TORONTO, ON / ACCESSWIRE / May 9, 2024 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG)(OTCQX:JAGGF) today announced financial results for the first quarter ended March 31, 2024 ("Q1 2024"). All figures are in US Dollars, unless otherwise expressed.

First Quarter Highlights

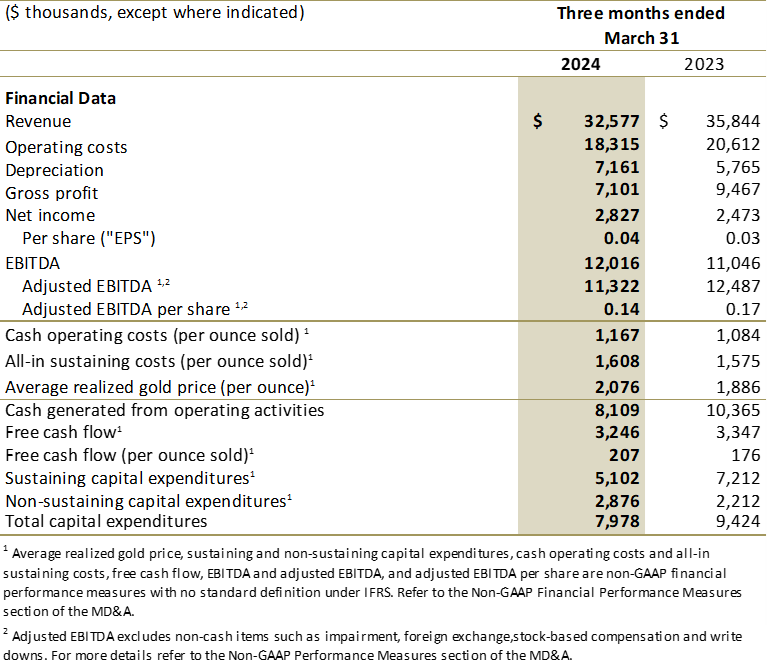

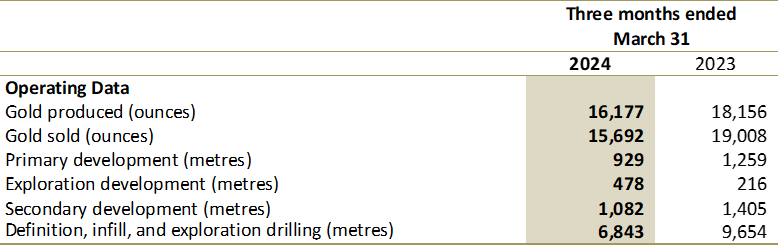

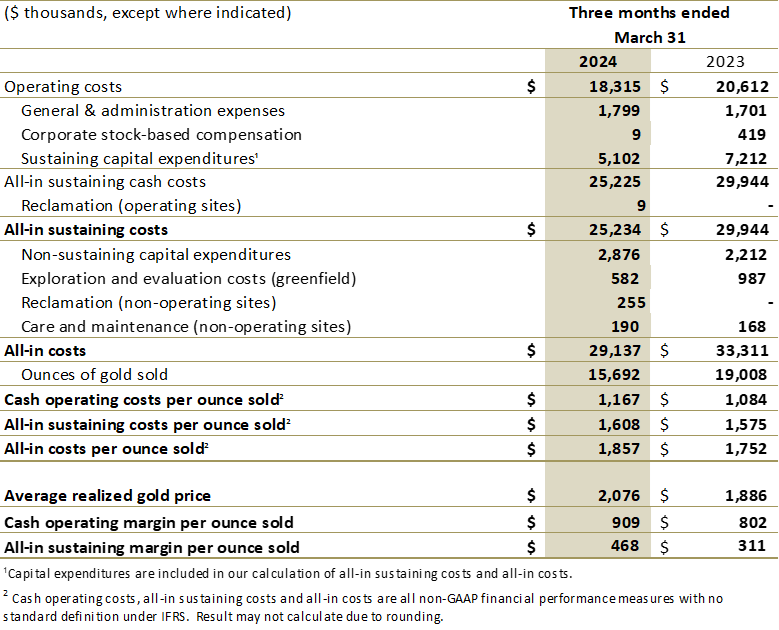

- Gold production for the quarter was 16,177 ounces with 15,692 gold ounces sold, at cash operating costs¹ of $1,167 per ounce of gold sold and all-in sustaining costs¹ of $1,608 per ounce of gold sold. Realized gold prices were $2,076 per ounce.

- Revenue for the quarter $32.6 million, 9% below revenue in the first quarter of 2023 ("Q1 2023") driven by lower production and fewer ounces sold which was partly offset by higher realized gold prices.

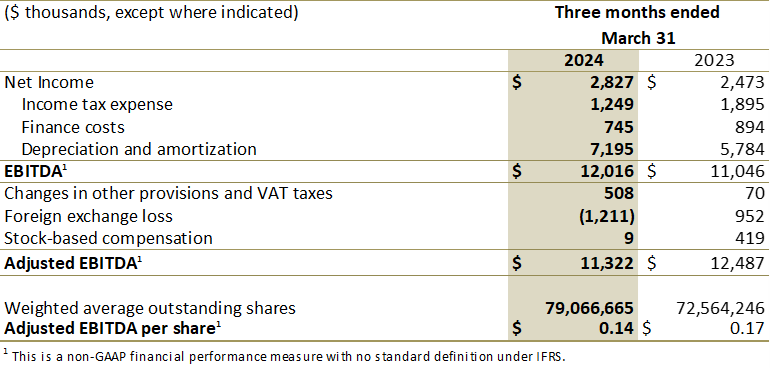

- Net income for the quarter was $2.8 million ($0.04 per share) and $0.4 million ($0.01 per share) higher than net income in Q1 2023.

- Operating costs for the quarter were $18.3 million compared to operating costs of $20.6 million in Q1 2023.

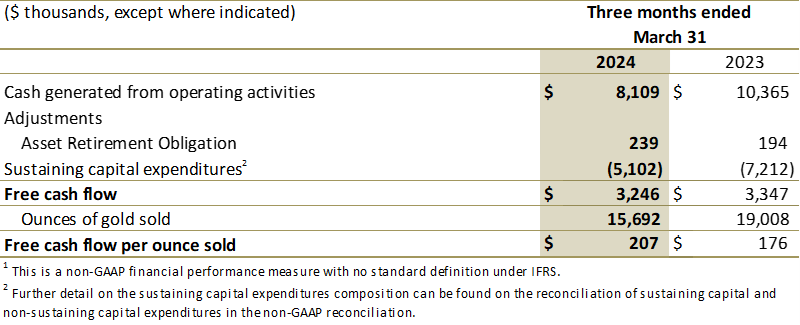

- Free cash flow 1 for the first quarter was $3.3 million and in line with Q1 2023, based on operating cash flow plus asset retirement obligation expenditures, less capital. Free cash flow per ounce 1 sold for the quarter $207 and $176 per ounce sold in Q1 2023.

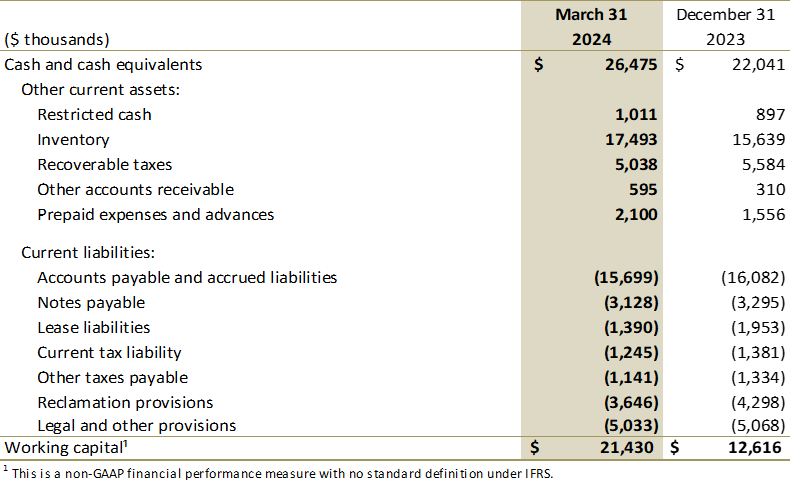

Cash position and working capital 1

- As of March 31, 2024, the Company had cash and cash equivalents of $26.4 million, compared to $22.0 million in cash and cash equivalents as at December 31, 2023.

- As of March 31, 2024, working capital was $21.4 million, compared to $12.6 million as at December 31, 2023.

Vern Baker, President and CEO of Jaguar, stated : "I am very pleased with how our efforts have progressed at advancing Faina in the Turmalina Mine and BA in the Pilar Mine. Despite first-quarter production challenges and a Dengue epidemic, the company continued operating in a cost-conscious manner and increased its cash position while continuing to invest in Faina and BA. The BA orebody made a significant contribution to Q1 production at Pilar, specifically in March, and ongoing development of the BA orebody is expected to contribute to stoping throughout the year. Consolidated production levels in the second quarter will be similar to the first quarter as we work through grade issues that have impacted production at Turmalina since the beginning of April. We are making additional investments in development at Turmalina which we expect will bring its grades back above three grams per tonne. In addition, we have restructured management at the mine to enhance our focus on grade and fully integrate Faina within the production team. In the third quarter, production at Turmalina will return to expected levels, augmented by production at Faina. Overall, we expect to see increased production in the second half of the year with totals expected above 2023 levels."

First Quarter 2024 Results

Non-GAAP Performance Measures

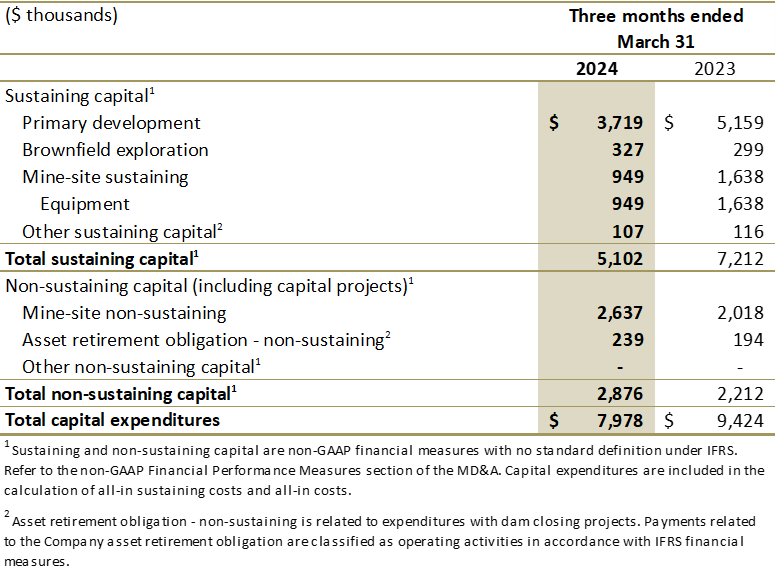

The Company has included the following Non-GAAP performance measures in this document: cash operating costs per ounce of gold sold, all-in sustaining costs per ounce of gold sold, average realized gold price (per ounce of gold sold), sustaining capital expenditures, non-sustaining capital expenditures, adjusted operating cash flow, free cash flow, earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted EBITDA and working capital. These Non-GAAP performance measures do not have any standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other companies.

The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance. Accordingly, they are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. More specifically, Management believes that these figures are a useful indicator to investors and management of a mine's performance as they provide: (i) a measure of the mine's cash margin per ounce, by comparison of the cash operating costs per ounce to the price of gold; (ii) the trend in costs as the mine matures; and (iii) an internal benchmark of performance to allow for comparison against other mines. The definitions of these performance measures and reconciliation of the Non-GAAP measures to reported IFRS measures are outlined below.

Reconciliation of sustaining capital to non-sustaining capital expenditures 1

Reconciliation of Free Cash Flow 1

Reconciliation of Cash Operating Costs, All-In Sustaining Costs and All-In Costs per Ounce Sold 1

Reconciliation of Net Income to EBITDA and Adjusted EBITDA 1

Working capital 1

Qualified Person

Scientific and technical information contained in this press release has been reviewed and approved by Jonathan Victor Hill, BSc (Hons) (Economic Geology - UCT), FAUSIMM, who is Advisor Exploration and Geology to Jaguar Mining Inc. and is a "qualified person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento. Jaguar holds the third largest gold land position in the Iron Quadrangle with over 55,000 hectares.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the Turmalina Gold Mine Complex and Caeté Mining Complex (Pilar and Roça Grande Mines, and Caeté Plant). The Company also owns the Paciência Gold Mine Complex, which has been on care and maintenance since 2012. The Roça Grande Mine has been on temporary care and maintenance since April 2019. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact:

|

Vernon Baker Alfred Colas |

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, the anticipated impact of planned changes in mining systems and cost cutting initiatives on the Company's future performance and production results, information related to expected sales, production statistics, ore grades, tonnes milled, recovery rates, cash operating costs, definition/delineation drilling, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, currency fluctuations, capital requirements, project studies, mine life extensions, restarting suspended or disrupted operations, continuous improvement initiatives, and resolution of pending litigation. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the estimated timeline for the development of its mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR+ at www.sedarplus.com. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

1 This is a Non-GAAP financial performance measure with no standard definition under IFRS. For more details, refer to the Non-GAAP Performance Measures section of the MD&A

SOURCE: Jaguar Mining Inc.

View the original press release on accesswire.com