With a market cap of $60.3 billion, Sempra (SRE) is a leading energy infrastructure company. It focuses on energy distribution, transmission, and infrastructure development across the U.S. and international markets, supporting the energy transition with electricity and natural gas services.

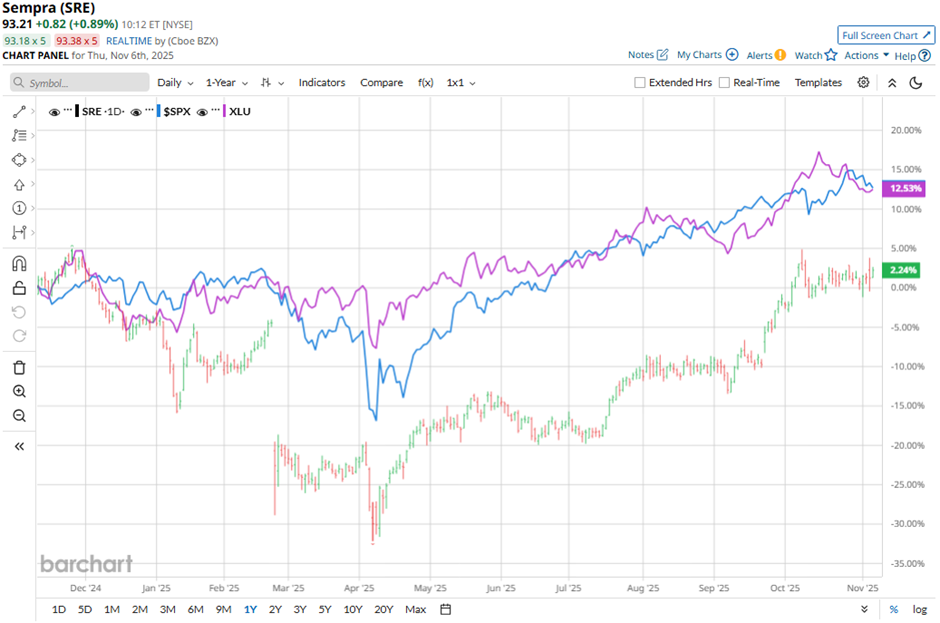

Shares of the San Diego, California-based company have underperformed the broader market over the past 52 weeks. SRE stock has risen 5.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.5%. In addition, shares of SRE are up 6.5% on a YTD basis, compared to SPX’s 15.4% gain.

Moreover, shares of the natural gas and electricity provider have lagged behind the Utilities Select Sector SPDR Fund (XLU), which has returned 14.9% over the past 52 weeks.

Sempra reported better-than-expected Q3 2025 adjusted EPS of $1.11 on Nov. 5. The upside was driven by strong performance at its Texas utility Oncor, which is expanding its grid to meet surging power demand from industrial and data center customers and plans to boost its $36 billion 2025 - 2029 capital plan by over 30% in the next cycle. Despite the solid results, the stock fell slightly on the day.

For the fiscal year ending in December 2025, analysts expect SRE’s adjusted EPS to decline 2.6% year-over-year to $4.53. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

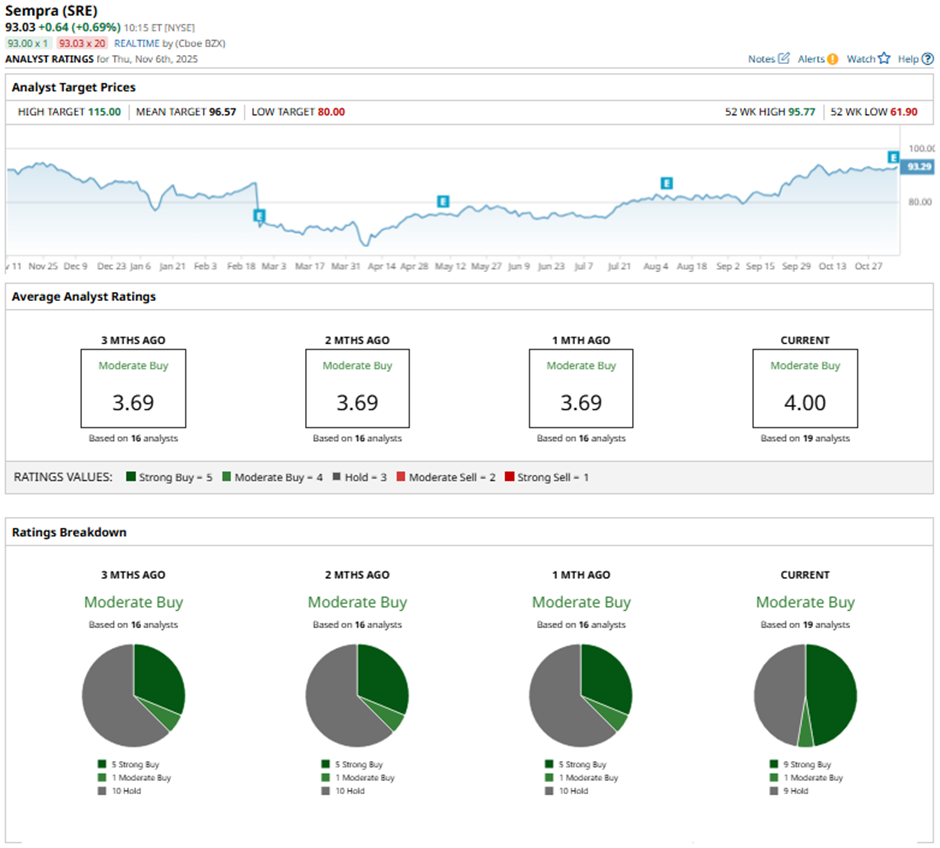

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” and nine Holds.”

This configuration is more bullish than three months ago, with five “Strong Buy” ratings on the stock.

On Oct. 22, Morgan Stanley analyst David Arcaro raised the price target on Sempra Energy to $99 and maintained an “Overweight” rating.

The mean price target of $96.57 represents a premium of 3.8% to SRE's current levels. The Street-high price target of $115 implies a potential upside of 23.6% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Expect Growth at Amazon to ‘Accelerate.’ Does That Make AMZN Stock a Buy Now?

- Google Cloud Could Grow More Than 50% in 2026. Should You Buy GOOGL Stock Here?

- Apple’s Record Quarter Hints at Something Huge Coming: Is AAPL Stock a Buy Now?

- 2 Chart Indicators to Confirm Stock Breakouts & Reversals with Heikin Ashi Candlesticks