ContextLogic Inc. (WISH) has been grappling with a significant downfall in its monthly active users (MAUs) and revenues post-pandemic. Its MAU stands at 24 million. Unlike the general post-pandemic slowdown faced by e-commerce businesses, WISH finds itself particularly precarious.

For the fiscal first quarter, the company reported revenues of $96 million, signifying a steep 49.2% year-over-year decline. Its net loss has also amplified – registering at $89 million versus the preceding year’s quarter loss of $60 million. Furthermore, net loss per share increased to $3.83 from $2.72. The company also reported a negative free cash flow of $92 million.

WISH is making significant strides toward recovery through strategic initiatives designed to retain buyers and improve customer satisfaction. However, the road to revival could prove challenging given the intensified competition from fresh market players and established industry giants like Amazon.com, Inc. (AMZN).

While the company has been striving for improvement, Wall Street analysts remain skeptical about its upcoming performance. They project a further revenue deterioration and anticipate a sustained negative EPS for the coming quarters.

The company’s stock value has significantly plummeted over the past year and is presently trading at $6.58, perilously near its 52-week low of $6.36, touched on May 3, 2023. With anticipated continued selling pressure, avoiding this stock, for now, would be prudent.

Here, I outline key metrics reinforcing my bearish stance on WISH.

An Overview of WISH’s Financial Challenges: Examining Trends in Net Income, Revenue, Gross Margin, and Price Targets

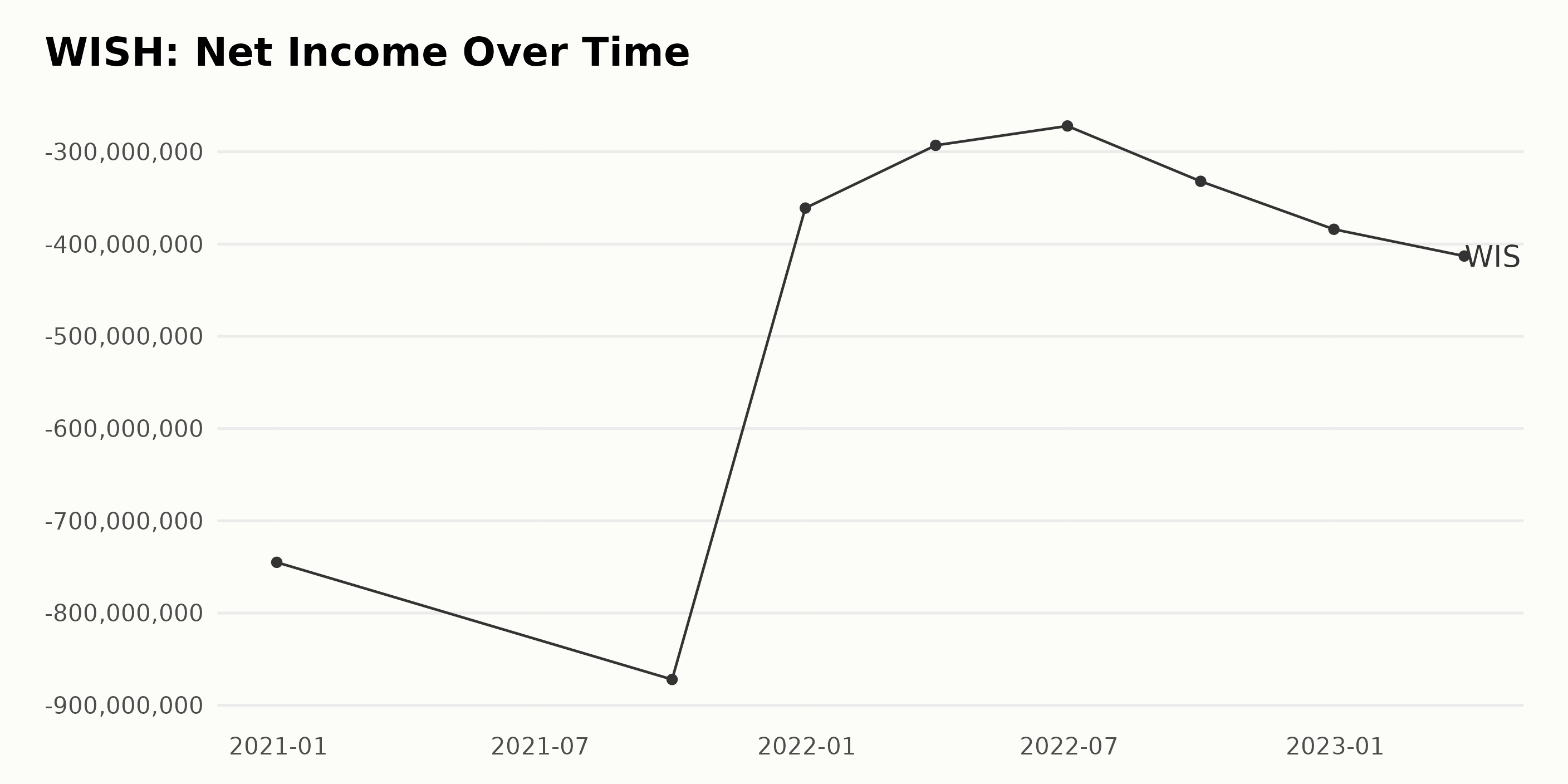

WISH’s trailing-12-month net income has shown a generally negative trend over the observed period.

Specifically, here are some key data points:

- On December 31, 2020, the reported net income was -$745 million.

- There was a subsequent increase in losses to -$872 million by September 30, 2021.

- However, a downward fluctuation in losses was observed, with net income improving to -$361 million on December 31, 2021.

- This improvement trend continued into the first two quarters of 2022, with reported net income at -$293 million (March 31) and -$272 million (June 30), respectively.

From the latter half of 2022 and into 2023, however, the company’s net losses started increasing again:

- The company reported a net income of -$332 million on September 30, 2022, followed by -$384 million by the end of December that same year.

- Losses increased further on March 31, 2023, with net income falling further to -$413 million.

The recent trend, especially in 2023, shows that WISH has been facing increasing financial challenges, given the successive rise in quarterly net losses.

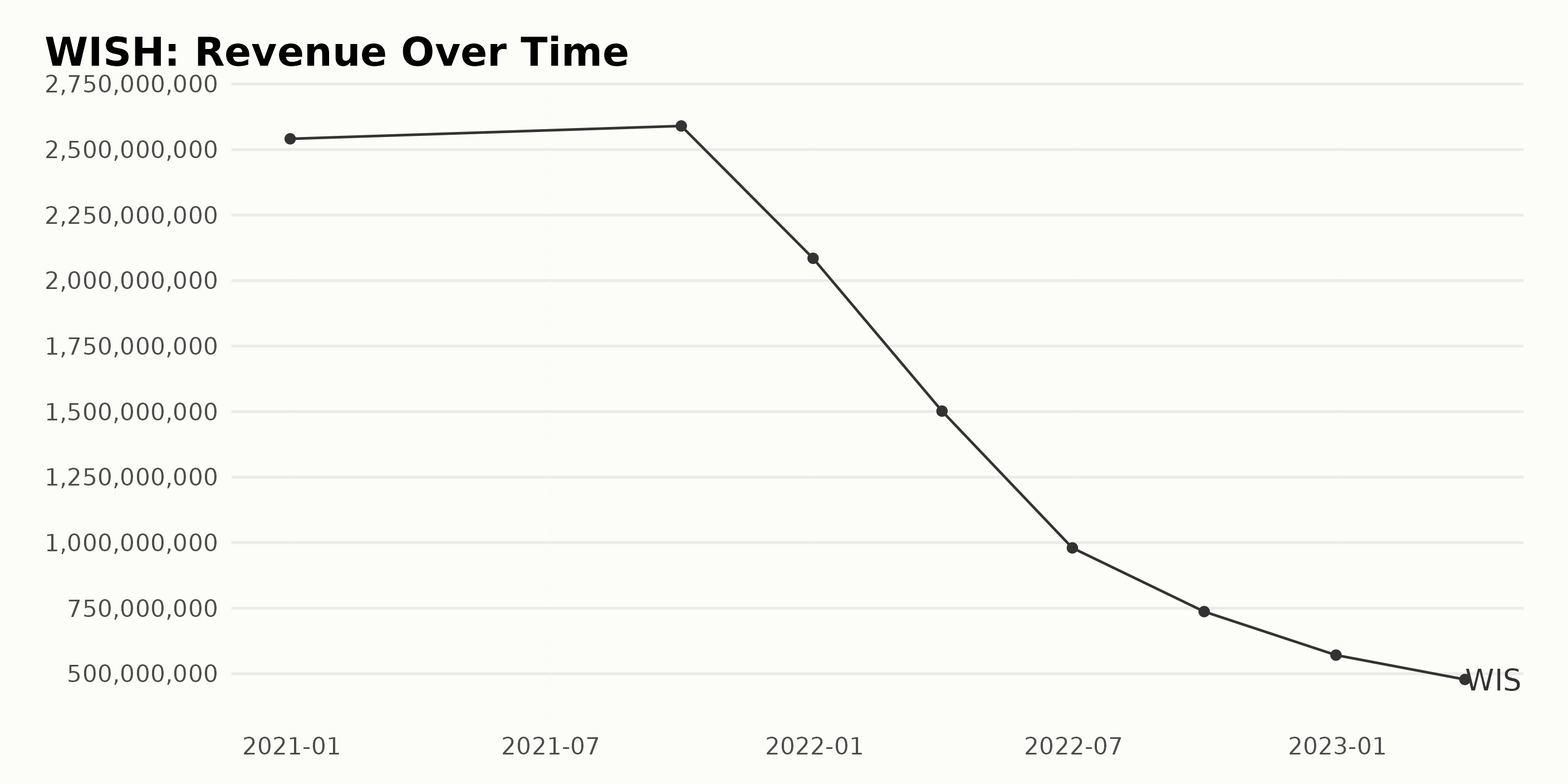

The trend and fluctuations in the trailing-12-month revenue of WISH show a marked decrease over the analyzed period from December 31, 2020, to March 31, 2023.

The trend and fluctuations in the trailing-12-month revenue of WISH show a marked decrease over the analyzed period from December 31, 2020, to March 31, 2023.

- On December 31, 2020, the company’s revenue was $2.54 billion.

- Nine months later, on September 30, 2021, there was a slight increase to $2.59 billion.

- However, by the end of 2021 (December 31), a significant decrease to $2.08 billion was reported, a downturn from the previous gains.

- This downward trend continued into 2022, with revenue falling to $1.5 billion by March 31, $980 million by June 30, and further plummeting to $737 million by September 30.

- By the end of 2022 (December 31), it had reduced considerably to $571 million.

- As of the most recent data entry on March 31, 2023, WISH’s revenue stood at $478 million.

This represents a steep fall from the $2.54 billion recorded at the beginning of the period under review. The overall growth rate, therefore, indicates a significant negative trend when comparing the first and last values. While there was a minor increase within the first nine months of 2021 (from $2.54 billion to $2.59 billion), the following periods have consistently witnessed a significant downward spiral in WISH’s revenue. Such persistent decrease across the periods could be a considerable concern for stakeholders.

