Palantir Technologies (PLTR) has become one of the most talked-about artificial intelligence (AI) stocks after delivering another blockbuster quarter. With record government contracts, surging U.S. commercial growth, and profitability metrics that few software companies can match, investors are paying attention again.

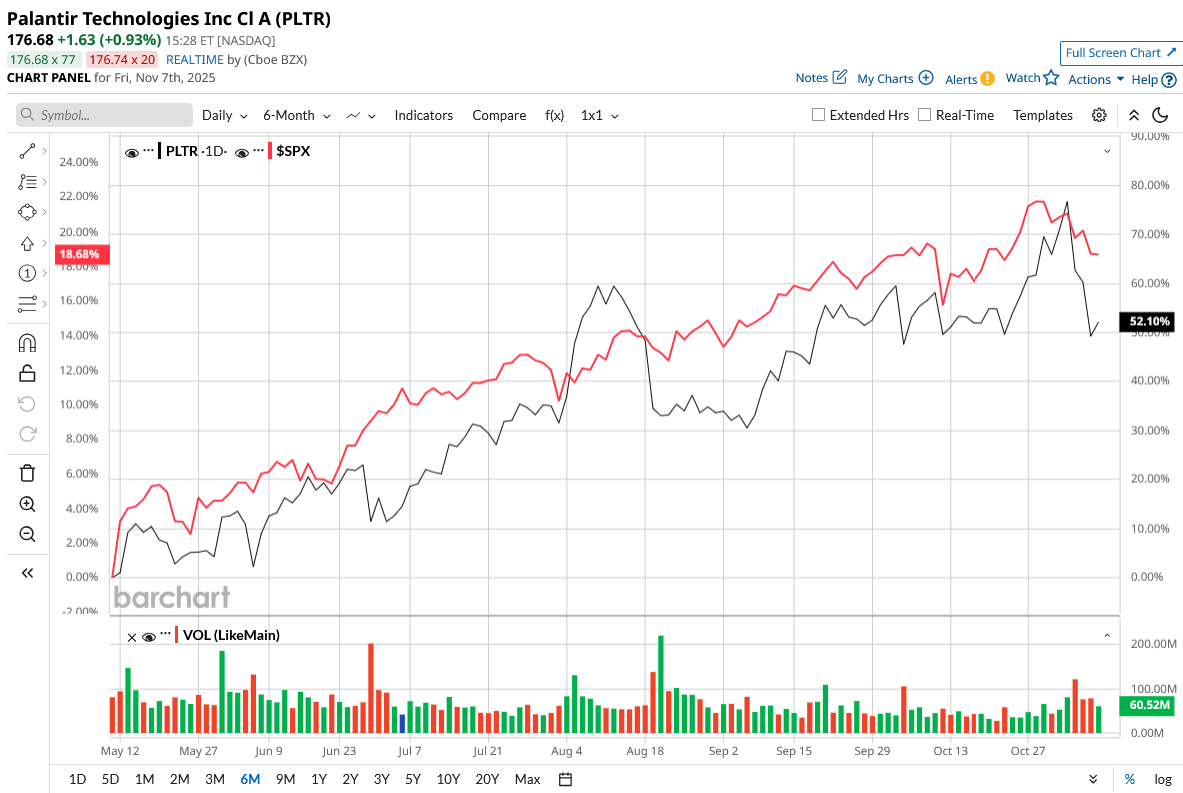

PLTR stock has soared 135% so far this year, outperforming the Magnificent Seven group. Here’s why everyone’s watching Palantir right now.

Big Contracts, Big Growth, Big Risk

Valued at $407.4 billion, Palantir builds powerful data and AI software that helps governments and companies make better decisions. Its platforms, like Foundry, Gotham, and Artificial Intelligence Platform (AIP), collect and analyze enormous volumes of data to solve complex challenges ranging from tracking military actions to boosting company efficiency.

In the third quarter, total revenue jumped 63% year-over-year (YoY) to $1.18 billion. Palantir’s government business remains its core strength, growing 52% YoY and 14% sequentially. In the U.S. alone, government revenue climbed 52% YoY to $486 million, fueled by strong execution in existing defense and intelligence programs and new contracts that reflect soaring demand for AI-driven software.

Its platforms, Foundry and AIP, continue to power mission-critical systems for the U.S. military and allied partners. The U.S. Army even issued a directive requiring all units to consolidate data operations on Vantage, a Palantir-based platform. Internationally, Palantir’s government revenue grew 66% YoY and 16% sequentially, boosted primarily by its continued work with the UK government. Overall, this public-sector performance contributed to Palantir's record-breaking total contract value (TCV) bookings of $2.8 billion, up an astonishing 151% YoY. It comprised 204 deals for more than $1 million, including 53 worth more than $10 million. The company also saw a net dollar retention rate of 134%, signaling that customers are not only staying but also spending much more on Palantir's platforms as AI usage grows globally.

However, over-reliance on government contracts has often drawn criticism, as analysts believe these contracts are restricted by budget constraints. Palantir realized the same and has been growing its commercial segment rapidly. The U.S. commercial business, now its fastest-growing division, surged 121% YoY and 29% sequentially, fueled by corporations rushing to scale AI across their operations. Palantir is not only growing rapidly, but it is also growing profitably. The company delivered an adjusted gross margin of 84%. Net income totaled $476 million, or 40% of revenue, with an adjusted earnings per share of $0.21.

Palantir generated $540 million in adjusted free cash flow in Q3 alone and crossed $2 billion in trailing twelve-month adjusted free cash flow for the first time in company history. With $6.4 billion in cash and short-term securities and an active share repurchase program, Palantir has the financial strength to continue aggressive expansion while rewarding shareholders.

Palantir's Excellent Rule of 40 Score

The standout factor in the third quarter was Palantir’s Rule of 40 score of 114, marking the company's ninth consecutive quarter of expansion. According to management, the Rule of 40, which measures the balance of growth and profitability, rarely surpasses 40% in mature software firms. Palantir's score shows its success in both increasing sales and sustaining strong profits.

CEO Alex Karp wasn’t modest about it and stated, “These are arguably the best results any software company has ever delivered.” Karp also used this opportunity to answer critics who often have questioned Palantir’s unconventional methods. He emphasized that Palantir's success is not based on hype but rather on 20 years of significant technological investment in ontology, Foundry, and AIP, which now powers the most essential operations in defense, intelligence, and enterprise sectors.

For the full year 2025, Palantir now expects a Rule of 40 score of 102%, projecting $4.4 billion in revenue, over $2.15 billion in adjusted income from operations, and up to $2.1 billion in adjusted free cash flow. Analysts who cover Palantir expect the company’s revenue to increase by 53.7% to $4.4 billion in 2025, followed by earnings growth of 76.4% to $0.72 per share. Additionally, revenue and earnings could increase by 37.7% and 35.9% in 2026, respectively. Currently, PLTR stock is trading at 178x forward 2026 earnings, compared to most tech peers. Its premium valuation reflects investors betting heavily on its long-term AI potential rather than its current profits.

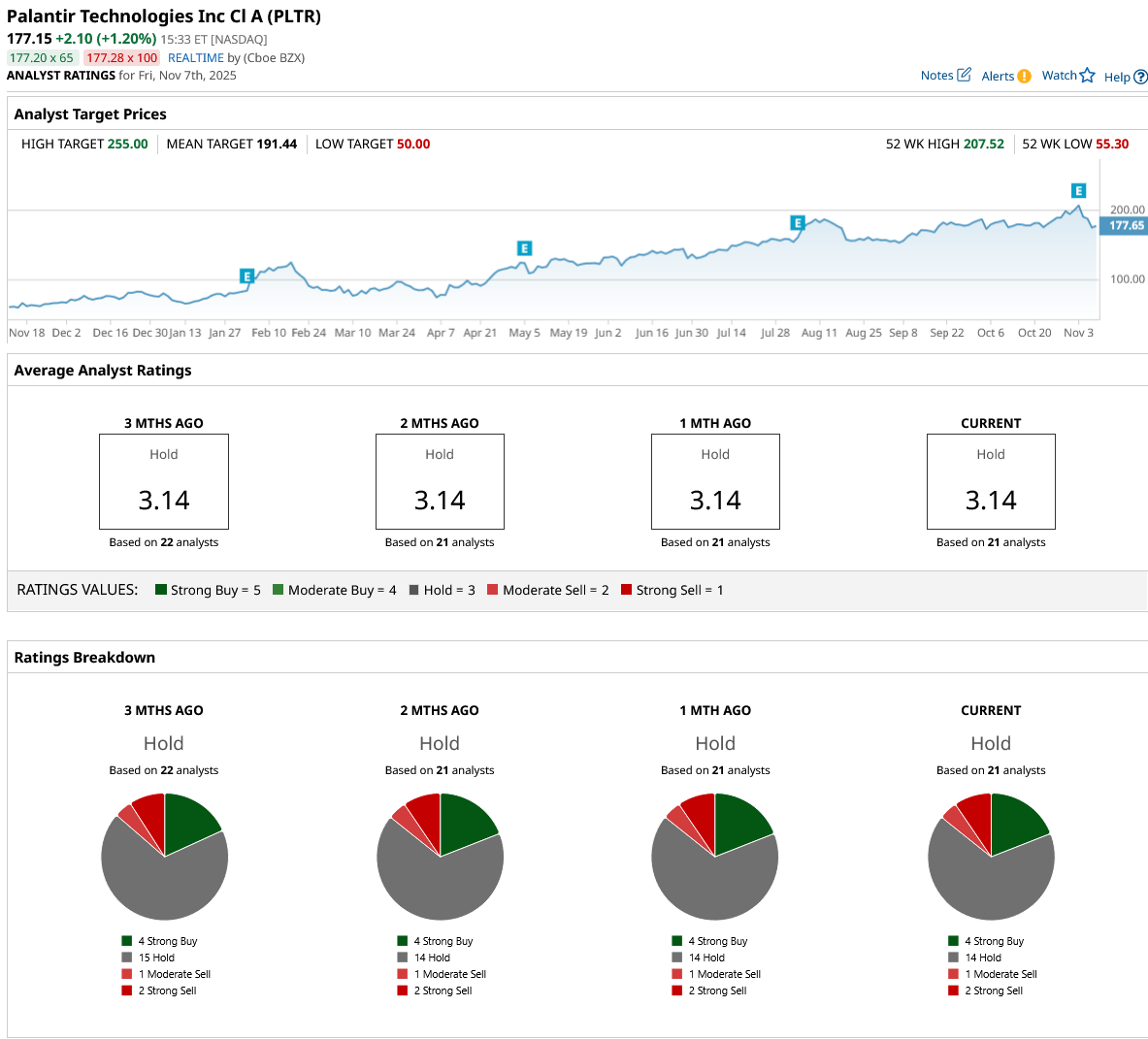

Is PLTR Stock a Buy, Hold, or Sell on Wall Street?

Wall Street remains skeptical of PLTR stock due to its sky-high valuation and rates it an overall “Hold.” Among the 21 analysts that cover the stock, four rate it a “Strong Buy,” 14 say it is a “Hold,” one rates it a “Moderate Sell,” and two say it is a “Strong Sell.” Its average target price of $191.44 suggests the stock can climb by 12% from current levels. Plus, its Street-high estimate of $255 implies the stock has upside potential of about 50% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why Is Everyone Watching Palantir Stock?

- The Saturday Spread: How the Game of Baseball Can Be Used to Effectively Trade Options

- Core Scientific Just Rejected CoreWeave’s Bid. Should You Buy CRWV Stock Here or Stay Far Away?

- This Little-Known Stock Just Got a Major Trump Boost and Analysts Think It Can Gain 95% from Here