Based in Arlington, Virginia, The AES Corporation (AES) operates a substantial international energy business that spans the generation and delivery of power worldwide. The company’s activities include constructing, funding, and overseeing a range of energy projects, from renewable solutions to classic power sources.

Through its global footprint and innovative partnerships, AES supplies dependable electricity to various sectors, boosting energy access in dozens of countries while prioritizing sustainable operations. The company has a market capitalization of $9.88 billion.

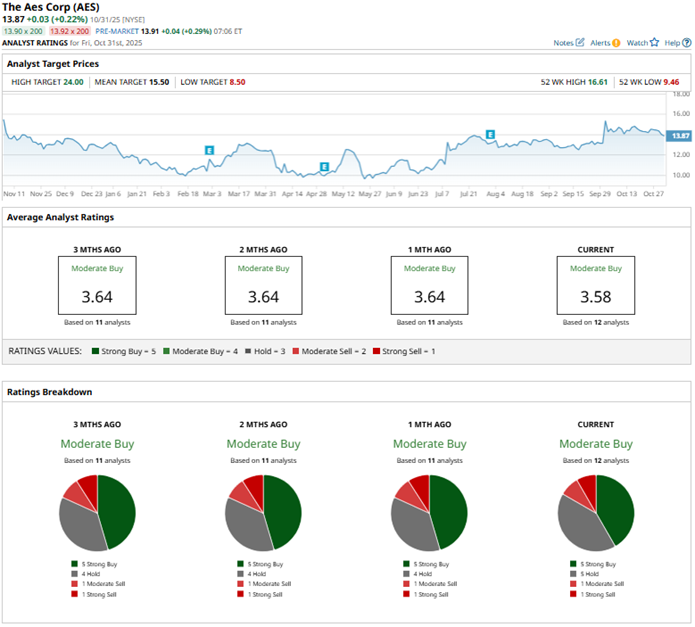

Recently, the company’s stock price has experienced fluctuations. Over the past 52 weeks, the stock has declined by 15.5% due to weak financials. However, worries have somewhat subsided as the year has progressed, as the stock has increased by 7.8% year-to-date (YTD). The shares reached a 52-week low of $9.46 in May, but are up 46.6% from that level.

The stock has broadly underperformed the S&P 500 Index ($SPX), which has gained 17.7% and 16.3% over the same periods, respectively. Turning our focus to the sector-specific The Utilities Select Sector SPDR Fund (XLU), we see that the ETF is up by 12.7% over the past 52 weeks and 17.7% YTD, outperforming AES’s stock.

On July 31, AES reported its second-quarter results for fiscal 2025. The company reported results that were quite mixed. Its revenue decreased 3% year-over-year (YOY) to $2.86 billion, primarily due to a 7.1% annual decline in non-regulated revenues. On the other hand, its adjusted EPS increased from $0.38 in Q2 2024 to $0.51 in Q2 2025. While the adjusted EPS figure was higher than the $0.39 that Wall Street analysts had expected, the topline missed the expected $3.30 billion.

Wall Street analysts still believe in AES’ ability to grow its bottom line. For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect AES’ EPS to grow 1.4% YOY to $2.17 on a diluted basis. EPS is also expected to increase 8.8% to $2.36 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in three of the four trailing quarters.

Among the 12 Wall Street analysts covering AES’ stock, the consensus is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, five “Holds,” one “Moderate Sell,” and one “Strong Sell.” The ratings configuration has remained relatively unchanged over the past three months.

Last month, Morgan Stanley analyst David Arcaro raised the price target on the stock from $23 to $24, while maintaining an “Overweight” rating on its shares, as the firm raised the price targets of regulated and diversified utilities. As a part of their third-quarter earnings preview of the power and utilities sector, Barclays analysts raised the price target on AES from $14 to $15, while keeping an “Overweight” rating.

AES’ mean price target of $15.50 indicates an 11.8% upside over current market prices. The Street-high Morgan Stanley-given price target of $24 implies a potential upside of 73%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.