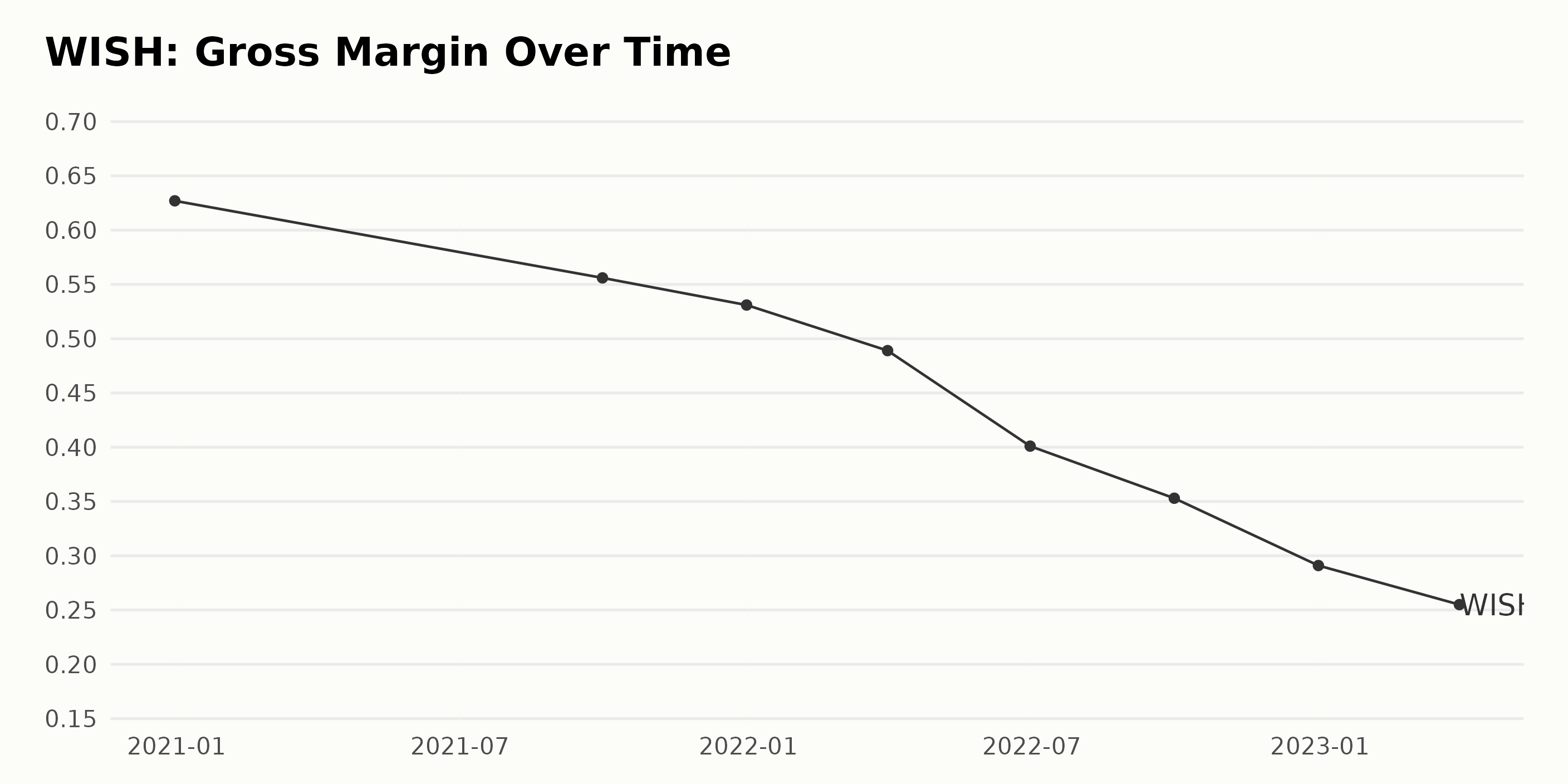

- As of December 31, 2020, the WISH’s gross margin stood at 62.7%.

- There was a downtrend over 2021, with the gross margin falling to 55.6% by September 30 and 53.1% by the end of December.

- In 2022, the gross margin continued to decrease; it was at 48.9% in the first quarter (March 31), dipped to 40.1% in the second quarter (June 30), and further fell to 35.3% by the end of the third quarter (September 30).

- The downward trend escalated towards the year-end, with the gross margin reported at 29.1% on December 31, 2022.

- By the end of the first quarter of 2023, the gross margin of WISH had decreased to 25.5%.

Following this pattern, the gross margin has notably declined from the end of 2020 to early 2023. Over this period, the gross margin has fallen from 62.7% to 25.5%, representing a negative growth rate of approximately 59.35%.

By analyzing price target data for WISH, we can observe several key stages:

By analyzing price target data for WISH, we can observe several key stages:

- November 2021 - March 2022: The analyst price target consistently hovered around $5.

