The global cell therapy market was valued at $5.88 billion in 2024 and is on track to hit $44.39 billion by 2034, expanding at a striking 22.69% CAGR. Researchers credit this explosive growth to record investments in R&D and rapid-fire breakthroughs in biotechnology. In little more than a decade, gene editing has evolved from a Nobel Prize-winning discovery into a commercial force unlocking new hope for tough-to-treat diseases.

CRISPR Therapeutics has become a key name in this revolution, earning a historic first FDA approval for a CRISPR-based therapy and steadily expanding its scientific reach. Now, with its ex vivo and in vivo breakthroughs attracting headlines, CRSP stock is the subject of serious market whispers. Talk of a potential takeover has sent shares rallying, as investors bet on just how pivotal this moment could be.

Could today’s buyers catch a rare break if CRISPR Therapeutics goes private, or will the story take another twist? Let’s find out what CRISPR has to offer.

CRISPR Therapeutics’ Financials

CRISPR Therapeutics AG (CRSP), with a market capitalization of $5.27 billion, advances next-generation gene-editing therapies for genetic, cardiovascular, and autoimmune diseases. Its shares are at $53.47 for Nov. 18, up 30% year-to-date (YTD) and 9% over the last 52 weeks.

This value dwarfs the sector’s price/sales (P/S) ratio at 134.16x compared to a 3.86x median and holds a price/book (P/B) of 2.49x versus 2.80x, presenting a premium on projected future growth.

The company’s most recent earnings report, released on Nov. 10, gives a full view of its financial health. The company reported a Q3 loss per share of $1.17, surpassing consensus estimates by $0.15 and producing a positive earnings surprise of 11.36%.

It begins with a strong cash position, as cash, cash equivalents, and marketable securities stood at $1.94 billion as of Sept. 30, a slight rise from $1.90 billion at the end of 2024. That boost came mainly from financings such as new share issuances and option exercises, along with stronger interest income. The gain, however, was offset by ongoing operating expenses and a significant $25 million upfront payment tied to the Sirius Agreement, which is part of the company’s push into next-generation RNA therapeutics.

CRISPR’s third quarter saw R&D spending at $58.9 million, down sharply from $82.2 million last year due to less external research, streamlined manufacturing, and lower employee expenses. The company insists this reflects tightening efficiency without sacrificing forward progress. General and administrative expenses stayed steady at $16.9 million, a touch lower than last year’s $17.4 million. It’s a sign CRISPR is managing its administrative overhead while continuing to scale.

Meanwhile, net loss for Q3 reached $106.4 million, up from $85.9 million last year. This jump encapsulates the nature of building out a deep, late-stage pipeline and investing in partnerships meant to secure long-term commercial gains. That performance contributes to the current takeover speculation swirling around the stock.

CRISPR’s Landmark Therapies Propel Sector Leadership

CRISPR Therapeutics AG secured the world’s first approval for a CRISPR-based gene therapy in partnership with Vertex Pharmaceuticals (VRTX). That landmark was achieved with Casgevy, an ex vivo therapy for sickle cell and beta thalassemia. The company didn’t stop there. Following the launch, it redirected attention to in vivo candidates, steadily advancing in cardiovascular and autoimmune spaces.

Reports now show CRISPR is pushing multiple late-stage programs with ambitious clinical targets. Casgevy’s success isn’t just a headline. The product’s impact was felt throughout 2025 as industry analysts tracked how real-world adoption might accelerate future revenues. CRISPR’s aggressive pipeline expansion is matched by calculated strategic collaborations.

The partnership with Sirius Therapeutics opens up RNA interference therapies for the company. In particular, their SRSD107 candidate targets thromboembolic disorders through a novel approach intended to elevate patient compliance and boost safety. It’s an inventive move for CRISPR’s portfolio and speaks to their broader strategy of diversifying cutting-edge treatments.

Wall Street’s Bullish Bets and Next Moves

The next earnings release for CRISPR Therapeutics is set for Feb. 10, 2026. Analysts expect an average loss of $1.16 for the current quarter ending December 2025, with projections matching that for the following quarter in March 2026. The current quarter should see an estimated year-over-year (YoY) decline of -163.64%, while the full-year 2025 estimate calls for a -24.19% decline. However, 2026 is expected to bounce back with +23.19% growth. These numbers show a steady march toward lower annual losses.

This bullish perspective is echoed by individual analysts tracking CRISPR’s performance closely. Citizens JMP’s Silvan Tuerkcan, a well-known healthcare analyst, recently affirmed a “Buy” rating and set his price target at $86. Also, Truist Financial’s Joon Lee also reiterated a “Buy” on the stock, adding further weight to the positive consensus.

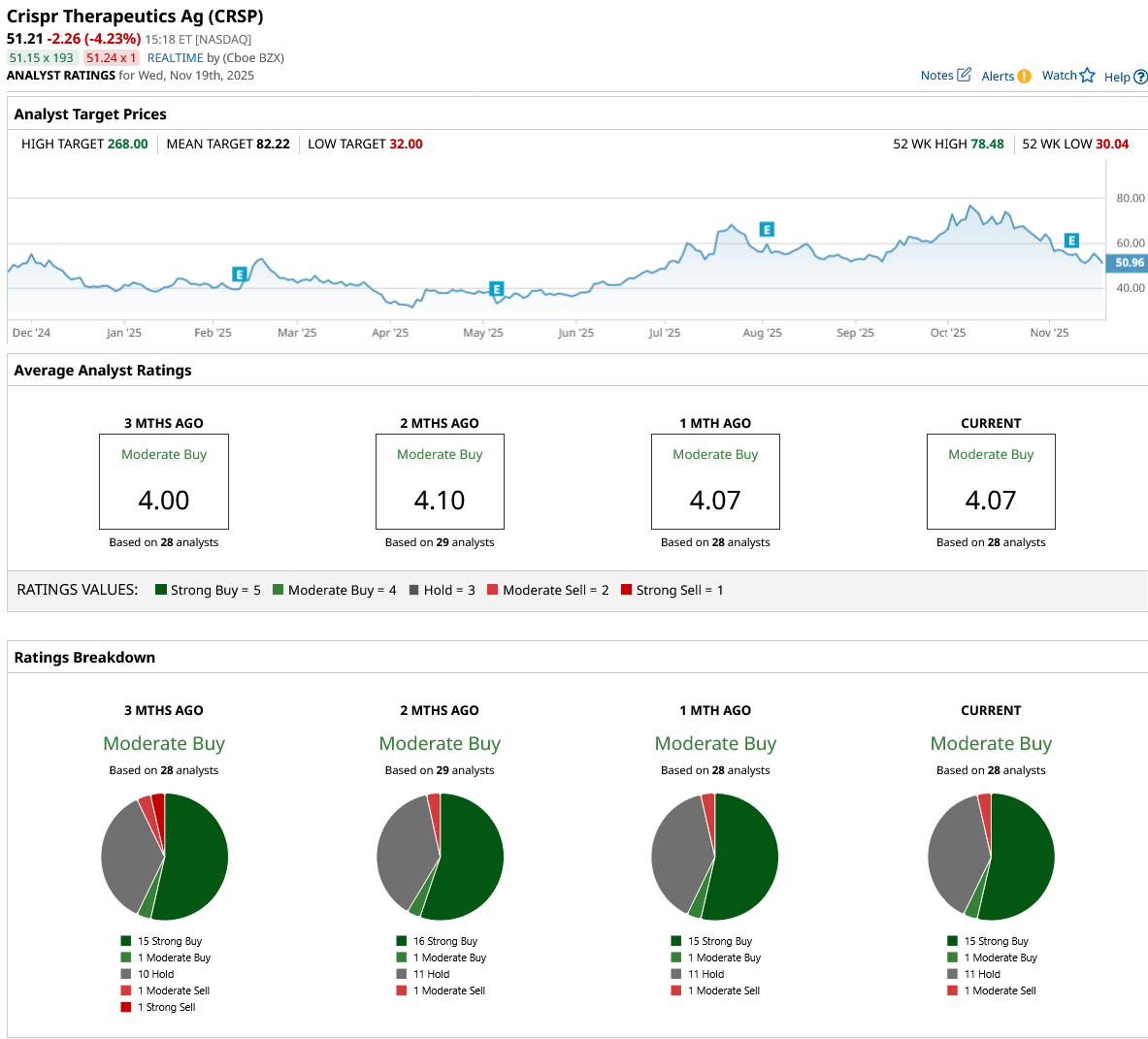

Taking this into account, analysts are remarkably optimistic about CRSP’s prospects. Of the 28 surveyed, there’s a consensus “Moderate Buy” rating. This optimism is reflected in the numbers. The average price target stands at $82.22, suggesting a potential upside of 61% from the current price.

Conclusion

Long story short, CRISPR Therapeutics has the numbers, innovation, and analyst backing to drive its stock higher. Especially if takeover talk turns real. This shift could send investor sentiment soaring, since buyout premiums and scarcity tend to drive shares even higher. Buying ahead of potential privatization seems like a smart move for investors who want in before the next chapter unfolds.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is GOOGL Stock a Buy, Sell, or Hold as Google Launches Gemini 3?

- Elliott Management Is Betting Big on This Dividend-Paying Gold Stock. Should You Buy Shares Now?

- This Leading Gene-Editing Stock Could Be Going Private. Should You Buy Its Shares First?

- Small-Cap Stocks Are Sounding a Very Scary Alarm. Here’s How to Protect Yourself… and Even Profit.