There is no denying that OpenAI is the artificial intelligence company that started it all, as the November 2022 launch of its ChatGPT large language model (LLM) has completely changed the way millions of users search and consume data.

Having the ability to find large quantities of information, and condense millions of data points down into actionable insights, is very valuable. Thus, the launch of ChatGPT spawned a race between publicly listed mega-cap tech stocks to “catch up” with their own AI innovations.

With this in mind, news that OpenAI sent out an internal memo calling for a “code red” at the company has taken some investors aback. What’s going on, and what does it mean for OpenAI competitors such as Alphabet (GOOG) (GOOGL). I personally think GOOG stock could actually be a big winner from this turmoil.

In other words, I do think OpenAI CEO Sam Altman has something to be worried about.

Tensor Chips, Gemini Could Be Meaningful for Alphabet

News that Gemini 3 has become the top-ranked LLM according to a number of industry benchmarks should have OpenAI and other competitors scrambling. Alphabet’s core search and cloud businesses drive some of the most incredible cash flows in the world. This means Alphabet has among the deepest pockets, and is able to simply throw more capital at its LLM to make it best-in-class.

The fear for OpenAI and others is that Alphabet’s newfound pole position in the AI LLM race could degrade the moats other operators have tried to put around their own models. We’ll have to see how sticky or choosy consumers end up being with their LLM of choice.

But by using its own tensor processing units (TPUs), a cheaper and more efficient alternative to GPUs, Alphabet has clearly found a way to vertically integrate and capture more value across the supply chain. If other companies begin ordering its TPUs in bulk, this is a business that could thrive on its own and lead to even higher margins than the 28.6% margin noted above.

With an impressive 35% return on equity and more than 25% return on assets, Alphabet’s core ratios don’t look overvalued at all. In terms of pure valuation, on a forward price-earnings level, GOOG stock does appear to be expensive at around 30x. But factoring in a higher growth rate moving forward, the company’s PEG ratio could be closer to 1x, meaning it would be fairly valued in my view.

That’s impressive, given Alphabet’s recent rise, and suggests that the market believes these growth catalysts are more likely than not to drive much higher profitability over time.

What Do Other Analysts Think?

The consensus among most Wall Street analysts is that the AI revolution is still in its early innings. As such, we’ve seen a number of notable upgrades across this sector.

And while OpenAI is still a private company, the AI giant has raised money at a $500 billion valuation. I’d expect future funding rounds to see even higher private market caps.

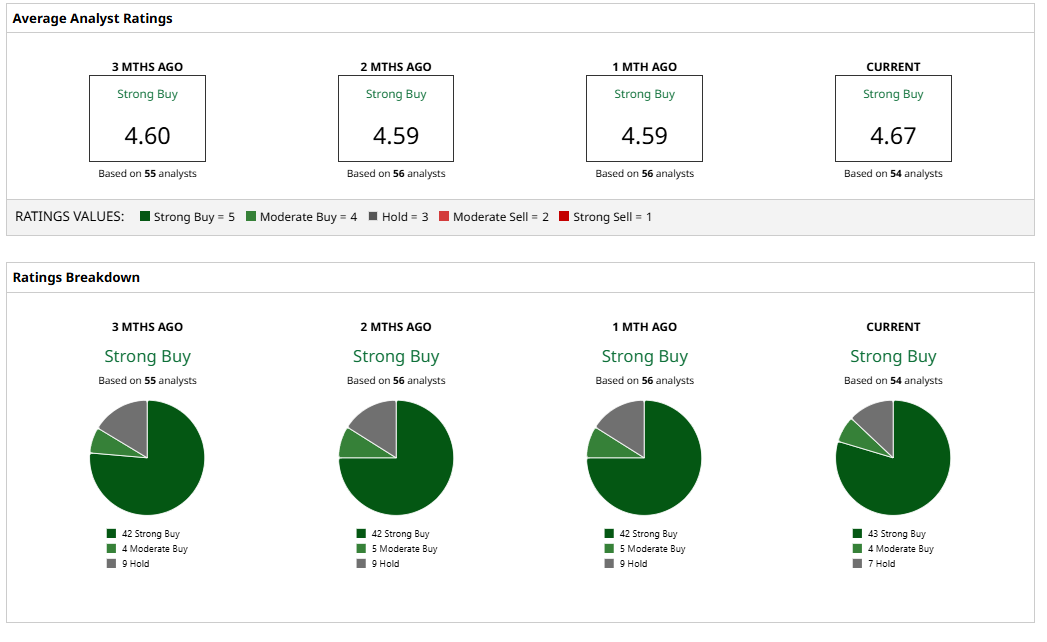

Thus, with 54 analysts giving GOOG stock a collective “Strong Buy” rating and a consensus price target of $324 per share, there is some upside to be had by investing in right now. That said, Alphabet’s recent rise has led to a divergence between its stock price and price target, suggesting to me that further upgrades and price target increases are likely to come from the analyst community.

In my view, Alphabet remains one of the best long-term AI stocks worth considering for those who may be more value-conscious. On a relative basis, I still think GOOG stock is among the best options in this sector due to its growth catalysts and still-reasonable valuation in a sector that’s looking increasingly unreasonable.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Archer Aviation Just Signed on a New Aerospace Partner. Should You Buy ACHR Stock Here?

- Stifel Says This 1 ‘Picks and Shovels’ AI Stock Is a Buy for Massive Growth in 2026

- As Trump Looks to Boost Robotics, This 1 Lesser-Known Stock Is a Strong Buy

- With Fears Swirling, IBM Says There Is No AI Bubble. Does That Make IBM Stock a Buy Here?