- March-August 2022: There was a moderate drop to $2.

- August - November 2022: A slight decrease lowered the analyst price target to $1.75.

- November 2022 - January 2023: There was another decline in price, with it persisting at $1.25.

- January - March 2023: The analyst price target saw its most significant fall during this period, ultimately sitting at just $0.5.

- End of March - Early April 2023: An unprecedented fall to $0.45 is observed before the target price unexpectedly surged to $13.506.

- April - May 2023: Price targets fluctuated dramatically, peaking at $13.506 before settling at $7.8 by the end of June 2023. Interestingly, from mid-April to late May 2023, the Analyst Price Target faced significant fluctuations, swinging from a low of $0.45 (April 7) to a high of $13.506 (April 21) before finally stabilizing again at $7.8 (June onwards).

Immense volatility might distort this metric to some extent. This rollercoaster ride for WISH’s price target within such a short span depicts a tumultuous market sentiment and suggests a mercurial perspective on the firm’s prospects. While recent fluctuations are concerning, further monitoring is required to develop a comprehensive outlook.

Analyzing Six-Month Performance and Trends of WISH Stock: A Rollercoaster Ride

Analyzing Six-Month Performance and Trends of WISH Stock: A Rollercoaster Ride

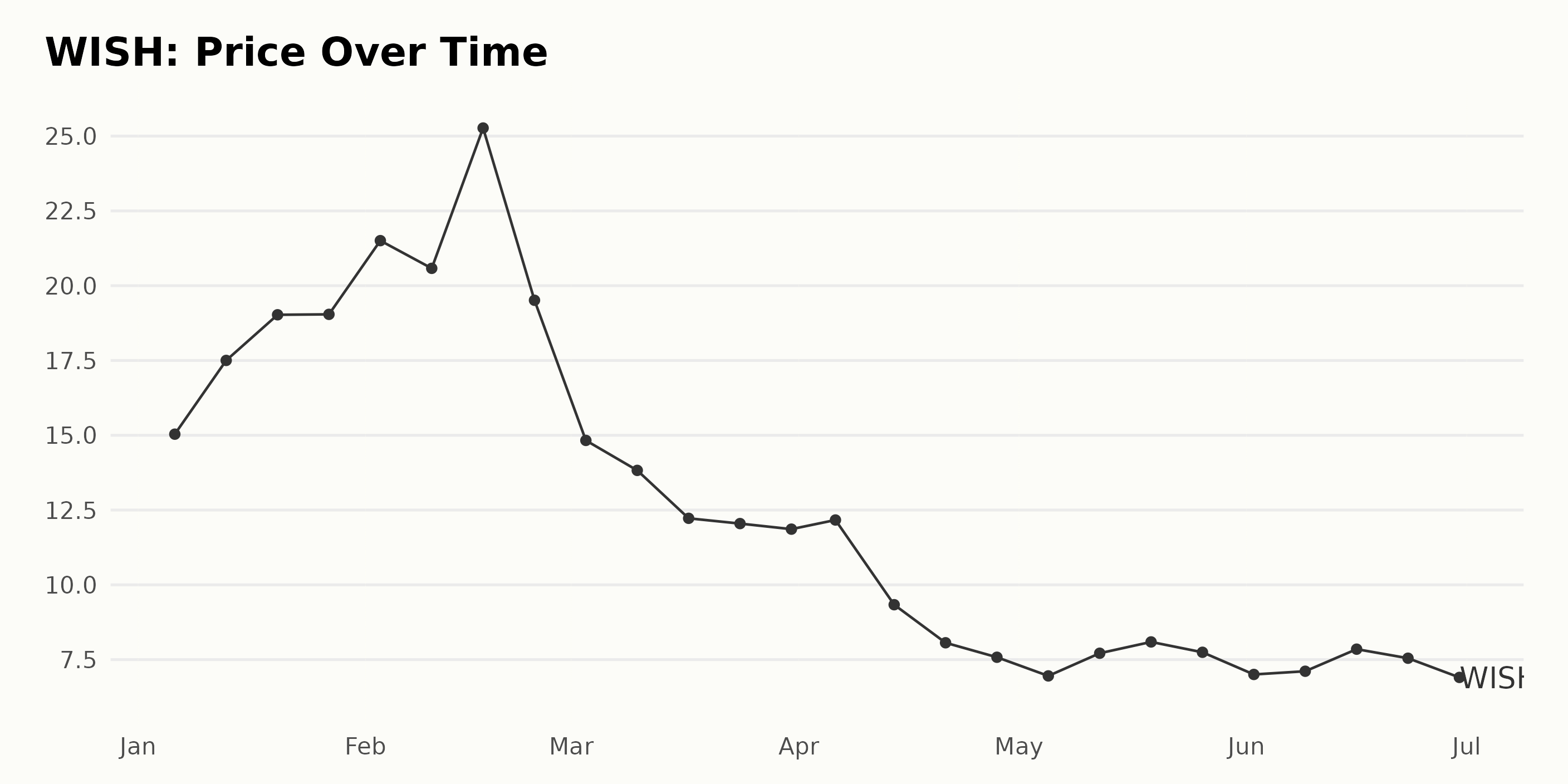

Analyzing the data provided for WISH, we can observe the following trends:

