Pittsburgh, Pennsylvania-based EQT Corporation (EQT) explores and produces natural gas, with a primary focus on the Appalachian Basin in Ohio, Pennsylvania, and West Virginia. Valued at $33.4 billion by market cap, EQT sells natural gas and natural gas liquids to marketers, utilities, and industrial customers through its pipelines.

The energy giant has significantly outperformed the broader market over the past year. EQT stock prices have soared 16.2% in 2025 and 38.9% over the past 52 weeks, marginally lagging behind the S&P 500 Index’s ($SPX) 16.3% gains in 2025, while substantially outpacing SPX’s 17.7% returns over the past year.

Narrowing the focus, EQT has also outperformed the sector-focused Energy Select Sector SPDR Fund’s (XLE) 2.9% gains in 2025 and a marginal 10 bps uptick over the past 52 weeks.

Despite delivering better-than-expected results, EQT stock prices dropped nearly 4% in the trading session following the release of Q3 results on Oct. 21. During the quarter, the company’s sales volumes increased 9.1% year-over-year to 634.4 Bcfe, coming in at the high end of management’s guidance. Further, its average sales prices soared 39.7% year-over-year to $2.64 per Mcfe. Overall, the company’s topline soared 52.3% year-over-year to $1.96 billion, beating the consensus estimates by a notable margin. Meanwhile, its adjusted EPS skyrocketed 225% year-over-year to $0.52, surpassing the Street’s expectations by 10.6%. Following the initial dip, EQT stock prices remained in the green for three subsequent trading sessions.

For the full fiscal 2025, ending in December, analysts expect EQT to deliver an adjusted EPS of $2.84, up 76.4% year-over-year. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

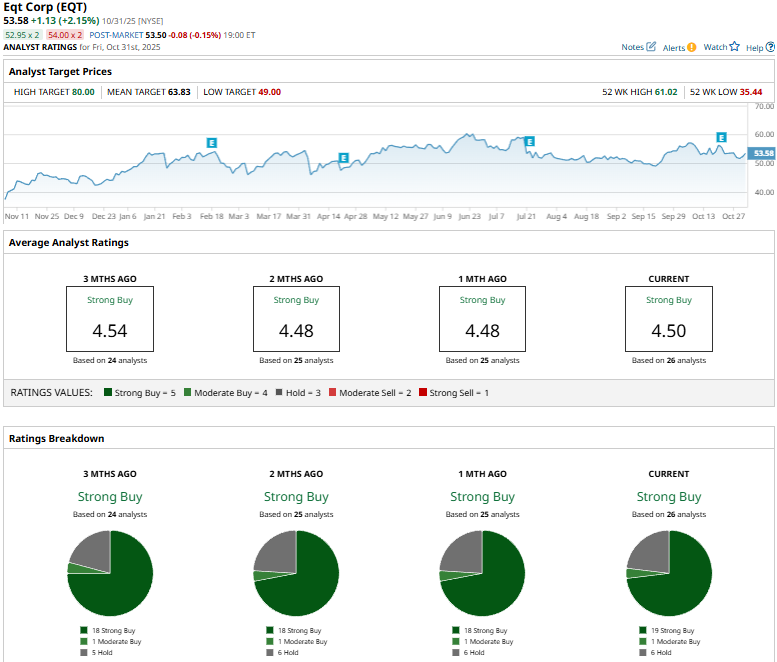

Among the 26 analysts covering the EQT stock, the consensus rating is a “Strong Buy.” That’s based on 19 “Strong Buys,” one “Moderate Buy,” and six “Holds.”

This configuration is slightly more bullish than a month ago, when 18 analysts gave “Strong Buy” recommendations.

On Oct. 23, Wells Fargo (WFC) analyst Sam Margolin reiterated an “Overweight” rating on EQT, but reduced the price target from $68 to $66.

EQT’s mean price target of $63.83 suggests a 19.1% upside potential. Meanwhile, the street-high target of $80 represents a notable 49.3% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart