TORONTO, ON / ACCESSWIRE / August 14, 2023 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG)(OTCQX:JAGGF) is pleased to announce that the Company has reached an agreement with a subsidiary of AngloGold Ashanti Limited (NYSE: AU)("AngloGold") for a non-cash royalty exchange on royalties previously attached to its Paciência Gold Mining Complex ("CPA") under a historical accord, in exchange for another two mining rights ("Carancas" and "Pacheca"), located close to AngloGold's other operating assets (Lamego and Córrego do Sítio).

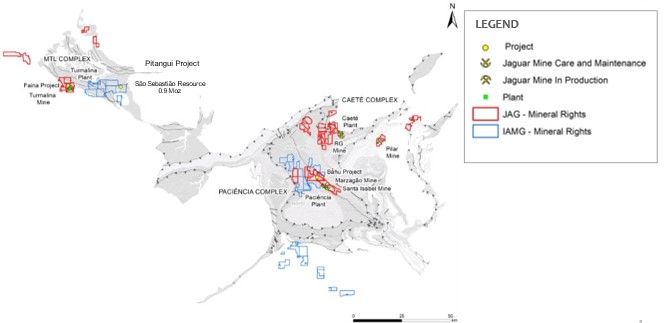

CPA is located close to two of the Company's operating assets (Caeté and MTL Complexes) in the prolific Iron Quadrangle area of Minas Gerais, Brazil (Figures 1 & 2). The complex is comprised of two underground mines, Santa Isabel and Margazao, and a processing plant with capacity to treat approximately 1,750 tpd within approximately 9,000 Ha of contiguous permitted mining tenements. The CPA Plant was commissioned in April 2008 and commercial production was declared in December 2008. Total production during this period is estimated at approximately 1,755 Mt at an average grade of 3.06 g/t Au containing approximately 154,000 ounces of gold. The operation has been on care and maintenance since 2012.

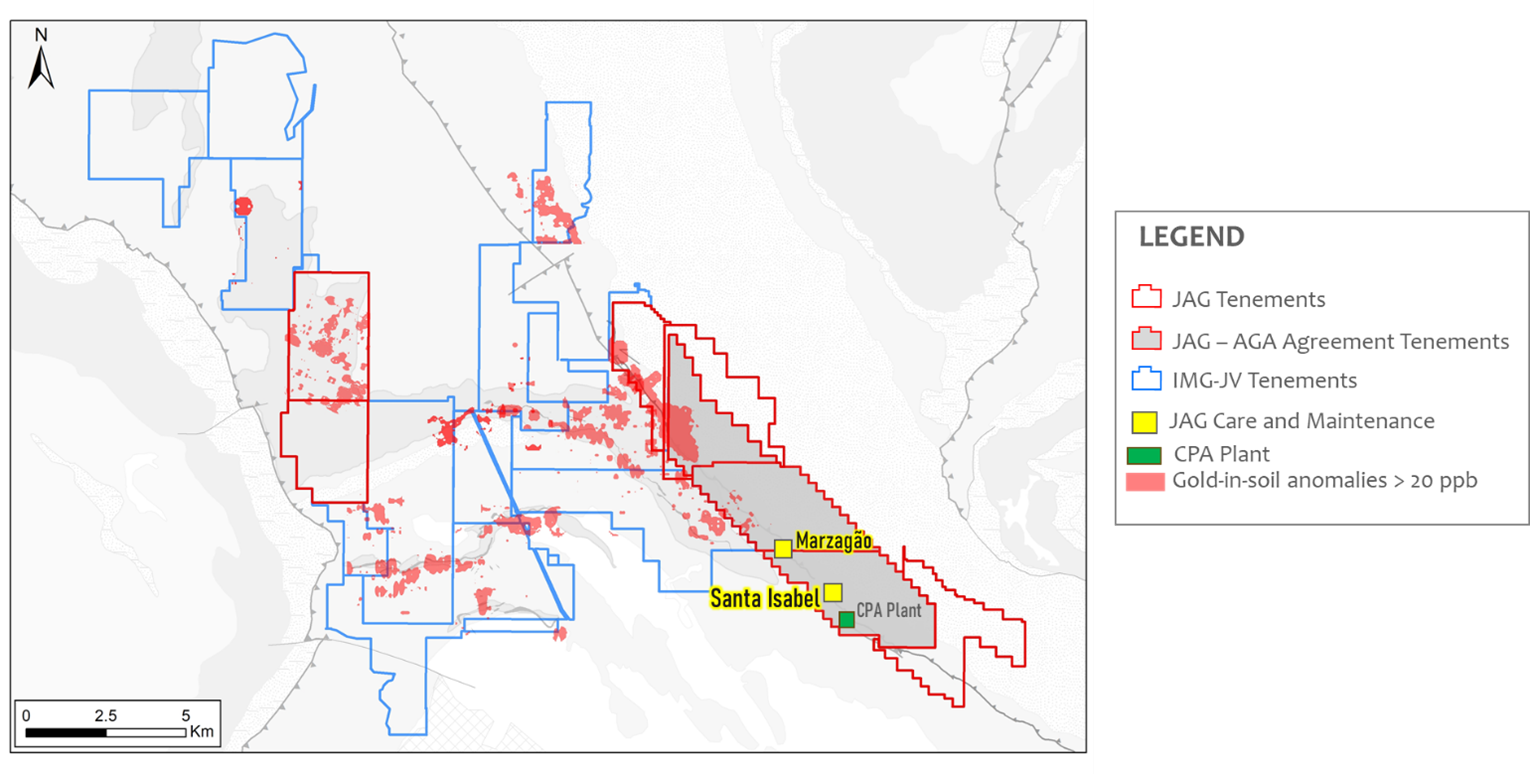

In the Company's most recent NI43-101 disclosure published in May 2023 (available on Sedar), CPA has an estimated Inferred Mineral Resource of 1.80 Mt at an average grade of 4.06 g/t Au, containing approximately 235,000 ounces of gold.

In 2003, the Company executed a sale purchase agreement with AngloGold covering the three main individual tenements related to CPA. The agreement included payment, related commitments, and a up to 4.5% NSR Royalty that was payable to AngloGold from production at a gold price above US$510 per ounce. The two companies have been in ongoing discussions regarding restructuring the NSR which, in its original form, did not reflect current or projected market conditions.

Vern Baker, President and CEO of Jaguar Mining stated: "We are very pleased to announce that we have reached this agreement with AngloGold. The removal of the royalty attached to our CPA asset coupled with the large additional contiguous tenements package (previously under joint venture) recently acquired from IAMGOLD allows us to proceed with an in-depth evaluation of potential redevelopment opportunities. CPA consists of two mines and a mill which have the potential to produce with minimal refurbishment capital investment. We also believe we can grow the current Mineral Resource inventory materially in size and quality to support the investment necessary to achieve this objective. Along with the recently announced full acquisition of the Acurui properties, this announcement is another step supporting our ongoing strategy to increase the utilization of our existing processing capacity, both through exploration on our land and potential arrangements with neighbors to fill our mills."

Figure 1. Location of Jaguar´s Paciência Gold Mining Complex relative to its Caeté and MTL Complexes and increased mineral rights areas following the recent acquisition of IAMGOLD´s Brazilian Assets

Figure 2. Jaguar´s Paciência Complex showing location of tenements impacted by the new agreement with AngloGold and contiguous tenements recently acquired from IAMGOLD

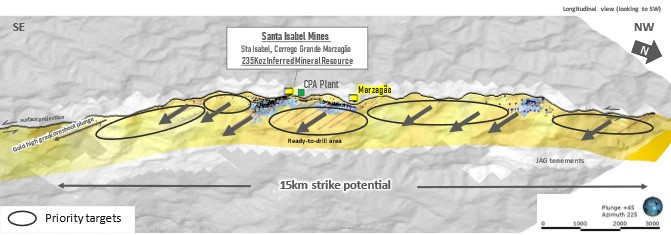

Historical mining activity at CPA has been focused on a relatively short 1.5 km strike length of Jaguar´s overall extensive tenement package which covers a highly prospective, 15 km strike segment of the regionally significant São Vicente/Paciência Lineament. This Lineament is a crustal scale shear zone that extends some 60 km across the Iron Quadrangle. Numerous gold deposits and prospects are spatially related along the entire length of this structure.

Gold mineralization is manifested as a regular series of shallowly dipping tabular sheets composed of quartz veins hosted in an altered matrix comprised of sericite/chlorite/carbonate schist with higher grades concentrated along structurally controlled plunging "oreshoots". The length of these individual shoots varies between 10 m and 200 m along strike and can extend greater than hundreds of metres following the down plunge direction of continuity. (Figure 3).

The mineralization is free milling with gold occurring as discrete, visible grains hosted by quartz veins and/or veinlets, or as tiny inclusions within sulphide crystals, mainly pyrite and arsenopyrite. Historical metallurgical recoveries have averaged 92.4%.

Figure 3 - Long Section facing Southwest showing the location of the Santa Isabel Mine and the significant upside strike and dip potential along a 15km segment of the São Vicente/Paciência Lineament within Jaguar´s Tenement Package

Qualified Person

Scientific and technical information contained in this press release has been reviewed and approved by Jonathan Victor Hill, BSc (Hons) (Economic Geology - UCT), FAUSIMM, Vice President Geology and Exploration, who is also an employee of Jaguar Mining Inc., and is a "qualified person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the Turmalina Gold Mine Complex and Caeté Mining Complex (Pilar and Roça Grande Mines, and Caeté Plant). The Company also owns the Paciência Gold Mine Complex, which has been on care and maintenance since 2012. The Roça Grande Mine has been on temporary care and maintenance since April 2019. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact:

Vernon Baker

Chief Executive Officer

Jaguar Mining Inc.

vernon.baker@jaguarmining.com

416-847-1854

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, the duration of the temporary suspension of the Company's 2023 production guidance in ounces and costs, the expected future release of new guidance for 2023, the anticipated impact of planned changes in mining systems and cost cutting initiatives on the Company's future performance and production results, information related to expected sales, production statistics, ore grades, tonnes milled, recovery rates, cash operating costs, definition/delineation drilling, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, currency fluctuations, capital requirements, project studies, mine life extensions, restarting suspended or disrupted operations, continuous improvement initiatives, and resolution of pending litigation. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the estimated timeline for the development of its mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR at www.sedar.com. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

SOURCE: Jaguar Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/773928/Jaguar-Mining-Announces-Non-cash-Royalty-Exchange-Agreement-With-AngloGold-Ashanti-on-CPA-Royalties