When OpenAI unleashed ChatGPT back in 2022, it didn’t just introduce a new tool. It ignited a global artificial intelligence (AI) frenzy that’s still burning bright today. In fact, according to Nvidia (NVDA) and Deutsche Bank's latest projections, worldwide AI investment could soar to $4 trillion by 2030, a staggering figure that reflects businesses' aggressive race to commercialize the technology that exploded in popularity just three years after ChatGPT’s debut.

At this point, everyone from big tech giants to tiny startups is pouring money into AI, hoping to capitalize on its immense potential. But with so much cash flowing in the same direction, many people have started to wonder if things are getting too overheated. In fact, market watchers are comparing the current excitement to the dot-com craze from over two decades ago. And this year, those bubble fears have grown even louder.

Ballooning debt to fund AI infrastructure buildout, a cluster of circular deals among a handful of big tech players, and endless proclamations about AI’s world-changing potential, without much profit on the table yet, have many fearing that we’re marching straight toward another dot-com-style meltdown. Yet despite the mounting anxiety, not everyone’s buying the bubble narrative.

For instance, International Business Machines Corporation (IBM) CEO Arvind Krishna, in a recent Verge podcast, made it clear that he isn’t losing sleep over any so-called AI bubble. And with the consultancy giant making some meaningful strides across the AI landscape, is now a good time to consider IBM’s stock?

About IBM Stock

Although IBM was founded in 1922, this New York–based tech giant is far from slowing down. Long recognized for its legacy in mainframes, enterprise software, and IT services, IBM has quietly reinvented itself for the next wave of innovation. Today, the company is doubling down on hybrid cloud, quantum computing, and, most importantly, AI.

IBM has been steadily building its presence in AI, making progress through its watsonx platform, new generative AI tools, and partnerships designed to help businesses automate work, improve decision-making, and use data more effectively. Currently, the company stands as a major player in hybrid cloud, AI, and business services, supporting organizations in over 175 countries.

Governments and major companies across key sectors such as finance, telecom, and healthcare also depend upon IBM’s hybrid cloud platform and Red Hat OpenShift to upgrade their systems securely and efficiently. With a market capitalization of about $282.9 billion, IBM has seen its shares steadily climb this year, supported by solid fundamentals and a busy pipeline across AI, hybrid cloud, and even quantum computing.

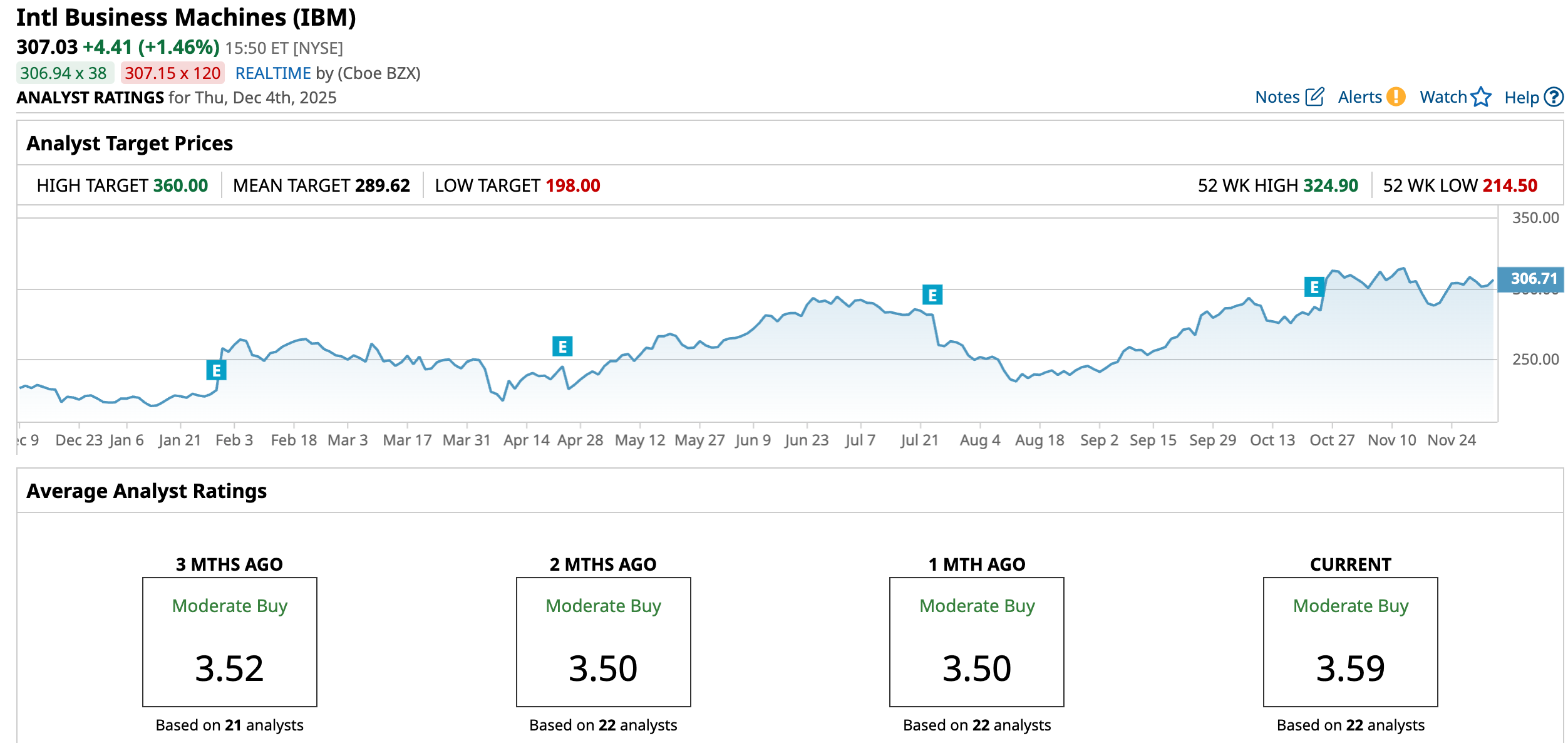

So far this year, the tech giant’s stock has surged an impressive 40.19%, comfortably beating the broader S&P 500 Index ($SPX), which is up a modest 16.42% during the same stretch. Momentum has been solid enough to push the shares to a new 52-week high of $324.90 on Nov. 12, and even after a slight pullback, the stock is still only about 5.9% below that peak.

Along with its steady climb in share price, IBM hasn’t forgotten about investors who love dependable income. The company has paid quarterly dividends every year since 1916, and its streak of 30 straight years of dividend hikes earns it a well-deserved spot among Dividend Aristocrats.

On Oct. 22, IBM announced its latest quarterly payout of $1.68 per share, payable on Dec. 10. That brings its forward annual dividend to $6.72 per share, translating to a solid 2.20% yield. In the third quarter alone, IBM returned roughly $1.6 billion to shareholders through dividends, continuing its long tradition of rewarding investors.

A Look Inside IBM’s Financials

On Oct. 22, IBM reported its fiscal 2025 third-quarter earnings, and the results landed ahead of what Wall Street was expecting. Revenue came in at $16.3 billion, up 9% year-over-year (YOY), its fastest pace in several years, and above the $16.1 billion consensus estimate. Profit growth was even more striking.

The company posted net income of $1.74 billion, or $1.84 per share, a major turnaround from the $330 million loss, or $0.36 per share, it recorded in the same quarter last year. Adjusted EPS rose 15.2% YOY to $2.65, beating analysts’ forecasts of $2.44. The gains were broad-based across IBM’s major segments.

Software revenue totaled about $7.2 billion, up roughly 10%, thanks to strong demand for automation tools and continued momentum within Red Hat/OpenShift. The infrastructure segment performed even better, climbing 17% YOY to $3.6 billion, powered by IBM Z mainframes that jumped almost 61%. Also, the Consulting division moved back into growth mode, posting low single-digit gains to approximately $5.3 billion after slower quarters earlier this year.

Cash flow was another bright spot. IBM generated $3.1 billion in net cash from operating activities, up $200 million YOY. Free cash flow increased to $2.4 billion, rising $300 million from the prior year. By quarter-end, the company held $14.9 billion in cash, restricted cash, and marketable securities, an improvement of $100 million from the end of 2024.

Commenting on the strong Q3 showing, CEO Arvind Krishna highlighted rising customer adoption, saying, “Clients globally continue to leverage our technology and domain expertise to drive productivity in their operations and deliver real business value with AI.” He also noted that IBM’s AI book of business has expanded to over $9.5 billion, up from $7.5 billion just a quarter earlier.

Riding this momentum, IBM lifted its full-year 2025 guidance. The company now expects revenue growth of more than 5%, compared with its previous outlook of at least 5%. Management also raised its free cash flow forecast to $14 billion, up from the earlier estimate of $13.5 billion.

Why Did IBM CEO Reject AI Bubble Fears?

In the podcast with The Verge, CEO Arvind Krishna was firm in his view that there is no AI bubble. While Krishna did acknowledge that some of the debt being used to fund AI growth could be risky, he compared the situation to the early days of fiber-optic networks, where only a few companies ultimately earned significant returns.

He suggested the same could happen in AI because the industry requires massive capital, and only a small number of players may generate the profits needed to justify that spending. Also, the CEO said there’s only a 0–1% chance that today’s AI models, like current LLMs, will lead to Artificial General Intelligence (AGI), because reaching AGI would require breakthroughs far beyond what we have now.

AGI refers to a hypothetical form of AI that could understand and learn any intellectual task a human can, essentially matching the full cognitive abilities of the human brain. Additionally, the CEO noted that quantum computing could play a crucial role in enabling those future leaps, since it can tackle problems that CPUs and GPUs can’t handle efficiently.

How Are Analysts Viewing IBM Stock?

Despite all the talk about a potential AI bubble, Bank of America (BAC) actually became more upbeat on IBM after Krishna’s interview on The Verge podcast. The investment firm reiterated its “Buy” rating on the company and $315 price target, saying the conversation boosted its confidence in IBM’s long-term opportunities.

BAC analyst Wamsi Mohan echoed the CEO’s optimism, noting that IBM’s quantum opportunity and its shift toward higher-margin software, which is boosting free cash flow, are key factors behind its positive view of the stock. And it’s not just BofA feeling upbeat. Wall Street’s overall view on IBM remains positive, with the stock carrying a “Moderate Buy” consensus rating.

Among the 22 analysts covering the stock, eight rate it a “Strong Buy,” one calls it a “Moderate Buy,” 11 recommend a “Hold,” and two see it as a “Strong Sell.” Even though IBM has already climbed past the Street’s average price target of $289.62, the highest target at $360 suggests the shares could still rise as much as 17.3% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Archer Aviation Just Signed on a New Aerospace Partner. Should You Buy ACHR Stock Here?

- Stifel Says This 1 ‘Picks and Shovels’ AI Stock Is a Buy for Massive Growth in 2026

- As Trump Looks to Boost Robotics, This 1 Lesser-Known Stock Is a Strong Buy

- With Fears Swirling, IBM Says There Is No AI Bubble. Does That Make IBM Stock a Buy Here?