Last week, Disney (DIS) announced its fiscal Q4 2025 earnings, which were a mixed bag and led to a selloff in the stock. One of the key highlights of the report was the 50% hike in its dividend, following which the company will pay an annual dividend of $1.50 in the current fiscal year.

Disney increased its dividends by 33% in December 2024, also. Since reinstating its dividends in late 2023, its semi-annual dividends have risen from $0.30 to $0.75 – a 1.5-fold increase. On the face of it, the hike looks quite astonishing, but should you buy Disney for its dividends? Let’s explore.

Disney Dividend History: The 50% Hike Is No “Magic”

Disney’s dividend hike is actually not as “magical” as it seems. The company suspended its dividends in 2020, like many other companies, and restored them only in late 2023. The three-year suspension was, however, much longer than other companies like Ford (F) and General Motors (GM), which resumed their dividends much sooner.

Disney began with a semi-annual dividend of $0.30, which was much lower than the pre-pandemic levels. The baby step toward dividend restoration was understandable as the company was still recovering from the COVID-19 pandemic, and its streaming business was losing a lot of money. However, despite the 1.5X rise since 2023, the payout is below the $0.88 semi-annual dividend that the company paid before the COVID-19 pandemic.

Secondly, even after the generous hike, Disney’s forward dividend yield is just about 1.42% which is not much different from the average S&P 500 Index ($SPX) peer. Finally, I won’t list Disney as a reliable dividend stock considering the elongated period it took to restore its dividends. Unlike high dividend payers, which typically include the likes of utilities, midstream companies, and REITs, dividends are a side story at best for Disney, and investors should expect the bulk of returns from capital appreciation, something the stock has failed to do for the last few years.

DIS Has Been a Terrible Underperformer

Disney has been a terrible underperformer and has fallen over 6% in the last 10 years, losing a lot of wealth for investors both on an absolute as well as relative basis, considering the over 3-fold rise in the S&P 500 Index over the period. The stock is in the red in 2025 also and is on track to underperform the S&P 500 Index this year—something it did in three of the last four years.

Notably, amid a sagging stock price and burgeoning streaming losses, which peaked at almost $1.5 billion in the final quarter of fiscal year 2023, Disney brought back Bob Iger as the CEO. The stock did jump following the announcement, but has underperformed under Iger’s watch despite the visible results, particularly in streaming, which posted an operating income of $1.3 billion in the last fiscal year.

However, the decline in Linear TV earnings has offset the gains made by Disney’s streaming segment. The company also got engulfed in some needless controversies, leading to boycott calls and more. Disney’s woes are not lost on the markets, and the stock’s valuations have plummeted. It now trades at a forward price-earnings (P/E) multiple of 16.2x, which is below the broader market.

Disney Stock Forecast

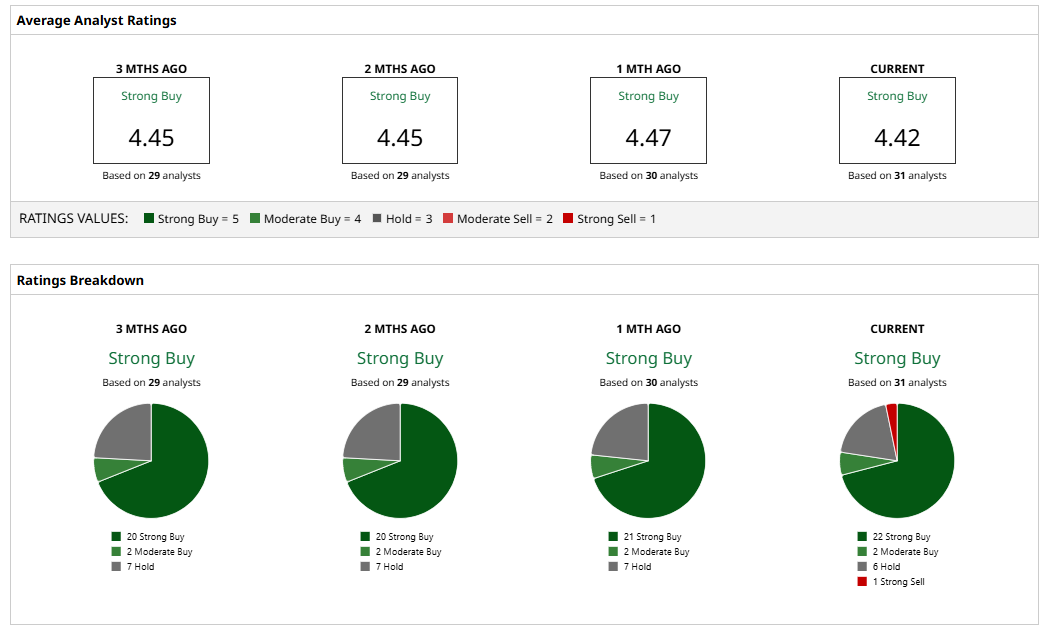

Disney has received a “Strong Buy” or “Moderate Buy” rating from 24 of the 31 analysts tracked by Barchart. One analyst rates DIS as a “Strong Sell” and the remaining 6 as a “Hold” or some equivalent. The stock’s mean target price is $133.73, which is over 25% higher than the current price levels.

Disney Stock Is a Buy, But Not for the 50% Dividend Hike

I remain bullish on Disney due to tepid valuations and expectations of double-digit earnings growth over the next couple of years. The company has addressed the issue of streaming losses and made improvements to its Parks, which are the key driver of its profitability. The box office performance has been patchy over the last couple of years, but the company has a strong release slate for the next year, which should help buoy sentiment.

The 50% dividend hike does not really change my investment thesis for Disney, and I would have preferred the company to have spent more on buybacks. Disney did double its share buyback program for the current fiscal year to $7 billion, which makes perfect sense given the depressed levels the stock trades at. Overall, I believe the dividend hike is just the cherry on top as Disney looks set for a rerating next year. The stock would, however, still not make sense for investors seeking a dividend stock, given the low yields.

On the date of publication, Mohit Oberoi had a position in: DIS , F , GM . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Stock’s Dividend Has Risen 1.5X in 2 Years. Is It a Buy Here?

- Wall Street Sees a ‘Buying Opportunity’ in This Rare Earths Stock. Should You Snap Up Shares Now?

- Billionaire Gina Rinehart Is Now the Top Investor in MP Materials. Should You Follow the Money and Buy MP Stock Too?

- Can Nvidia Stock Test Wall Street’s Price Target of $350?