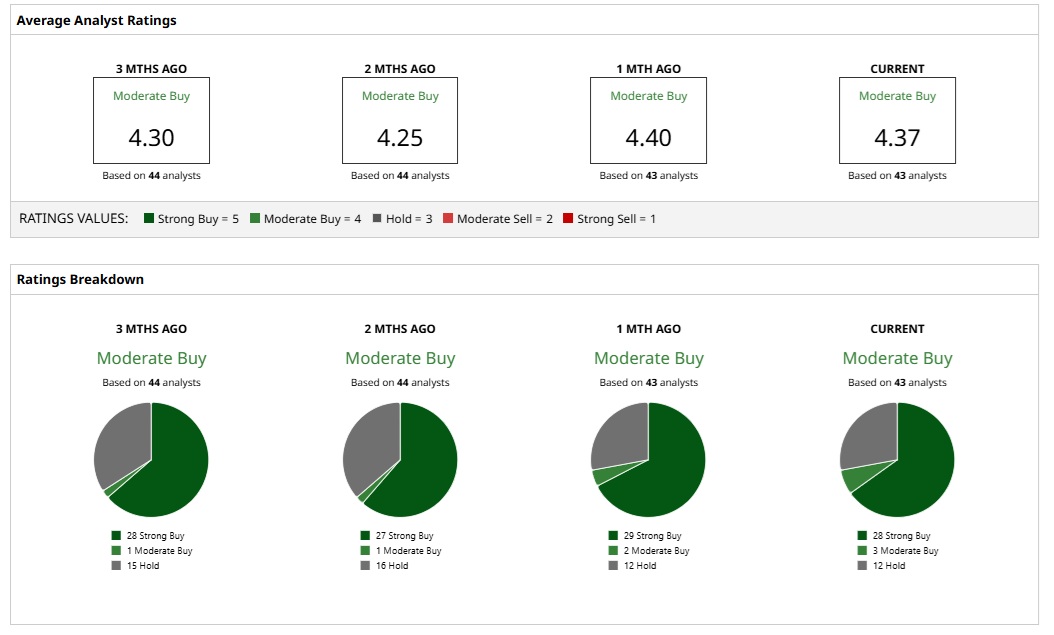

Based on the rating of 43 analysts, AMD stock is a consensus “Moderate Buy.”

While 28 analysts have assigned a “Strong Buy” rating, three and 12 analysts have a “Moderate Buy” and “Hold” rating, respectively.

Based on these ratings, the analysts have a mean price target of $291.3. This would imply an upside potential of 34.9%. Further, considering the most bullish price target of $380, the upside potential is 75.9%.

From a valuation perspective, a forward price-earnings ratio of 68.9 might seem stretched. It's, however, worth noting that analysts expect earnings growth of 73% for FY 2026. The growth acceleration is likely to translate into positive price action.

In October 2025, AMD stock traded at 52-week highs of $267.08. There has been a correction of 18% from the highs, and it might be a good time to consider entry.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Netflix Is Buying Warner Bros. Discovery. Should You Buy NFLX Stock?

- Amazon Just Released Its Graviton5 CPU. Should You Buy, Sell, or Hold AMZN Stock Here?

- Tesla, Netflix, and ON Semiconductor: 3 Unusually Active Cash-Secured Put Options to Sell Now

- Down 40% in the Past Month, Morgan Stanley Says This 1 Stock Is Key to the Future of AI