It’s striking how quickly the gears of artificial intelligence (AI) have shifted. In just a couple of years, AI has gone from reading text and images to reading the room. The pace has only accelerated as mega-cap rivals are now pouring billions into infrastructure built to shape the next wave of intelligent services.

In the middle of this high-stakes race stands Alphabet (GOOG) (GOOGL), which has now stepped forward with Gemini 3, its latest AI model designed to deliver sharper, more intuitive answers “so you get what you need with less prompting,” as CEO Sundar Pichai put it.

The debut lands eight months after Gemini 2.5 and 11 months after Gemini 2.0. With 650 million monthly app users and 2 billion monthly users engaging with AI Overviews, its momentum is picking up. By comparison, OpenAI reported in August that ChatGPT reached 700 million weekly users.

Given the accelerating and competitive landscape, let us explore what stance to keep for GOOGL stock.

About Alphabet Stock

Headquartered in Mountain View, California, Alphabet builds technology that seamlessly connects people to information, services, and digital tools. Its ecosystem powers global search, YouTube, Android, Chrome, and Google Cloud, while its AI models, advertising platforms, and consumer services, including Maps, Gmail, and Workspace, form the backbone of daily digital life.

With a market cap brushing $3.5 trillion, the company’s investments also extend into autonomous driving through Waymo, health tech innovations, and advanced computing.

GOOGL’s market performance mirrors the broad reach. Shares of GOOGL have surged 66% over the past 52 weeks, significantly outpacing the tech-heavy Nasdaq Composite ($NASX), which posted a 19% gain, and outperforming the Roundhill Magnificent Seven ETF (MAGS), which advanced 23% over the same period.

Moreover, the stock set a fresh 52-week high of $303.81 today, Nov. 19, rising 3.1% intraday after legendary investor Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) invested $4.3 billion to acquire 17.8 million GOOGL shares.

Valuation metrics further underscore GOOGL's market positioning. The stock trades at 27.20 times forward adjusted earnings and 8.60 times sales, indicating a premium to the industry averages. It indicates that investors are willing to pay for the company's dominant position and growth potential.

Alphabet also rewards shareholders with consistent dividends, paying an annual $0.84 per share, yielding 0.29%. The most recent quarterly payout of $0.21 per share is scheduled for Dec. 15 to shareholders of record on Dec. 8.

Alphabet Surpasses Q3 Earnings

On Oct. 29, GOOGL shares rose 2.7% as the company reported Q3 fiscal year 2025 earnings in which revenue grew 15.9% year-over-year (YoY) to $102.4 billion, surpassing the Street’s $99.9 billion forecast. The growth marked the first quarter in the company’s history to exceed $100 billion.

Google Services revenue increased 13.8% to $87.1 billion, driven by robust performance across Google Search & other, Google subscriptions, platforms, devices, and YouTube ads. Alphabet now has over 300 million paid subscriptions, led by Google One and YouTube Premium.

Google Cloud emerged as a standout, posting a 33.5% increase to $15.2 billion, fueled by strong growth in Google Cloud Platform (GCP), AI Infrastructure, and Generative AI Solutions. Google Cloud’s momentum remained strong, ending the quarter with a $155 billion backlog.

Total operating income rose 9.5% YoY to $31.2 billion, with operating margins holding at a healthy 31%. Net income climbed 33% to $35 billion, while EPS increased 35.4% to $2.87, comfortably topping analyst estimates of $2.26.

The company’s expansion into new businesses continues to accelerate. Through Q3 2025, it signed more deals exceeding $1 billion than in the previous two years combined.

With robust growth across core operations and escalating Cloud demand, Alphabet now anticipates capital expenditures for 2025 to range between $91 billion and $93 billion, underscoring its commitment to infrastructure and innovation.

Analysts maintain a broadly positive outlook for Alphabet as well. They project Q4 EPS to rise 19.5% YoY to $2.57. The full fiscal year 2025 bottom line is expected to climb 30.4% to $10.48. Meanwhile, fiscal year 2026 is projected to extend the upward trajectory, with EPS forecasted to advance 4.2% to $10.92.

What Do Analysts Expect for GOOGL Stock?

Bank of America Securities analyst Justin Post has reaffirmed his “Buy” rating on GOOGL with a $335 price target, citing the company’s strong growth trajectory in AI and cloud services as key drivers of long-term value.

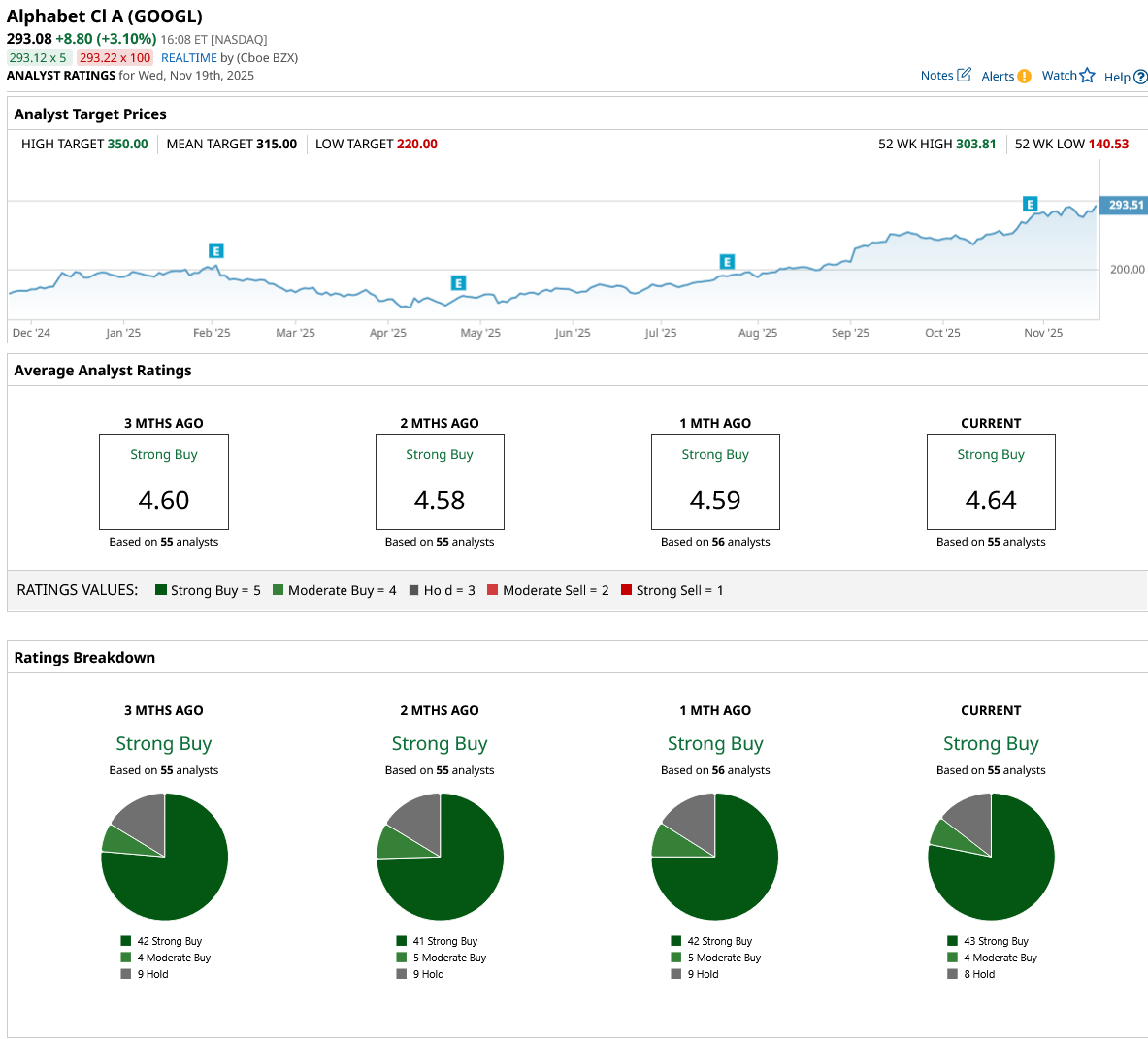

His bullish outlook mirrors the broader analytical consensus, which remains overwhelmingly positive with an overall rating of “Strong Buy.” Among 55 analysts covering the stock, 43 recommend “Strong Buy,” four recommend “Moderate Buy,” and eight suggest “Hold.”

GOOGL’s average price target of $315 represents potential upside of 8%. Meanwhile, the Street-high target of $350 suggests a potential gain of 23.1% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is GOOGL Stock a Buy, Sell, or Hold as Google Launches Gemini 3?

- Elliott Management Is Betting Big on This Dividend-Paying Gold Stock. Should You Buy Shares Now?

- This Leading Gene-Editing Stock Could Be Going Private. Should You Buy Its Shares First?

- Small-Cap Stocks Are Sounding a Very Scary Alarm. Here’s How to Protect Yourself… and Even Profit.