- In January 2023, the share price of WISH experienced a steady increase. It raised from $14.91 on January 6 to $19.04 on January 27. This represents a growth rate of about 27.68% over the month.

- There was a mixed trend over February as the share price peaked at $25.27 on February 17 but ended at $19.51 on February 24. The overall growth for the month was negative, at -9.6%, considering the starting price of the month ($21.51).

- March saw a steady decline in the share price, hitting a low of $11.86 on March 31 from the opening value of $14.83 on March 1. This indicates a negative growth rate of nearly 20.03%.

- April’s figures were again in decline, with the share price ending at $7.58 on April 28 from the start at $12.17 on April 6. This suggests a decelerating trend with a rate of decline of about 37.71%.

- May began with further decline reaching its lowest point at $6.96 on May 5, then recovering somewhat, fluctuating around $8 by the end of May, yielding a positive growth of 15.52% by May 26 before a small drop at the end of the month.

- June performed fairly similarly to May, with some oscillation, concluding with a share price of $6.58 on June 30 from a high of $7.85 on June 16, representing a decrease of 11.97% in two weeks' time.

The overall trend for WISH over this period is a marked deceleration. The highest price was $25.27 in February and hit a low below $7 later. However, there appear to be recovery periods, such as the later parts of May. Here is a chart of WISH’s price over the past 180 days.

Analyzing WISH’s POWR Ratings

Analyzing WISH’s POWR Ratings

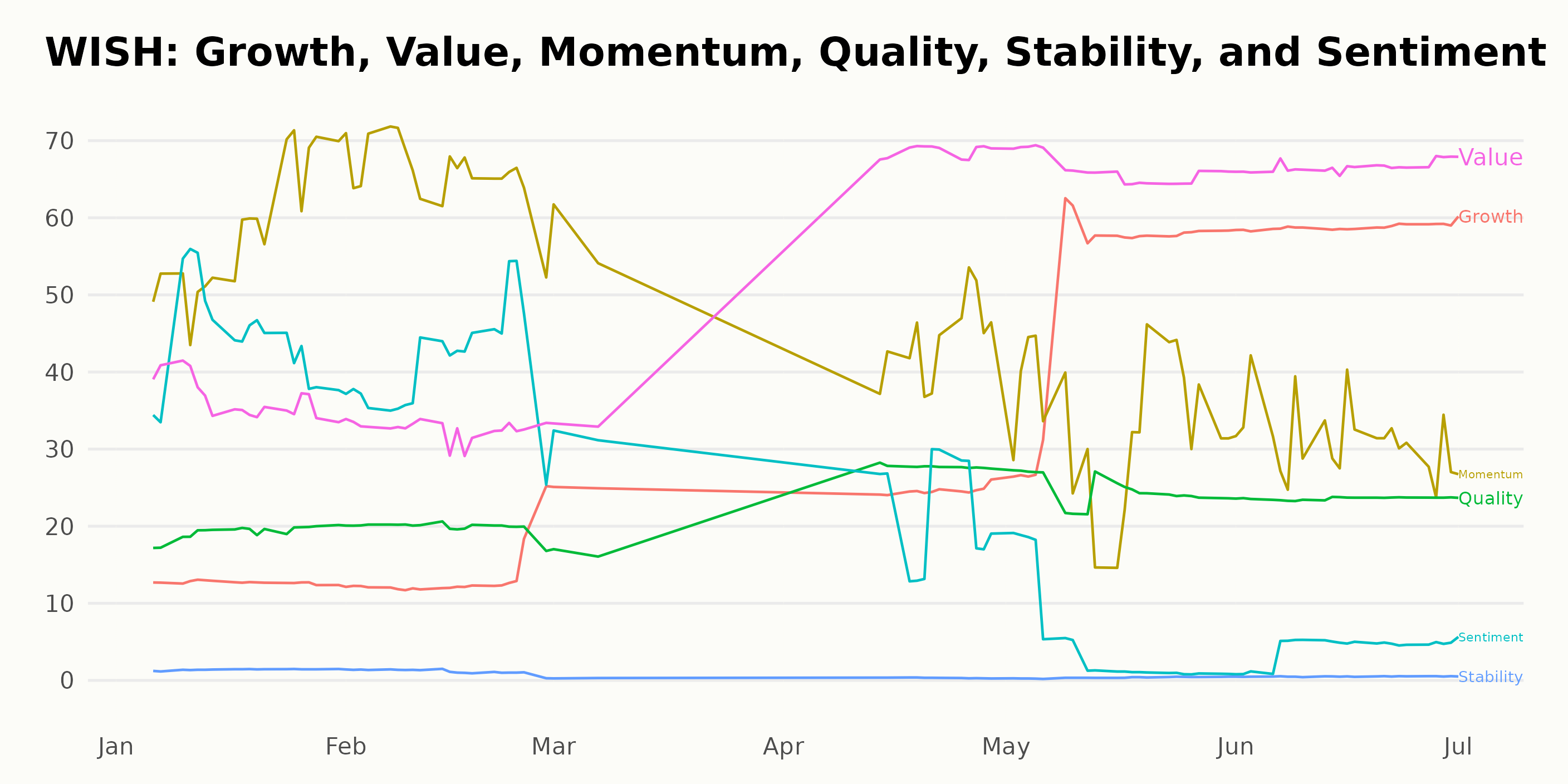

WISH has an overall D rating, translating to a Sell in our POWR Ratings system. WISH is ranked #53 out of the 58 stocks in the Internet category. It has an F grade for Stability and a D for Sentiment and Quality. Here is a summary of its progression and standing within the category over several weeks:

- WISH received an overall rating of D in January 2023, ranking between 54th and 56th in the category.

- In February 2023, WISH’s rating briefly dropped to an F, with the stock sliding to the bottom of the category at rank 57-58.

- The rating went back up to D by February 25. However, it fell back to F on March 1 and even slipped past the total category count to 59 on March 7.

- By mid-April, WISH regained a rating of D, improving its rank to #52.

- The stock maintained this D Grade throughout May, fluctuating slightly between ranks 50 and 54 in the category.

- This trend seems to have continued into June, maintaining a steady hold at the #54 position towards the end of the month.

- As of July 1, 2023, WISH has improved slightly to a rank of 53 while retaining the D rating.

Remember, a lower rank in category values denote a superior rank, meaning WISH’s performance within its category is closer to the lower end.

Stocks to Consider Instead of ContextLogic Inc. (WISH)

Stocks to Consider Instead of ContextLogic Inc. (WISH)

Other stocks in the Internet sector that may be worth considering are trivago N.V. (TRVG), Travelzoo (TZOO), and Yelp Inc. (YELP) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

WISH shares were trading at $6.73 per share on Monday afternoon, up $0.15 (+2.28%). Year-to-date, WISH has declined -54.00%, versus a 16.87% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post ContextLogic (WISH): Is it a Buy or Sell appeared first on StockNews.com