Nvidia (NVDA) shares closed lower on Nov. 20 amid a broader rout in tech stocks driven by artificial intelligence (AI) bubble concerns and expectations of higher-for-longer interest rates.

The semiconductor giant reported another blockbuster quarter and issued solid guidance for its Q4 this week, explicitly calling these concerns “overblown” on the earnings call.

Still, Nvidia stock is losing steam, now hovering below its 100-day moving average (MA) at the $180 level. Failure to close above this support may accelerate bearish momentum in the days ahead.

BofA Explains Why Nvidia Stock Remains Worth Owning

Bank of America’s senior analyst Vivek Arya expects the recent pressure on NVDA shares to prove temporary only.

According to him, the chipmaker remains a “top pick” heading into 2026 as “AI demand continues to strengthen – and supply is being well-managed.”

The artificial intelligence stock is currently trading at 42x forward earnings, which Arya dubbed “compelling given potential for 40%+ EPS growth rates” in his research report.

BofA maintains a “Buy” rating on Nvidia with a price target of $275, signaling potential upside of more than 50% from here.

Supply-Demand Dynamics Warrant Buying the Dip in NVDA Shares

The supply-demand dynamics also suggest Nvidia shares are worth owning on the pullback.

In a recent interview with CNBC, renowned Wedbush analyst Dan Ives said for every chip produced, Nvidia has 12 buyers lined up, adding “the Street is underestimating demand by up to 30%.”

This 1-to-12 supply-demand ratio reinforces that AI is not a bubble since supply tends to overshoot demand in bubble scenarios. For Nvidia, however, supply is being the bottleneck instead.

NVDA stock remains attractive also because its margins stand at about 73% currently, well above 60% that many view as the “holy grail” for tech companies.

Historically, the AI stock has delivered nearly 8% in November, which further adds to the overall investment thesis for Nvidia as a long-term winner in artificial intelligence infrastructure.

What’s the Consensus Rating on Nvidia Heading into 2026?

The ongoing selloff in Nvidia stock hasn’t deterred other Wall Street analysts either.

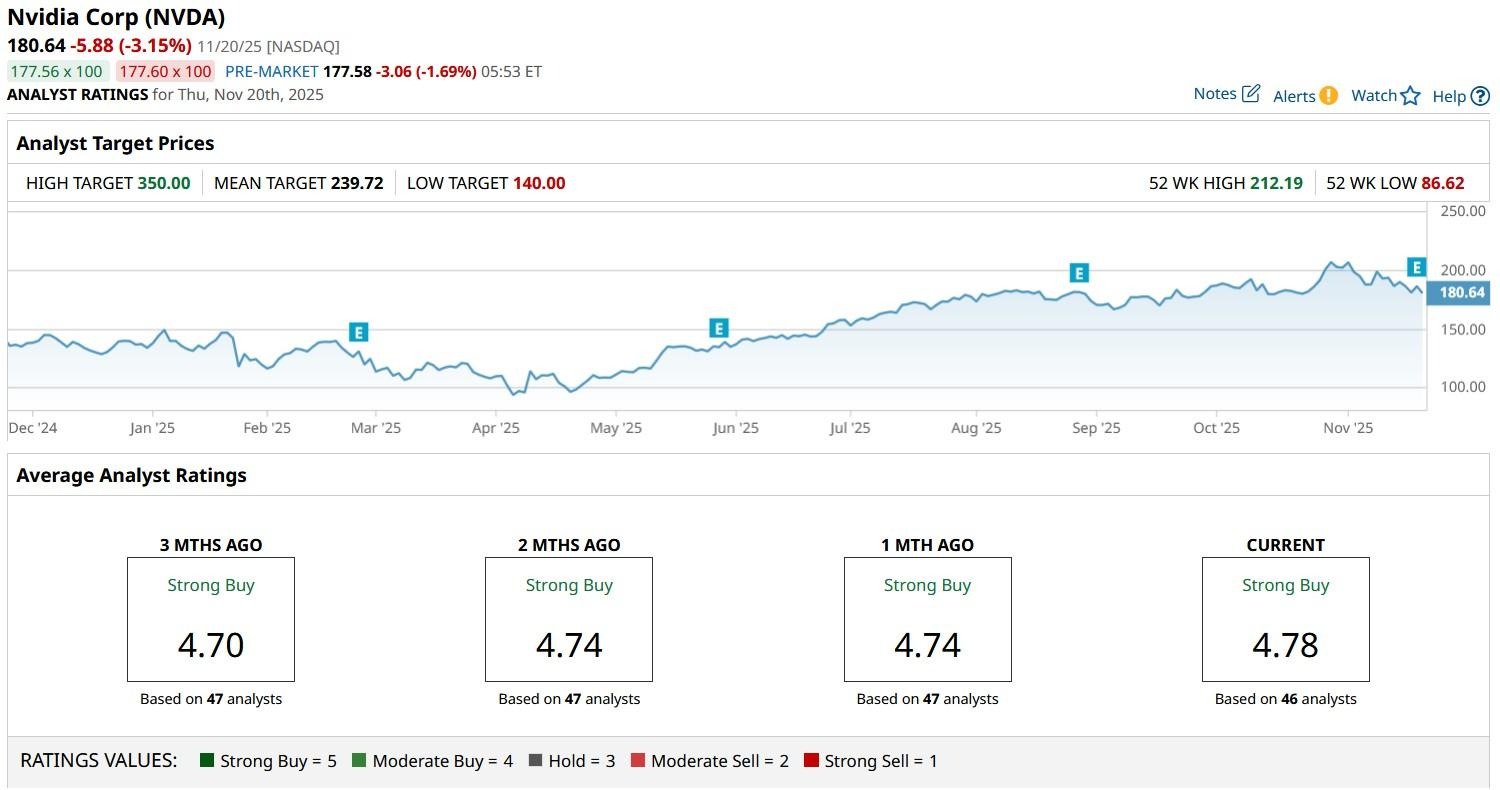

The consensus rating on NVDA shares remains at “Strong Buy” with the mean target of about $240 indicating potential upside of more than 33% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart