A new research note from Wells Fargo reveals that “power” is among the hottest buzzwords in third-quarter earnings calls so far, with mentions of “power,” “electricity,” or “energy” surging by more than 100% year-over-year among S&P 500 Index ($SPX) members, according to the firm. As hyperscalers scramble to secure power supplies for their ambitious data center projects, Wells Fargo writes, “Power remains our preferred way to play the AI capex cycle.”

The AI Power Trade

It’s an investing narrative that Barchart’s own Senior Market Strategist, John Rowland, CMT, has been following closely for a while now. From the energy storage demand that’s driving battery stocks higher to the nuclear energy renaissance that’s boosting the joint venture between GE Vernova (GEV) and Hitachi (HTHIY), Rowland has been right on top of this “behind the meter” trade – down to the last copper wire.

And as valuation concerns spark a pullback among the front-runners of the artificial intelligence (AI) trade this week – including hardware leader Nvidia (NVDA) and hypergrowth software stock Palantir (PLTR) – it’s worth considering a broader look at the “AI industrial complex” for investing ideas that aren’t quite so crowded.

What’s Driving Solar Stocks?

While the resurgence of nuclear energy has grabbed a lot of headlines, alongside expectations for strong data center-driven natural gas demand, it’s worth pointing out that all of the “Big 4” hyperscalers – Amazon (AMZN), Google (GOOG) (GOOGL), Meta (META), and Microsoft (MSFT) – have also signed power purchase agreements (PPAs) to buy electricity from various solar projects to help fuel their data center ambitions.

According to the Solar Energy Industries Association (SEIA), the entire solar supply chain has now been reshored, and the industry now has the ability to produce every major component of the supply chain domestically. U.S. solar module production capacity was up 37% in October on a year-to-date basis, driven by $4.5 billion in private investment.

However, SEIA notes the current administration’s policies of solar grant clawbacks, permitting slowdowns, and project cancellations could slow new capacity growth by 27% by the end of the decade.

3 Solar Stocks on John’s Watchlist

So, how should traders approach solar stocks right now?

Our Senior Market Strategist has 3 key names on his watchlist:

“Several of the leaders' stock prices already reflect the strong demand for solar despite the current administration headwinds,” Rowland explains. “In contrast, several key component manufacturers in the solar space have been punished. They could present a profitable opportunity if one can find the right combination of industry (niche) leaders, adoption, and persistence revenue growth.”

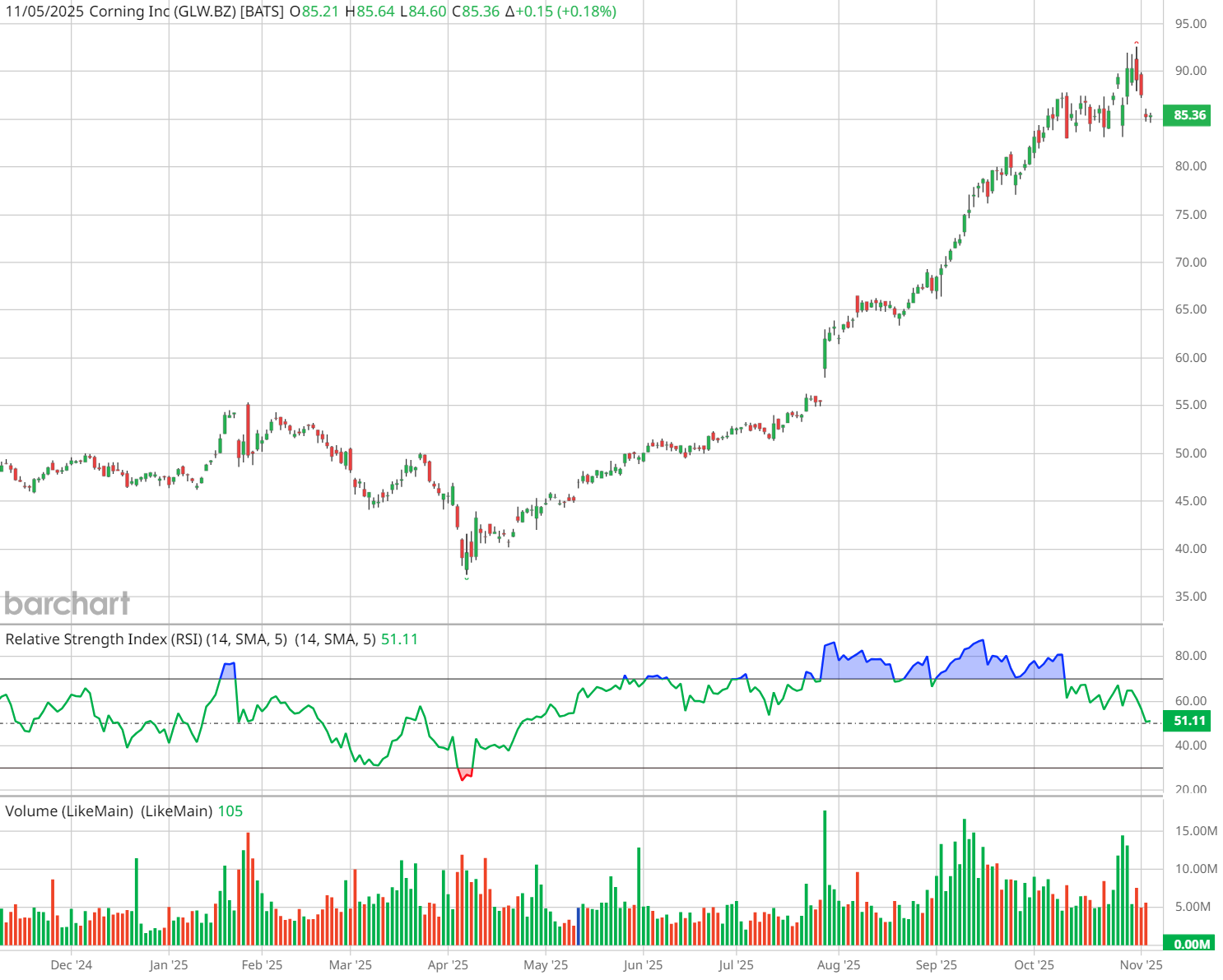

While Rowland notes that “end users want one-stop shopping, like FSLR,” he prefers to “focus on companies that have or are part of the supply chain with little to no competition, such as Corning.”

On the date of publication, Elizabeth H. Volk did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart