Fremont, California-based Lam Research Corporation (LRCX) is a leading supplier of semiconductor manufacturing equipment and services. Valued at a market cap of $194.9 billion, the company’s solutions play a crucial role in enabling advanced logic, memory, and 3D semiconductor architectures across nodes used in data centers, AI, mobile devices, and automotive electronics.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and LRCX fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the semiconductor equipment & materials industry. With deep industry partnerships, a strong focus on innovation, and exposure to long-term growth drivers like AI and cloud computing, Lam Research remains a key player in the semiconductor equipment supply chain.

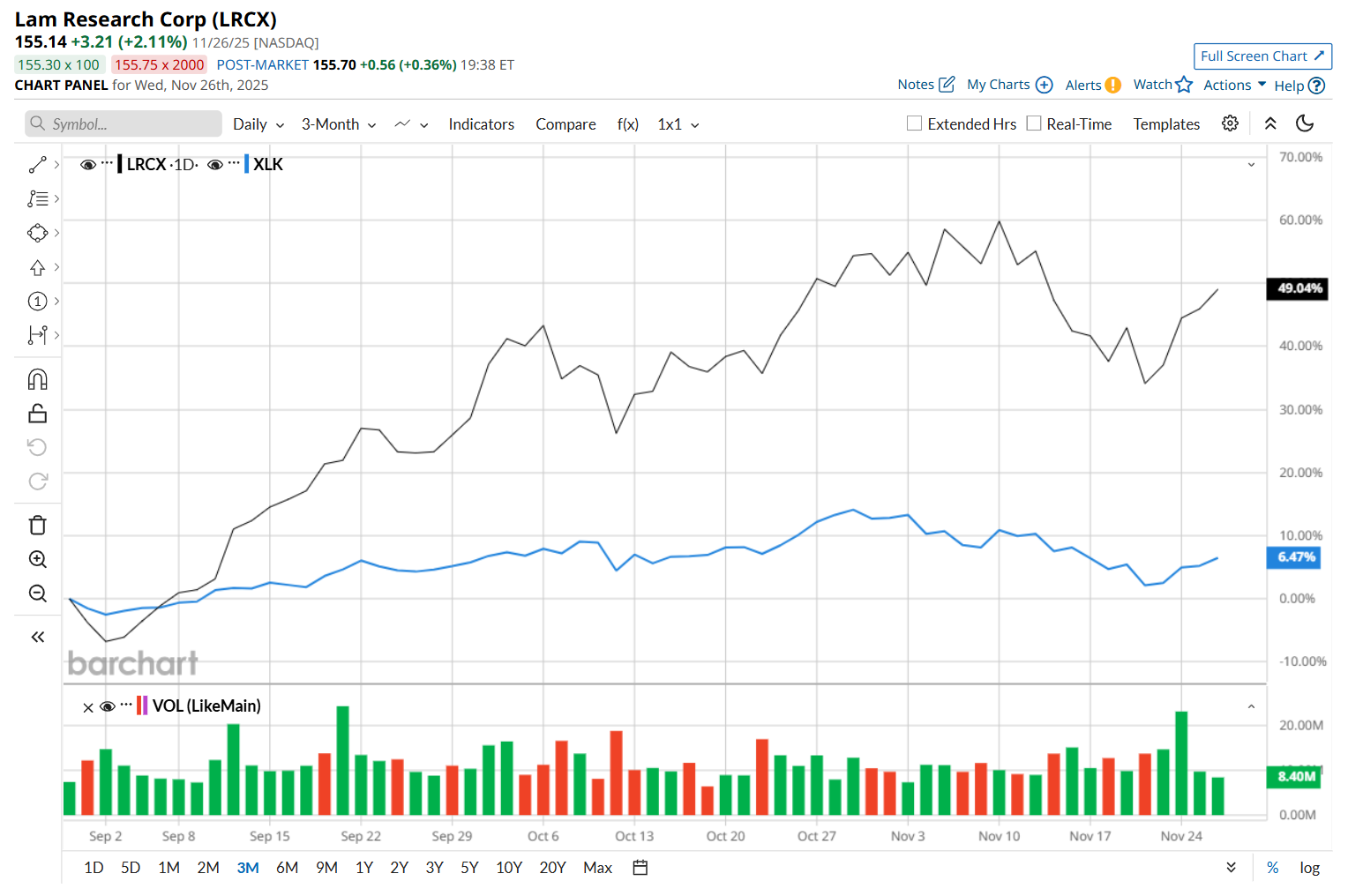

This tech giant is currently trading 7.2% below its 52-week high of $167.15, reached on Nov. 10. Shares of LRCX have rallied 49.7% over the past three months, considerably outpacing the Technology Select Sector SPDR Fund’s (XLK) 7.9% return during the same time frame.

Moreover, on a YTD basis, shares of LRCX are up 114.8%, compared to XLK’s 22.1% rise. In the longer term, Lam Research has soared 113.4% over the past 52 weeks, significantly outperforming XLK’s 20.9% uptick over the same time frame.

To confirm its bullish trend, LRCX has been trading above its 200-day and 50-day moving averages since early May, with slight fluctuations.

On Oct. 22, shares of LRCX dipped 2.6% after its Q1 earnings release, despite delivering a better-than-expected performance. Due to strong growth in systems revenue, the company’s total revenue improved 27.7% year-over-year to $5.3 billion, surpassing consensus estimates by 1.9%. Moreover, its adjusted EPS of $1.26 also came in 4.1% ahead of analyst expectations. However, its bottom line declined 5.3% from the last quarter, which might have made investors jittery. Nonetheless, its stock rebounded and surged by 4.5% in the following trading session.

LRCX has also considerably outpaced its rival, Applied Materials, Inc. (AMAT), which soared 44.3% over the past 52 weeks and 53.7% on a YTD basis.

Given LRCX’s recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 31 analysts covering it, and the mean price target of $162.78 suggests a 4.9% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘Insatiable’ Demand Is Powering This ‘Picks and Shovels’ AI Stock up 245%. Should You Buy It Here?

- Using Probability Density to Extract a Huge Payout from Microchip’s Potential Breakout

- Dear UnitedHealth Stock Fans, Mark Your Calendars for January 30

- As Founder Ray Dalio Warns the Market Is in a Bubble, Bridgewater Associates Just Bought CoreWeave Stock