NetApp, Inc. (NTAP), headquartered in San Jose, California, specializes in advanced cloud, on-premises, and hybrid data solutions. The company develops unified data storage hardware and software, delivering efficient management for network environments and enabling enterprises to maximize the potential of their data.

NetApp’s technology supports data-driven decision-making, cybersecurity, and scalable cloud integration, streamlining business operations and fostering innovation for organizations worldwide. The company has a market capitalization of $22.55 billion.

Volatility in enterprise software stocks, along with cautious sentiments regarding IT spending, has led to a decline in stock prices over the past year. Over the past 52 weeks, the stock has declined 9.3%. It had reached a 52-week low of $71.84 in April, but has bounced back and is now up 56.6% from that level. Based on better-than-expected results, NetApp’s shares have gained 20.4% over the past six months.

The stock’s subdued performance has broadly underperformed the S&P 500 Index ($SPX), which has gained 14% over the past 52 weeks and 20.7% over the past six months. Turning our focus to the company’s own tech sector, we see that the stock has underperformed here as well, while the Technology Select Sector SPDR Fund (XLK) is up 24.6% over the past 52 weeks and 35.8% over the past six months.

On Aug. 27, NetApp reported its first-quarter results for fiscal 2026 (the quarter that ended on July 25). The company’s net revenues increased by 1% year-over-year (YOY) to $1.56 billion, which was higher than the $1.54 billion that Wall Street analysts had expected. While its non-GAAP EPS of $1.55 was 1% lower than the prior year’s period, it was slightly higher than the $1.54 that analysts had expected.

Last month, NetApp introduced a data breach detection capability into its enterprise data storage to counter the growth in attack surfaces that artificial intelligence (AI) has enabled in a way. The cyber resilience capabilities are equipped with “AI-powered capabilities to detect early indicators of data exfiltration attempts.” The company also introduced NetApp AFX, a comprehensive enterprise-grade data platform for AI, to accelerate modern AI workloads.

For the fiscal year 2026, which ends in April 2026, Wall Street analysts expect NetApp’s EPS to grow 8.3% YOY to $6.27 on a diluted basis. Moreover, EPS is expected to increase 13.2% annually to $7.10 in fiscal 2027. The company has a solid history of surpassing consensus estimates, topping them in three of the four trailing quarters. NetApp is set to report its Q2 FY 2026 results on Nov. 25 after the market closes. Wall Street analysts expect EPS to drop 1.3% YOY to $1.51 for the quarter.

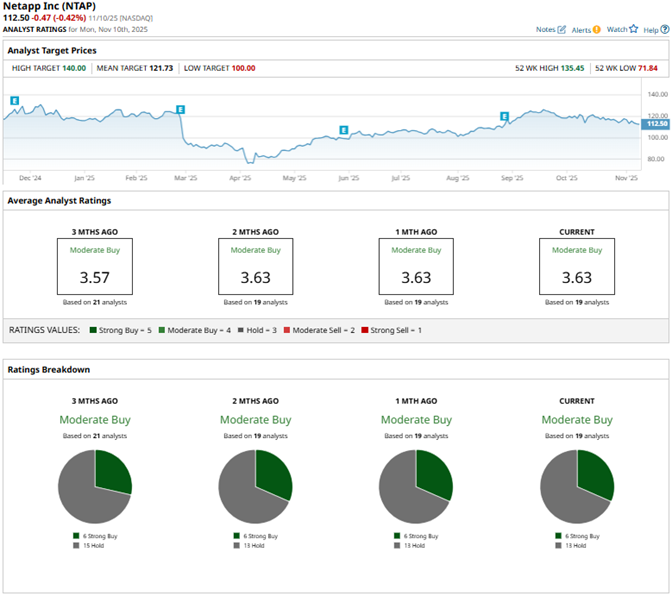

Among the 19 Wall Street analysts covering NetApp’s stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings and 13 “Holds.” The ratings configuration has remained the same over the past two months.

Last month, analysts at Citigroup maintained a “Neutral” rating on NetApp’s stock, while raising the price target from $115 to $130. Citigroup analysts expect investor sentiment to improve for storage due to the demand surrounding inference-led AI.

NetApp’s mean price target of $121.73 indicates an 8.2% upside over current market prices. The Street-high price target of $140 implies a potential upside of 24.4%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart