Wallingford, Connecticut-based Amphenol Corporation (APH) designs, manufactures, and markets a wide range of electrical, electronic, and fiber optic connectors. Valued at a market cap of $169.1 billion, the company serves diverse industries, including automotive, information technology, mobile devices, aerospace, industrial, and broadband communications.

Shares of this tech company have significantly outpaced the broader market over the past 52 weeks. APH has surged 91.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.4%. Moreover, on a YTD basis, the stock is up 98.9%, compared to SPX’s 14.3% return.

Zooming in further, APH has also notably outperformed the Technology Select Sector SPDR Fund’s (XLK) 20.9% uptick over the past 52 weeks and 23.5% rise on a YTD basis.

On Oct. 22, APH posted better-than-expected Q3 earnings results, and its shares surged 5% in the following trading session. The company’s net sales improved by a notable 53.4% year-over-year to $6.2 billion, surpassing consensus estimates by 13%. Moreover, its adjusted EPS came in at $0.93, up 86% from the prior-year quarter and 17.7% ahead of analyst expectations. This robust performance was fueled by strong organic growth across nearly all end markets, particularly in the IT datacom segment, along with positive contributions from recent acquisitions.

For the current fiscal year, ending in December, analysts expect APH’s EPS to grow 74.6% year over year to $3.30. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

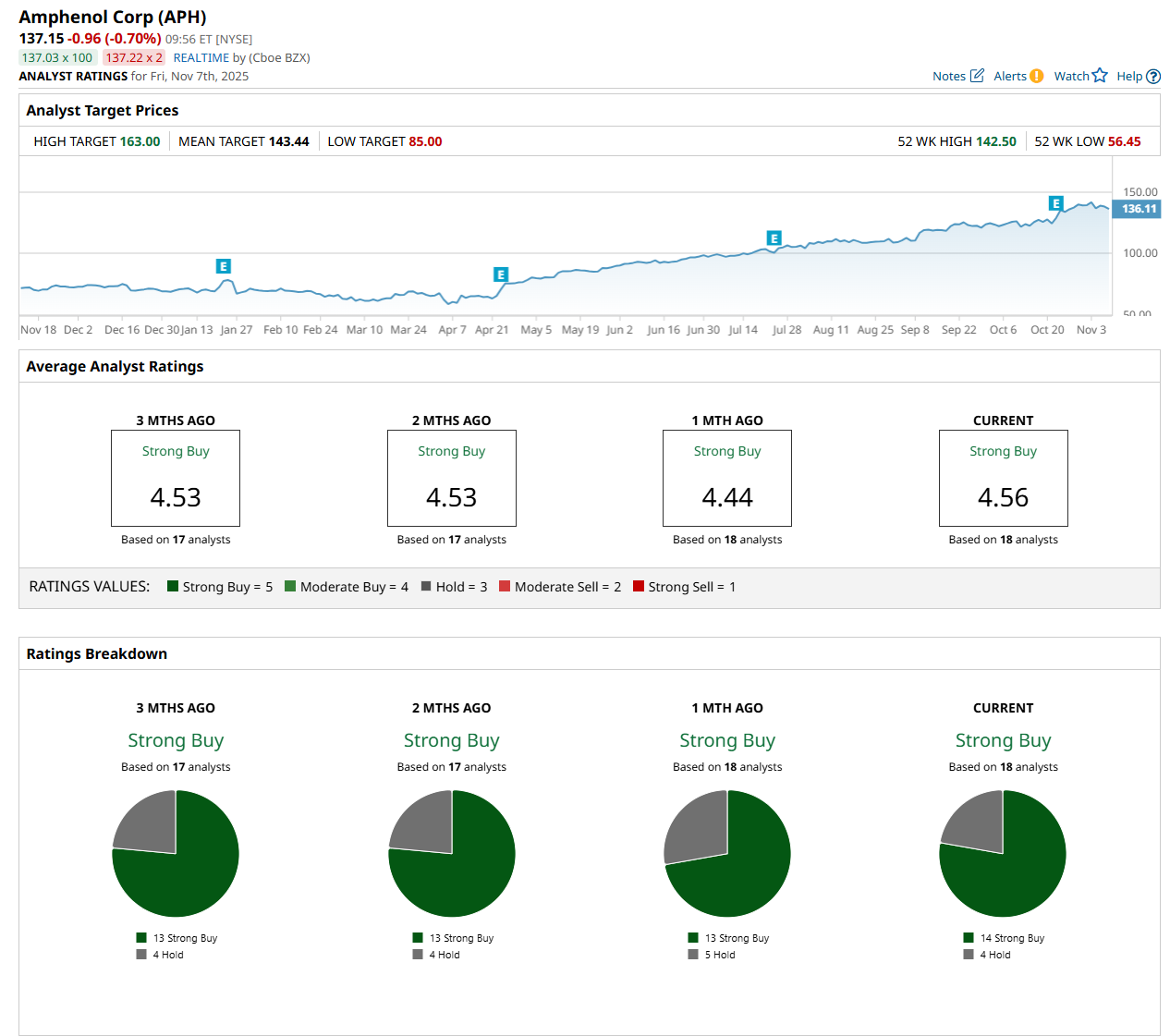

Among the 18 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 14 “Strong Buy” and four "Hold.”

This configuration is slightly more bullish than a month ago, with 13 analysts suggesting a “Strong Buy” rating.

On Oct. 23, Amit Daryanani from Evercore Inc. (EVR) maintained a "Buy" rating on APH, with a price target of $150, indicating a 9.4% potential upside from the current levels.

The mean price target of $143.44 represents a 4.6% premium from APH’s current price levels, while the Street-high price target of $163 suggests an upside potential of 18.8%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart